Key moments

- XRP is approaching key support levels between $1.88 and $1.91, which could trigger a bullish reversal.

- A breakout above $2.44 and $2.99 resistance levels could confirm the start of a new uptrend, targeting $5.00 – $5.85 and potentially $8.00.

- Technical indicators, including the RSI and descending wedge pattern, suggest that selling momentum is exhausting, making a reversal increasingly probable.

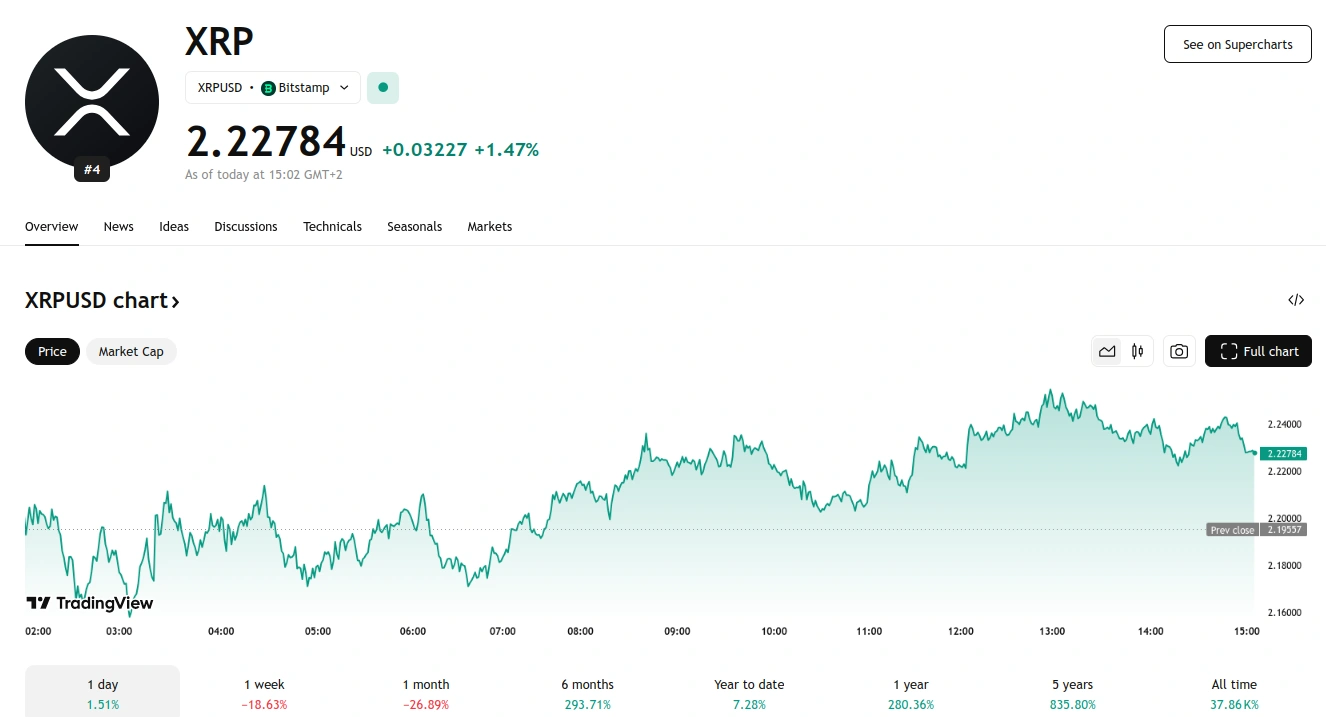

In sync with the overall crypto market trend, XRP’s price has plummeted by nearly 35% since reaching its mid-January high of $3.40. However, analyst Dark Defender (@DefendDark) suggests that this downward trajectory could soon come to a close. His recent technical analysis indicates that XRP is close to finalizing an ABC correction pattern on the daily chart, with the Relative Strength Index (RSI) nearing oversold levels. This suggests a potential reversal in the current trend, setting the stage for a new bullish momentum.

The ABC correction pattern, which is a key component of Elliott Wave Theory, reflects a three-wave corrective sequence that follows a strong upward movement. In this pattern, Wave A initiates the decline, Wave B represents a temporary bounce, and Wave C marks the final downward movement, often indicating the establishment of a significant bottom. Dark Defender’s analysis suggests that XRP is nearing the conclusion of Wave C, which could indicate that the asset is on the cusp of a new upward trend.

Looking at the technicals, XRP is approaching vital support zones between $1.88 and $1.91, which could serve as a strong base for a potential reversal. If these support levels hold and confirm a bottom, the next phase could involve a bullish breakout targeting key resistance levels. The first significant resistance is at $2.44, and breaching this level could indicate a shift in trend. If this resistance is surpassed, the next challenge would be at $2.99, followed by a potential rally toward $5.85, which is in line with Fibonacci extensions.

Additional technical signals, including the RSI nearing oversold conditions, suggest that the selling pressure may soon be exhausted. A sharp rebound from this area could strengthen the case for an upward trend reversal. Moreover, the chart reveals that XRP has been forming a descending wedge pattern, which is typically linked to bullish breakouts. A decisive move beyond the resistance trendline of this wedge could signal the beginning of a new Elliott Wave cycle.

Dark Defender forecasts that after completing the correction phase, XRP might embark on a five-wave impulsive pattern. The first wave could target $3.00, followed by a slight pullback, and then an extended rally in Wave 3 toward $5.00 to $5.85. A consolidation phase in Wave 4 would lead to a final surge in Wave 5, potentially reaching $8.00, which aligns with the 2.618 Fibonacci extension as a long-term target.

Crypto traders monitoring XRP’s price action will have to keep an eye on the $2.44 and $2.99 resistance levels. A breakout above these zones would confirm the start of a bullish uptrend, while failure to hold the $1.88 – $1.91 support range could signal further downside risk. With momentum indicators pointing toward exhaustion in selling pressure, a reversal appears increasingly likely, making this a critical period for XRP’s market structure.

Dark Defender concludes, “XRP is close to finalising the ABC correction pattern in the daily time frame, considering the lowest RSI figures. RSI is close to the oversold area. The expected first wave will be towards $3, and our aim will be between $5 and $8, with Wave 3-5.”