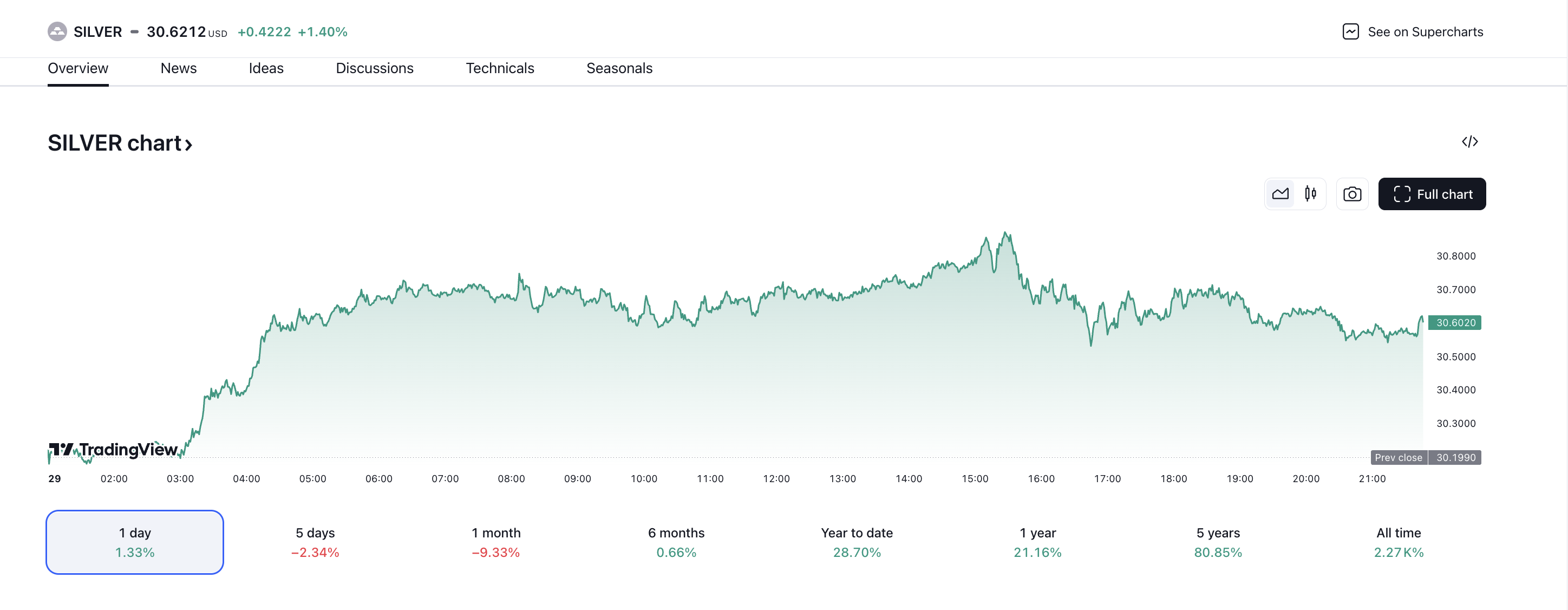

Yesterday’s silver trading saw a notable bounce, with prices rising above the key level of 29.95. According to technical indicators, long positions above this level have targets at 30.53 and 30.70 in extension. The Relative Strength Index (RSI) also suggests that a bounce is due, indicating that the recent downtrend may be reversing.

The pivot point at 29.95 serves as a crucial level, with prices above this mark indicating a bullish trend. In contrast, a break below 29.95 could lead to further downside, with targets at 29.80 and 29.65.

Support and resistance levels also played a significant role in yesterday’s trading, with key levels at 30.85, 30.70, 30.53, and 30.39. The last level, 29.95, served as a strong support, while 29.80 and 29.65 acted as resistance levels.

Overall, the technical indicators suggest that silver prices are poised for a bounce, with long positions above 29.95 offering potential targets at 30.53 and 30.70. However, a break below 29.95 could lead to further downside, and traders should be cautious of this alternative scenario.