Key Takeaways:

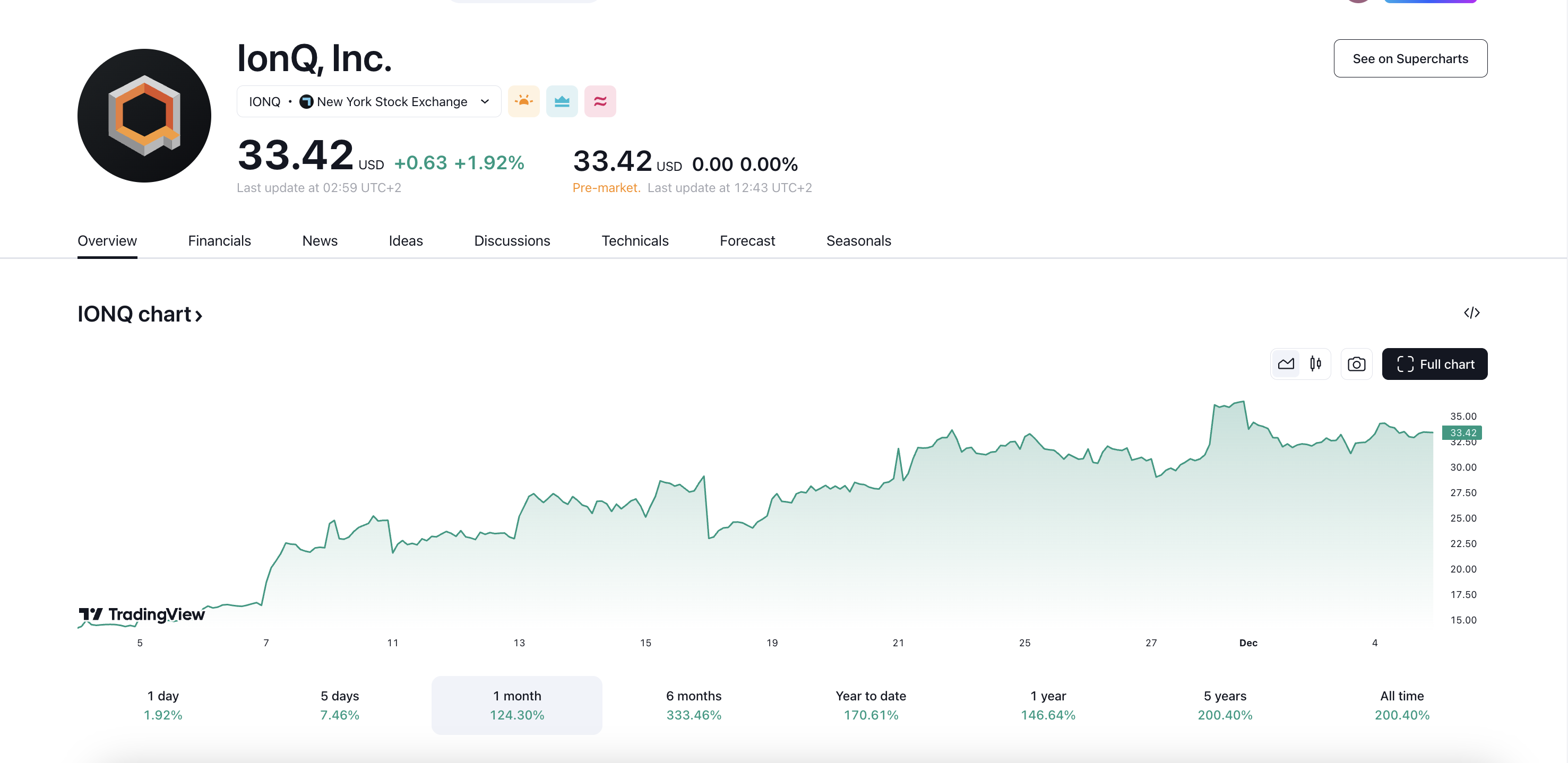

- IonQ’s Q3 revenue exceeded expectations, driving a remarkable 120% increase in its stock price over the past 30 days.

- Concerns over the company’s valuation remain, with a market capitalization of $7.23 billion and a price-to-book ratio of 14.36.

- Operating costs surged 36% year over year to $65.5 million, with research and development expenses alone jumping 35% to $33.2 million.

- IonQ faces intense competition from deep-pocketed tech giants like IBM, Google, and Microsoft.

- Valuation concerns and dilution risks remain a major issue for IonQ, with a stretched valuation and little room for error.

IONQ, a leading quantum computing firm, has seen its stock price skyrocket by 120% over the past 30 days, driven by a remarkable Q3 revenue that exceeded expectations. The company’s revenue for the quarter was boosted by new bookings worth $63.5 million, with a strong revenue outlook for 2024 projected at $38.5 million to $42.5 million.

Despite the impressive growth, concerns over the company’s valuation remain. With a market capitalization of $7.23 billion, IonQ’s price-to-book ratio of 14.36 far exceeds the industry average of 3.7. Additionally, the company’s operating costs surged 36% year over year to $65.5 million, with research and development expenses alone jumping 35% to $33.2 million.

IonQ’s ambitious expansion plans, including the planned acquisition of Qubitekk and partnerships with companies like AstraZeneca and Ansys, also raise concerns over the company’s financial reality. These initiatives require substantial capital investment at a time when the company is already burning through cash.

Furthermore, IonQ faces intense competition from deep-pocketed tech giants like IBM, Google, and Microsoft, who are pouring billions into quantum computing development. The emergence of well-funded Chinese players like Baidu and increasing investments from Amazon and Rigetti Computing further threaten IonQ’s market position.

Valuation concerns and dilution risks also remain a major issue for IonQ. The stock’s current price-to-sales (P/S) ratio is significantly higher than the industry average, indicating a stretched valuation. This leaves little room for error and makes the stock particularly vulnerable to any negative developments or earnings misses.

Despite these concerns, IonQ remains a key player in the rapidly advancing world of quantum computing. The company’s breakthrough advancements and promising future have attracted significant interest from investors keen to tap into the transformative potential of this emerging technology.

IonQ’s impressive growth and breakthrough advancements in quantum computing make it an attractive investment opportunity. However, concerns over the company’s valuation, operating costs, and competition from deep-pocketed tech giants must be carefully considered. Investors should closely monitor the company’s financials and industry developments to determine whether IonQ’s stock price is sustainable in the long term.