Key moments

- AAON reported a revenue of $297.7 million, a 2.9% year-over-year decrease, falling short of analyst expectations by 7.1%.

- The company’s adjusted earnings per share were $0.30, significantly below the projected $0.53.

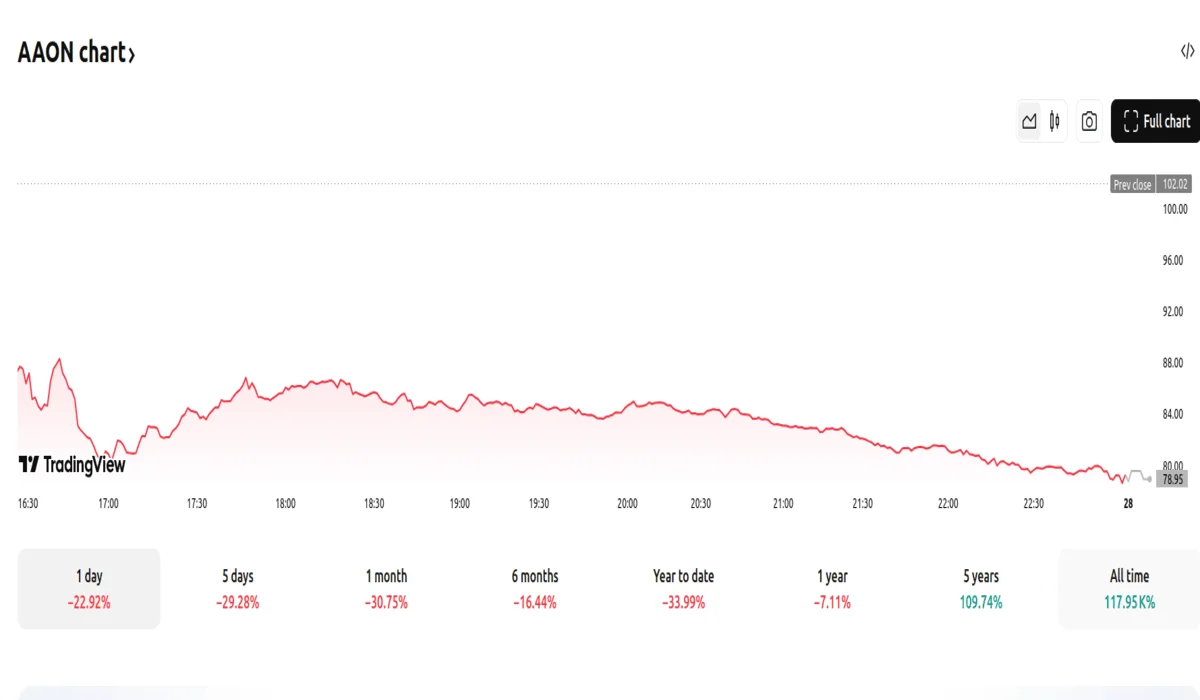

- AAON’s stock price plummeted 22.92% to $78.64 as a result of the disappointing figures.

AAON’s Quarterly Revenue Dips 2.9% to $297.7 Million

AAON, a provider of specialized heating, ventilation, and air conditioning solutions, witnessed a dramatic 22.92% decline in its stock value following the release of its Q4 CY2024 financial results. The company’s revenue for the quarter was $297.7 million, reflecting a 2.9% year-over-year decrease and a 7.1% shortfall compared to the $320.5 million projected by analysts. This revenue miss was compounded by a significant deviation in adjusted earnings per share, which were reported at $0.30, a 43.7% decrease from the anticipated $0.53.

Adjusted EBITDA also fell short at $47.02 million, considerably lower than the $76.76 million estimate, with a 15.8% margin and a 38.7% miss. Operating margins contracted sharply to 9.9%, down from 21% in the corresponding quarter of the previous year. The company’s free cash flow turned negative, registering -$95.44 million, a stark contrast to the $30.36 million generated in the same quarter of the preceding year.

Despite these financial challenges, AAON’s backlog reached $867.1 million, showcasing sustained demand in certain sectors. CEO Gary Fields emphasized the success of the BASX brand, which made significant strides in the data center market with its custom liquid cooling solutions and air-side equipment, contributing to a substantial 70% increase in the company’s total backlog compared to the end of 2023. To meet this growing demand, AAON strategically expanded its production capacity, completing a 245,000-square-foot addition in Longview, Texas, and acquiring a 787,000-square-foot facility in Memphis, Tennessee.

Conversely, the AAON brand encountered headwinds due to industry-regulated refrigerant transitions and a general weakening of nonresidential construction activity. While sales of AAON-branded equipment experienced a modest decline in 2024, bookings and year-end backlog demonstrated mid-to-high teens growth year-over-year. AAON’s five-year annualized revenue growth was 20.7%, surpassing the average for industrial companies.

However, the more recent two-year growth rate of 16.2% suggests a moderation in growth. Sell-side analysts project a 26.5% revenue growth over the next 12 months. The company’s five-year average operating margin was 17.1%, but this quarter’s 9.9% margin reflects increased expenses. Over the past five years, EPS grew at a 23.5% CAGR, outpacing revenue growth. Analysts forecast full-year EPS of $2.01, representing a 46% increase. AAON’s current market capitalization stands at $6.42 billion.