Key moments

- The US dollar has gained 0.2% against rival currencies, putting pressure on gold prices.

- Several Federal Reserve officials are scheduled to speak later in the day, which may provide insight into the central bank’s policy plans.

- The Personal Consumption Expenditures (PCE) index, a key inflation report, is due to be released on Friday and may impact gold prices.

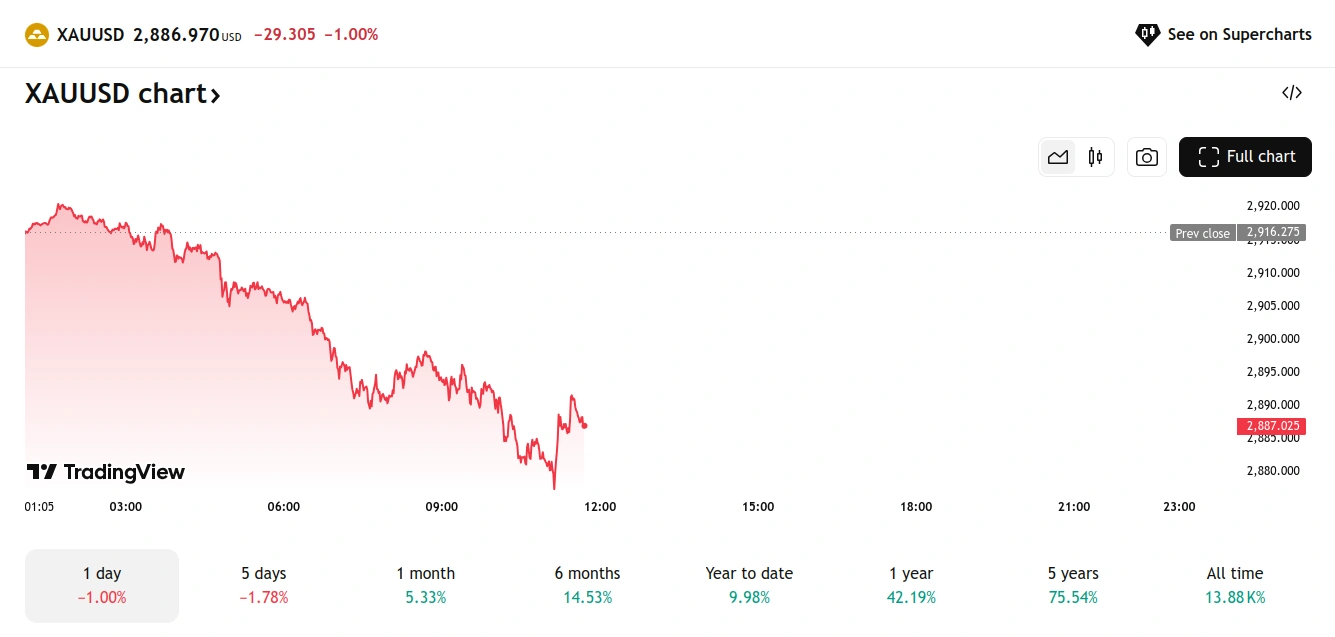

Gold prices experienced a slight decline on Thursday due to a stronger US dollar and rising Treasury yields, as investors await the release of a key inflation report to gauge the Federal Reserve’s policy direction. By 06:45 GMT, spot gold had fallen 0.6% to $2,897.91 an ounce, while US gold futures lost 0.7% to $2,909.30.

The dollar index rose 0.2%, moving further away from its recent 11-week lows, following vague pledges from US President Donald Trump to impose tariffs on Europe and delays to levies planned for Canada and Mexico. The benchmark 10-year US Treasury yields also rebounded, reducing the appeal of non-yielding gold. According to Ilya Spivak, head of global macro at Tastylive, “a light pickup in the dollar and US Treasury yields is seen to be pressuring gold a bit in this session,” although the overall uptrend for gold remains intact.

Several Fed officials are due to speak later in the day, offering more insights into the central bank’s policy easing this year. Markets are also looking ahead to the release of the PCE index on Friday, with a consensus forecast of a 0.3% monthly increase, unchanged from December 2024. Ilya Spivak noted that “the markets are sensitive to growth concerns at the moment after dismal US PMI data last week, and any stronger-than-expected PCE outcomes that point away from Fed rate cuts in the near term might hurt gold.” Gold is considered a safeguard against political risks and inflation, but higher interest rates can dampen its appeal. Meanwhile, spot silver retreated 0.2% to $31.77 an ounce, platinum fell 0.1% to $964.70, and palladium remained steady at $926.47.