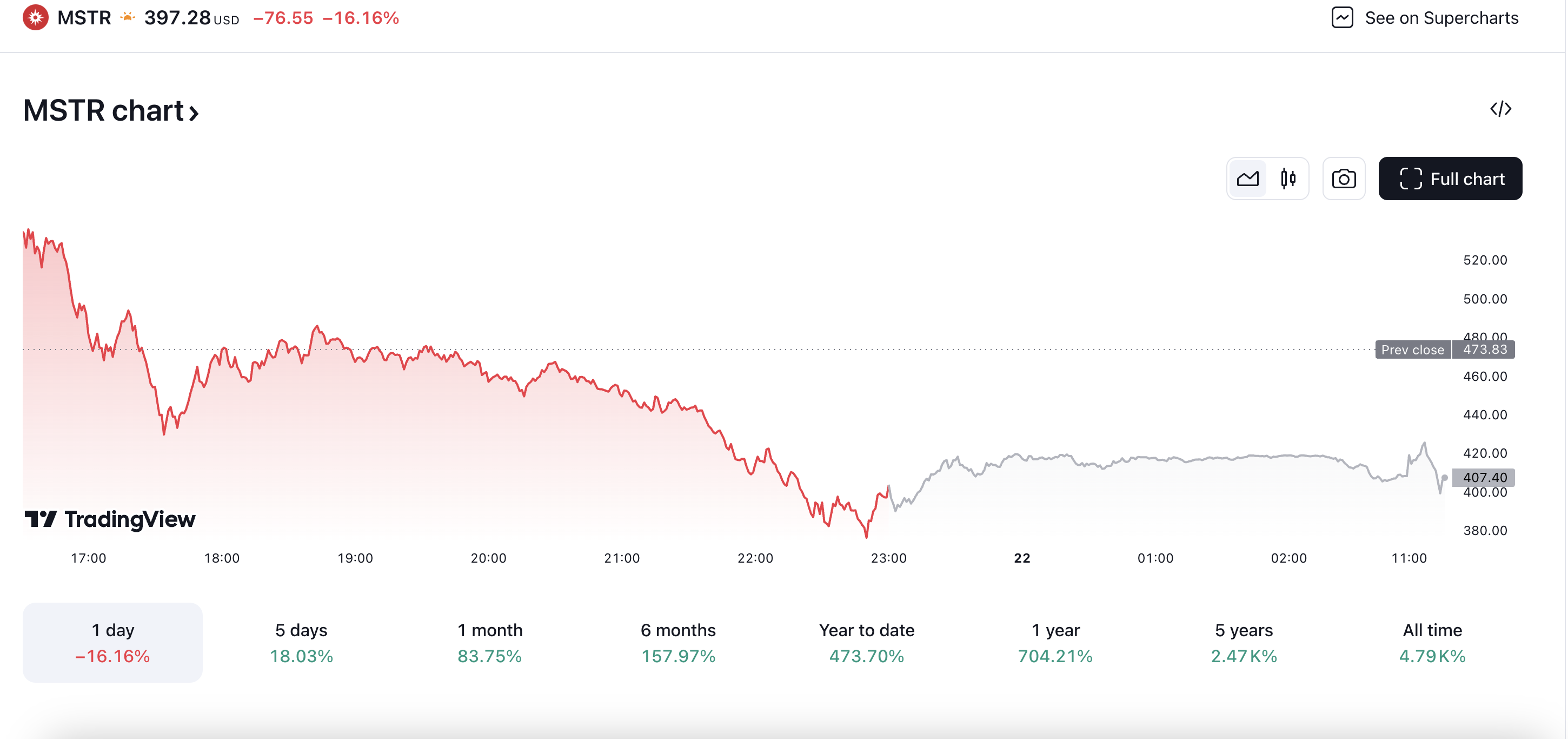

MicroStrategy’s stock price plummeted 16% on Thursday after Citron Research, a prominent short seller, announced that it had taken a new bet against the company. Despite this decline, MicroStrategy’s stock has still gained over 50% since President-elect Donald Trump’s victory earlier in November, fueled by the company’s significant investments in bitcoin.

MicroStrategy, a software company turned bitcoin play, has acquired a total of 331,200 bitcoins for $16.5 billion, with an average price of $49,874 per bitcoin. The company’s latest purchase of 51,780 bitcoins for $4.6 billion has contributed to the stock’s surge. However, some investors are now questioning the sustainability of this meteoric rise.

Citron Research, while remaining bullish on bitcoin, has expressed concerns that MicroStrategy’s stock price has become detached from the underlying fundamentals of the cryptocurrency. The firm’s decision to short MicroStrategy’s stock suggests that it believes the company’s valuation has become overstretched.

As bitcoin continues to reach new heights, hitting a record $98,000 on Thursday, investors are becoming increasingly cautious about the potential risks and volatility associated with investing in cryptocurrency-related stocks. While MicroStrategy’s bet on bitcoin has paid off so far, the company’s stock price may be due for a correction if the cryptocurrency market experiences a downturn.