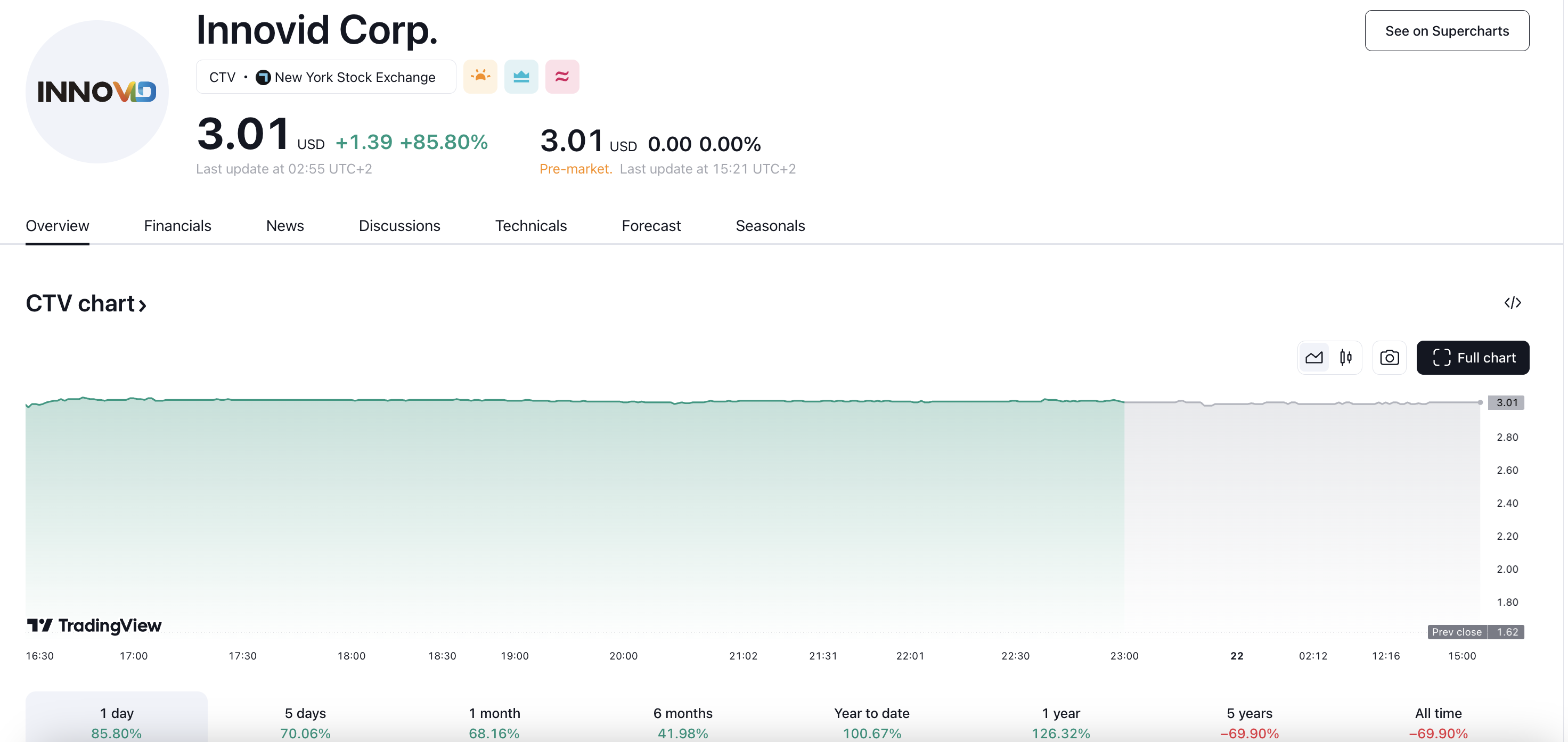

In a significant move to shake up the ad tech landscape, Mediaocean has announced a deal to acquire converged TV advertising company Innovid for approximately $500 million ($3.15 per share). The acquisition, which is expected to close early next year, will see Innovid merge with Flashtalking, a company acquired by Mediaocean in 2021, to create a global independent omnichannel ad-tech platform. After the announcement CTV shares increased with 85% and traded at $3.01.

The deal represents a 94% premium to Innovid’s closing price on Wednesday, and the combined organization will provide a broad array of complementary offerings, including ad delivery, creative personalization, measurement, and optimization across channels. The merger is expected to provide advertisers with increased control over data and decisions, more choice in where ad spend can go, and tools and workflows to make media investments more effective and efficient.

The acquisition is a strategic move by Mediaocean to establish a premier independent ad tech business, with a keen focus on creative and CTV. The combined company will be led by Innovid’s CEO and founder Zvika Netter, who will report to Bill Wise, co-founder and CEO of Mediaocean. Grant Parker, who currently runs Flashtalking, will become president of the combined organization.

The deal is seen as a significant milestone in the ad tech industry, as it creates an independent alternative to Google and other big tech platforms. The combined company will have a strong focus on innovation, growth, and building a future for brands, agencies, and publishers. With the acquisition, Mediaocean is poised to become a major player in the ad tech space, and the deal is expected to have a significant impact on the industry.