Key moments

- Robert E. Diamond Jr., a director of Triller Group Inc. (NASDAQ:ILLR), completed sales of 100,354 shares of common stock, totaling $104,657 over a three-day period.

- The largest single-day transaction involved the sale of 75,000 shares on February 25th, at a weighted average price of $1.05 per share.

- These sales occurred amidst significant volatility in Triller’s stock, which has experienced a substantial decline over the past year.

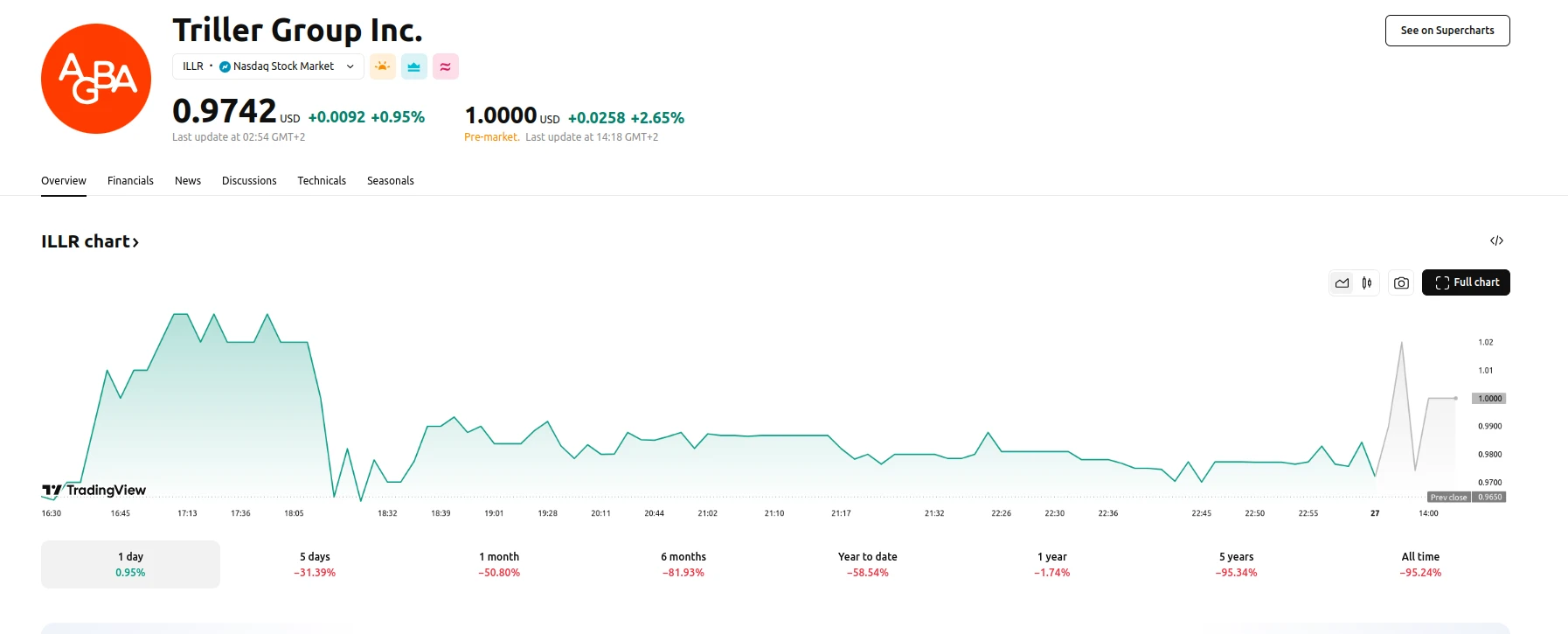

Triller Group Inc. director Robert E. Diamond Jr. recently executed a series of stock sales, as detailed in an SEC filing. The transactions, involving 100,354 shares of ILLR common stock, occurred over three days, with prices ranging from $1.02 to $1.15 per share. The total value of these sales reached $104,657. The timing of these sales coincides with a period of notable market pressure on Triller’s stock, which has seen a decline of over 77% in the past year. As of the time of the report, the stock was trading around $0.97 per share.

The most substantial transaction took place on February 25th, when Diamond sold 75,000 shares at a weighted average price of $1.05. Following these transactions, Diamond’s remaining holdings consist of 319,275 shares held indirectly through Atlas Merchant Capital LLC, where he serves as CEO and majority owner. Additionally, he retains restricted stock units that are scheduled to vest in the future. The company’s current market capitalization is approximately $159 million, placing the company in a challenging financial position.

These stock sales occur alongside other significant developments within Triller Group. The company is currently facing a $35.5 million lawsuit filed by YA II PN, Ltd., alleging default on financial agreements. Triller has indicated its intention to vigorously defend itself against these claims. Furthermore, Robert E. Diamond Jr. recently resigned from his position as chairman of the board, with no disclosed disagreements cited as the cause. The company has initiated a search for a new chairman. Triller has also recently detailed its strategic vision following a merger, which aims to create an integrated ecosystem across social media, commerce, and financial technology, with leadership highlighting potential for scalability and growth. These recent events, and the company’s history of name changes and strategic shifts, have drawn increased scrutiny from investors.