Key moments

- BP plans to increase annual oil and gas investment to $10 billion through 2027.

- The company aims to lower annual capital expenditure to $13-15 billion over the same period.

- BP targets $20 billion in divestments by the end of 2027.

- Investment in transition businesses will be significantly reduced to $1.5-2 billion per year.

In a major overhaul, BP has unveiled plans to boost its annual oil and gas investment to $10 billion through 2027, marking a significant shift in the company’s strategy. The energy giant also intends to reduce its annual capital expenditure to a range of $13-15 billion over the same period, while aiming to offload $20 billion in assets by the end of 2027. Furthermore, the company has announced a substantial reduction in investment in transition businesses, with spending expected to drop to $1.5-2 billion per year, a decrease of over $5 billion from previous projections.

According to BP’s CEO, Murray Auchincloss, the company has undergone a fundamental transformation, with a renewed focus on driving growth and improving financial performance. Auchincloss emphasized that BP is committed to reallocating capital to its most profitable ventures, while pursuing operational efficiencies and cost savings to achieve sustainable cash flow and returns. The company is set to provide further insight into its new direction at its upcoming Capital Markets Update, where Auchincloss and other senior executives will host an investor day presentation.

Market Reaction and Analysis

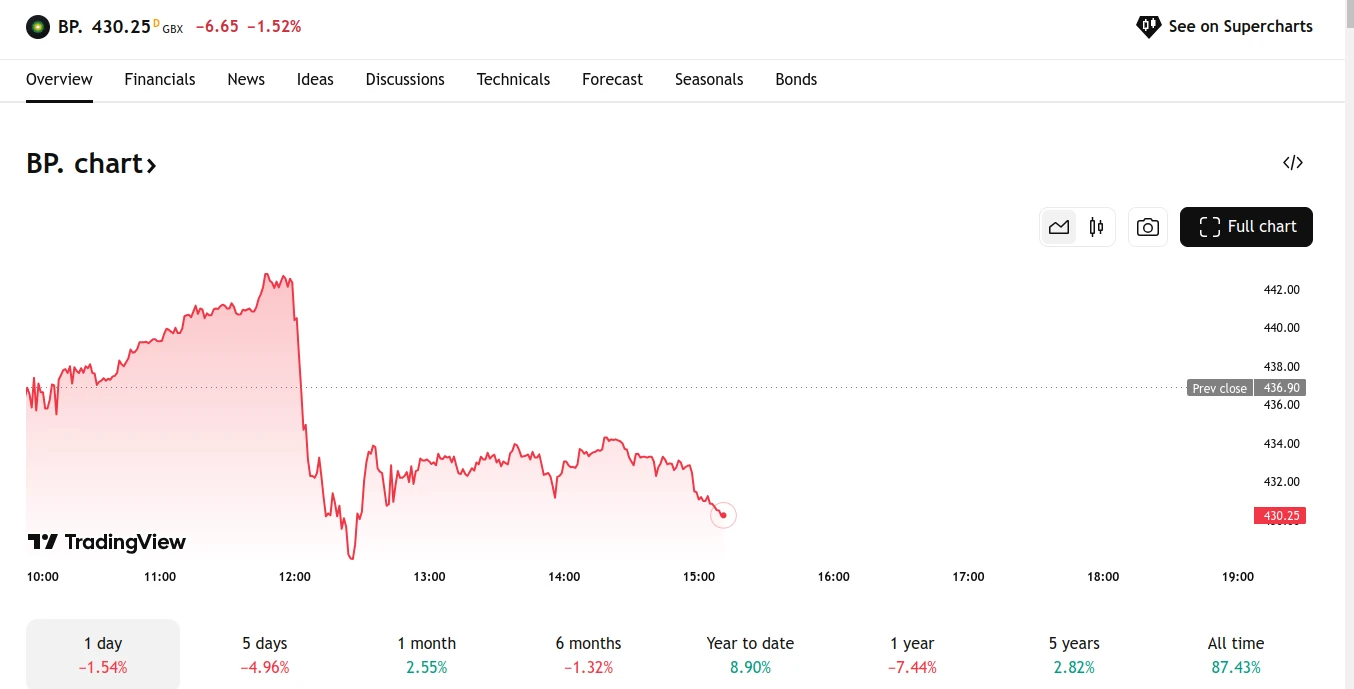

The announcement has been met with a mixed response, with BP’s shares dipping 1% on Wednesday morning. Industry experts have described the investor day as a critical moment for the company, particularly in light of activist investor Elliot Management’s recent stake acquisition. BP’s leadership is under pressure to demonstrate that the company is on a path to improved financial performance, having lagged behind its peers in recent years. Lindsey Stewart, a director at Morningstar Sustainalytics, noted that BP’s decision to scale back renewable investments and focus on fossil fuels may come as a shock to sustainability-focused investors, but is not entirely unexpected given the company’s previous underperformance.

Historical Context and Future Prospects

BP’s strategic shift is a notable departure from its earlier commitment to reducing emissions and increasing renewable energy production. Just five years ago, the company pledged to achieve net-zero emissions by 2050 and invested heavily in renewable projects. However, in 2023, BP revised its emissions target to a 20-30% reduction, citing the need to maintain investment in oil and gas to meet global demand. The company’s latest move has sparked speculation about its future plans, with some reports suggesting that BP may abandon its goal to increase renewable generation 20-fold by 2030. As the energy landscape continues to evolve, BP’s new direction is likely to have significant implications for the company’s future prospects and its position in the industry.