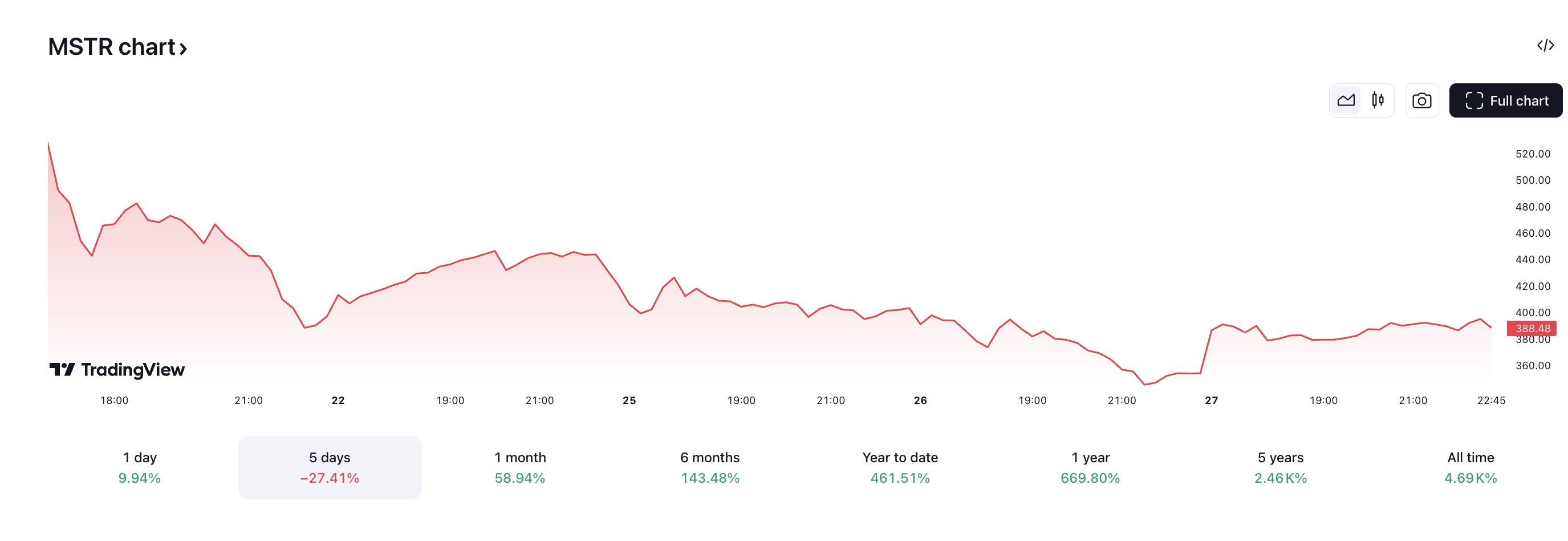

MicroStrategy, a business intelligence firm with a significant stake in Bitcoin, has experienced a substantial decline in its market value. The company’s market capitalization has dropped by over 27% in just four days, resulting in a loss of over $30 billion. This significant decline has sparked concerns about MicroStrategy’s role as a leveraged Bitcoin investment vehicle.

The recent correction in Bitcoin’s price has had a ripple effect on MicroStrategy’s stock price, which has plummeted by 27% over the same period. The company’s stock price has been closely tied to the performance of Bitcoin, and the recent decline has raised questions about the sustainability of this relationship.

Despite the recent correction, both Bitcoin and MicroStrategy have posted significant gains over the past month. Bitcoin’s price has risen by 45%, while MicroStrategy’s stock has rallied by over 58%. However, the company’s stock price has been highly volatile, with a 27% drop in just four days.

MicroStrategy’s business model is centered around its Bitcoin holdings, and the company has been actively acquiring more coins in recent months. The company has purchased an additional 55,000 BTC, bringing its total holdings to 386,700 coins. This significant investment in Bitcoin has raised concerns about the company’s exposure to the cryptocurrency’s price fluctuations.

The recent decline in MicroStrategy’s market value has highlighted the risks associated with investing in the company’s stock. While the company’s Bitcoin holdings have generated significant returns in the past, the recent correction has raised concerns about the sustainability of this investment strategy.

As Bitcoin approaches the $100,000 mark, MicroStrategy’s dual identity as a business intelligence firm and Bitcoin holding vehicle will continue to be under scrutiny. The company’s ability to navigate the challenges of the cryptocurrency market while maintaining its business operations will be closely watched by investors and analysts alike.