Key moments

- ZoomInfo Technologies’ stock price has surged over the past five days, driven by better-than-expected financial results for the fourth quarter of 2024.

- The company’s Q4 revenue declined 2% year over year to $309 million, but the addition of 58 new customers spending $100,000 annually has boosted investor confidence.

- Multiple analysts have upgraded their outlooks for ZoomInfo stock, citing a potential bottoming out of the company’s growth decline, despite guidance for essentially flat numbers in the coming year.

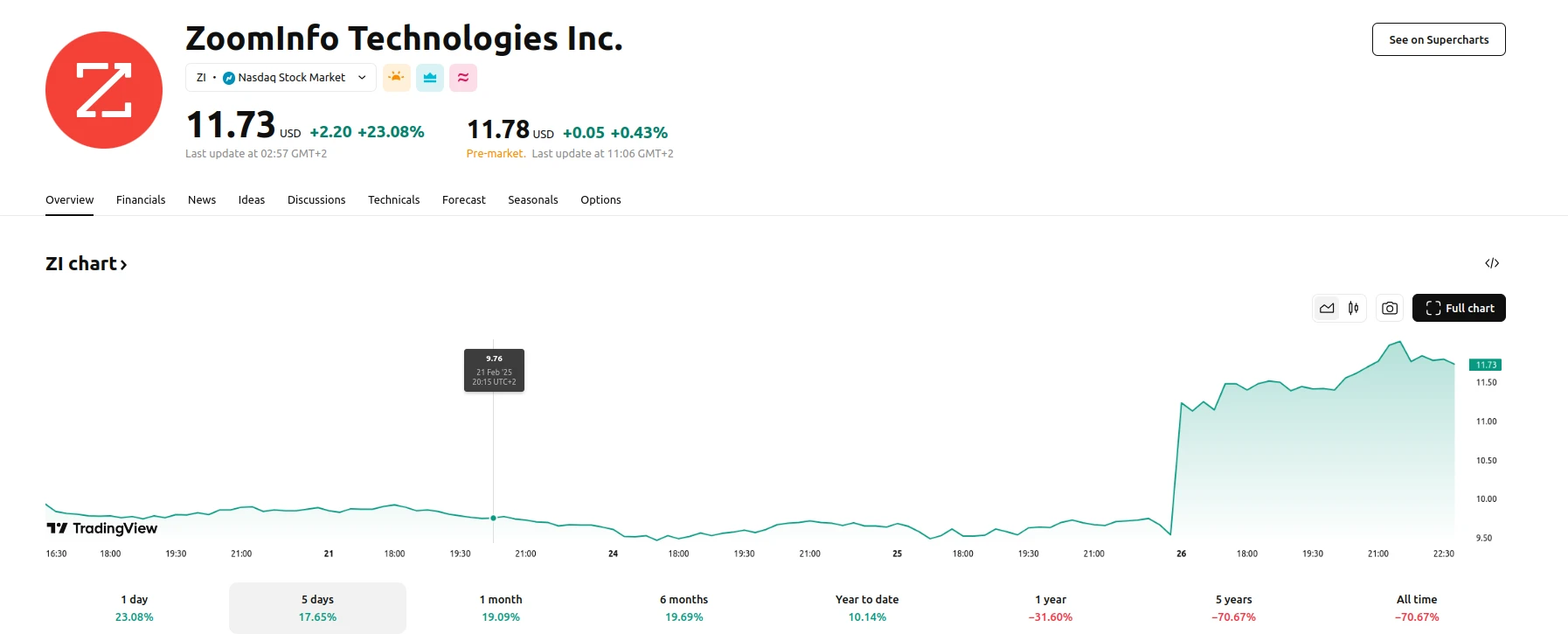

Over the past five days, ZoomInfo’s stock price has experienced a significant uptick, with the current price standing at $11.73, representing a 23.08% increase. This surge can be attributed to the company’s recent financial report, which, although showing a 2% decline in Q4 revenue, exceeded investor expectations. The addition of 58 new customers spending $100,000 annually has been a key factor in boosting investor confidence, taking the total number of such customers to 1,867.

The financial results for Q4 2024 have led multiple analysts to upgrade their outlooks for ZoomInfo stock. Despite the company’s guidance for essentially flat numbers in the coming year, with expected revenue of $1.2 billion, investors seem encouraged that the decline in growth may be bottoming out. The expected unlevered free cash flow of $420 million to $440 million, although slightly lower than the previous year’s $447 million, has also contributed to the positive sentiment.

A review of the stock’s performance over the past five days reveals a notable increase, with the highest price reaching $12.06 and the lowest at $9.38. The average price during this period stood at $10.14, with a difference of $2.69 between the highest and lowest prices. The significant surge in the stock price, particularly the 23.08% increase in the past 24 hours, indicates a strong investor response to the company’s financial report and future outlook.