Key moments

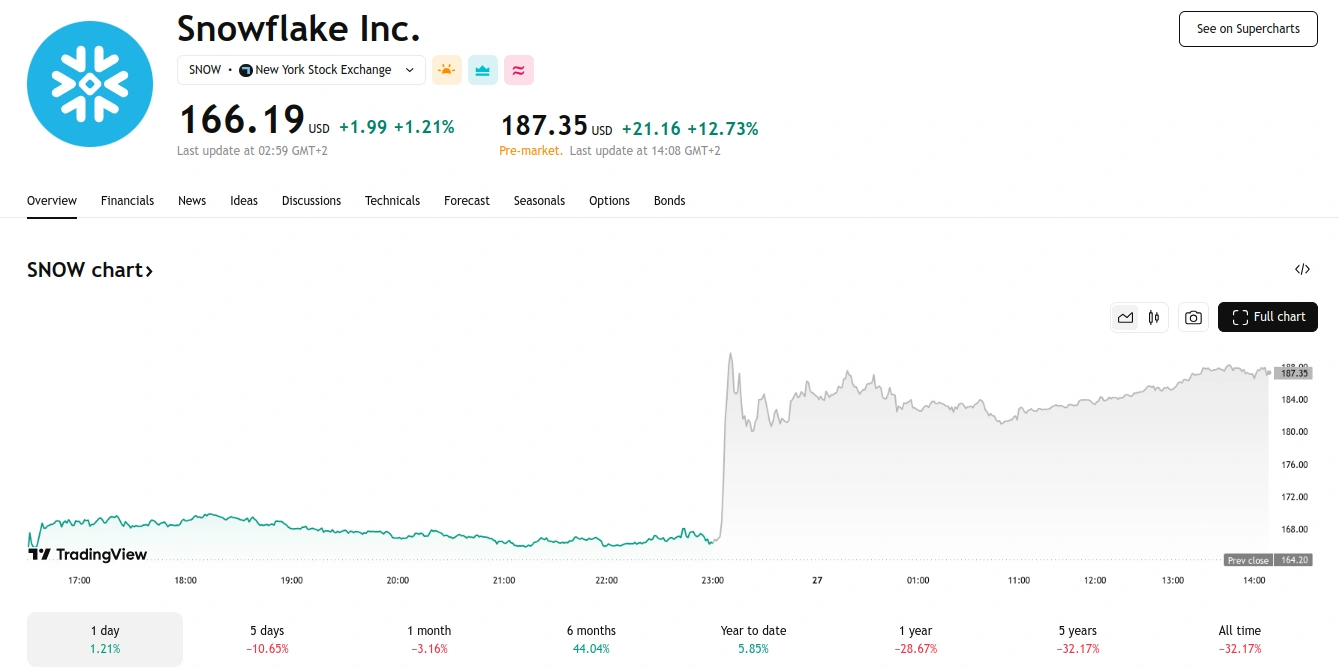

- Snowflake’s stock surged 13% in premarket trading on Thursday after the company reported better-than-expected fiscal fourth-quarter results.

- Snowflake announced an expanded partnership with Microsoft to integrate OpenAI models, highlighting the company’s growing focus on artificial intelligence (AI) products.

- Snowflake expects product revenue to grow 21-22% year-over-year in the first quarter of fiscal 2026, with full-year revenue projected to reach $4.28 billion.

On Thursday, Snowflake’s stock experienced a significant premarket surge of 13%, driven by the company’s impressive financial performance and optimistic forecast, which exceeded analyst expectations. This boost came on the heels of the cloud software provider’s announcement of an enhanced collaboration with Microsoft, focusing on the integration of OpenAI models.

The company’s fiscal fourth-quarter results for 2025 revealed adjusted earnings per share of $0.30, alongside a 27% year-over-year revenue increase to $986.8 million, surpassing Visible Alpha’s predicted $0.18 and $957.6 million, respectively. Product revenue saw a notable 28% rise to $943.3 million, exceeding estimates.

Snowflake’s CEO, Sridhar Ramaswamy, expressed pride in the company’s strong quarterly performance, highlighting a 28% year-over-year increase in product revenue to $943 million. Ramaswamy emphasized Snowflake’s position as a leading data and AI company globally.

The company reported a 27% year-over-year increase in customers with trailing 12-month product revenue exceeding $1 million, now totaling 580. Additionally, Snowflake serves 745 Forbes Global 2000 customers, marking a 5% year-over-year growth.

Looking ahead, Snowflake anticipates 21-22% year-over-year growth in product revenue for the first quarter of fiscal 2026, with projected revenue between $955 million and $960 million. For the full fiscal year 2026, the company expects product revenue of $4.28 billion, representing a 24% year-over-year increase, surpassing the previous consensus of $4.23 billion.

Analysts, led by Matthew Hedberg, have raised their target price for Snowflake to $221 from $210, citing potential growth of up to 30% in the second half of the year. Similarly, Jefferies analysts believe that the company’s initiatives from last year will yield positive results in the second half, positioning Snowflake for an acceleration narrative and solidifying its status as a key AI player.