Key moments

- The U.S. dollar rebounded from an 11-week low, supported by trade uncertainty and mixed signals from President Trump.

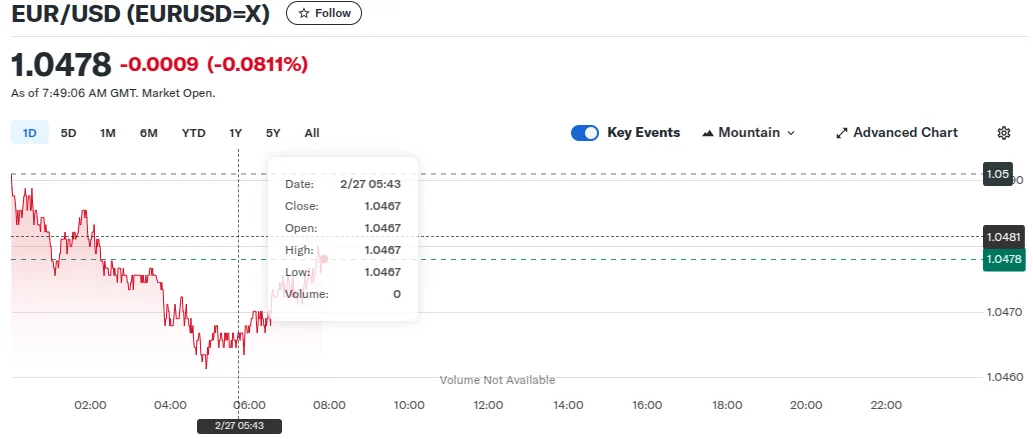

- The euro declined to 1.0467, moving away from its one−month high of 1.0529, as Trump floated a 25% reciprocal tariff on European goods.

- Tariffs on Canadian and Mexican goods remain in effect, with Trump delaying new levies until April 2.

The U.S. dollar strengthened on Thursday, recovering from an 11-week low, as mixed signals from President Donald Trump regarding trade tariffs fueled market uncertainty. The euro, meanwhile, retreated from its one-month peak of 1.0529 reached in the previous session, as traders reacted cautiously to Trump’s proposal of a 25% reciprocal tariff on European cars and goods.

Trump’s shifting stance on trade policy has kept the currency markets on edge. While he suggested delaying tariffs on Canadian and Mexican goods until April 2, a White House official clarified that existing tariffs remain in place pending further review. This ambiguity has left currencies trading within narrow ranges, with the Canadian dollar hovering near a two-week low and the Mexican peso stabilizing at 20.423 after brief gains.

The euro fell 0.17% to 1.0467, with investors also monitoring developments in Germany’s coalition talks following recent Bundestag elections. Analysts noted that Trump’s inconsistent messaging has limited market impact, as traders remain skeptical about the implementation of his tariffs.

Global trade tensions and concerns over U.S. economic growth have weighed on market sentiment. Recent data showing weak U.S. business activity and a sharp drop in consumer confidence have amplified fears, leading to a decline in U.S. Treasury yields. Despite these concerns, economists remain cautiously optimistic about the U.S. economy’s resilience, though they emphasize the need to monitor upcoming data closely.

Markets are now pricing in at least two Federal Reserve rate cuts in 2025, with approximately 58 basis points of easing anticipated. However, the Fed is expected to maintain its current stance in the near term, awaiting clearer economic signals. As trade uncertainties persist, investors remain vigilant for more definitive catalysts to guide market direction.