Key moments

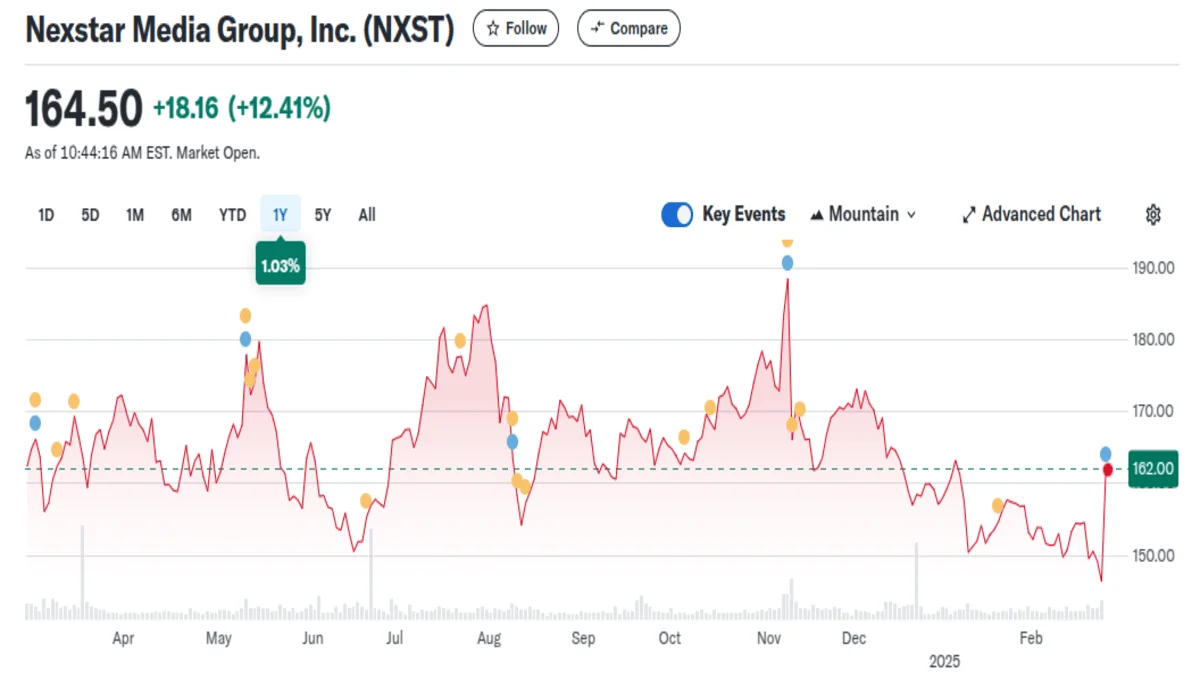

- Nextstar shares experienced a 2.2% increase in premarket trading following the release of its Q4 2024 financial results.

- The company achieved a Q4 revenue of $1.49 billion, surpassing analyst estimates and demonstrating a 14.1% YoY increase.

- Despite the revenue beat, the company’s GAAP earnings per share were $7.56, falling below the anticipated $8.41.

Nexstar Media Group, a leading U.S. local television broadcasting and digital media company, unveiled its revenue for the fourth quarter of 2024, presenting a mixed bag of results. The company’s shares responded positively, experiencing a 2.2% surge to $149.5 shortly after the results were released, reflecting investor optimism despite certain metrics falling short of expectations.

The company reported quarterly revenue of $1.49 billion, slightly exceeding the consensus analyst estimate of approximately $1.48 billion. This figure represents a 14.1% YoY increase, primarily propelled by a substantial rise in advertising revenue, which reached $758 million. Political advertising played a pivotal role in this growth, contributing $254 million, effectively offsetting a decline in non-political ad spending. Distribution revenue also saw a modest uptick of 1.4%, totaling $714 million, attributed to favorable contract renewals and rate adjustments.

However, the company’s adjusted earnings per share fell short of market expectations at $7.56, missing the analyst forecast of $8.41. Despite this EPS shortfall, the company’s adjusted EBITDA reached $628 million, surpassing analyst estimates of $578.7 million, showcasing strong operational efficiency. The operating margin also increased, reaching 28% from 17.6% in the same quarter of the previous year.

Nexstar’s CEO, Perry A. Sook, underscored the record net revenue, emphasizing the significant impact of election-year political advertising and the company’s extensive reach in contested election markets. He highlighted the effectiveness of local television broadcasting and Nexstar’s presence in nearly 85% of key electoral areas.

For the full year 2024, the company generated $1.2 billion in adjusted free cash flow and returned $820 million to shareholders through dividends and share buybacks. The company also provided adjusted EBITDA guidance for 2025, projecting figures between $1.5 billion and $1.595 billion.

The company’s free cash flow margin for the quarter reached 25.3%, a notable increase from 19.3% in the same period last year, demonstrating robust cash generation. However, analysts predict a slight decrease in the company’s cash conversion over the next year. While the company’s long-term sales growth has been acceptable, it has not met the standards for the consumer discretionary sector, which enjoys a number of secular tailwinds. However, the company has shown robust cash profitability, giving it an edge over its competitors.