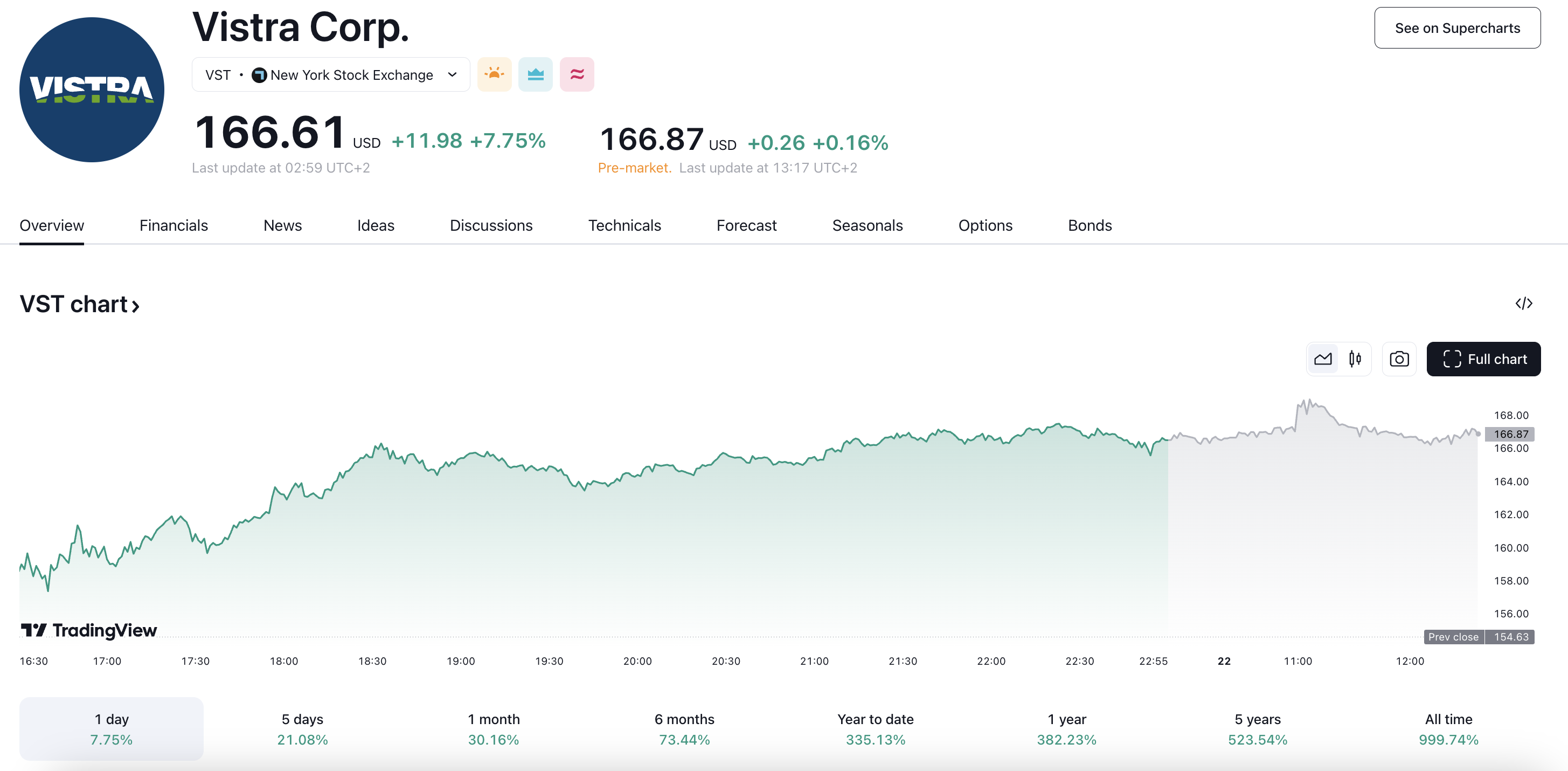

Vistra Corp. (NYSE:VST) has reached an all-time high, with its stock price surging 21% in the last 5 days to touch $165.53. This remarkable growth has propelled the company’s market capitalization to $56.69 billion, solidifying its position as a leading player in the energy sector.

The company’s impressive performance can be attributed to its robust financial results, strategic initiatives, and commitment to growth. Vistra’s Q3 earnings met revised expectations, with a revenue of $1.444 billion, and the company has announced plans for at least $3.25 billion in share repurchases from 2024 to 2026. Additionally, Vistra has introduced its 2025 guidance, with projected EBITDA ranging from $5.5 billion to $6.1 billion, and free cash flow between $3.0 billion and $3.6 billion.

Vistra’s management has also been aggressively buying back shares, which often signals confidence in the company’s future prospects and can contribute to stock price appreciation. The company’s commitment to shareholder returns is evident in its consistent dividend raises over the past six years.

While Vistra’s price-to-earnings (P/E) ratio of 30.6x may seem high compared to the market average, investors are likely willing to pay a premium for the company’s strong earnings growth and future prospects. With a growth-oriented focus and a robust financial performance, Vistra Corp. is well-positioned for continued success.

As the company explores diverse growth opportunities, including energy projects and configurations, investors will be closely watching its progress. With a strong track record of delivering results, Vistra Corp. is certainly a stock to watch in the energy sector.