Key moments

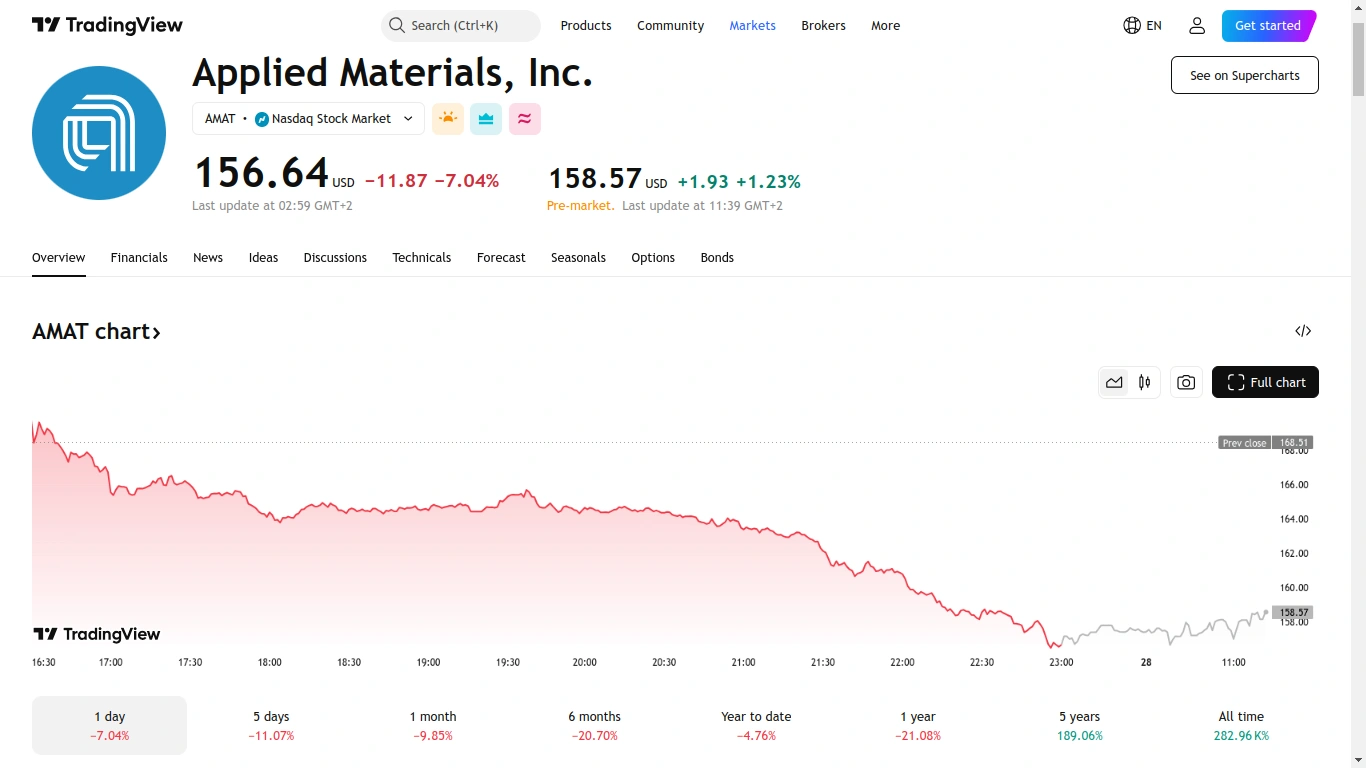

- Applied Materials’ stock declined 7.04% but analysts are optimistic about the company’s future growth.

- On February 24, 2025, Applied Materials secured a significant financing arrangement, establishing a $2.0 billion line of credit.

- Applied Materials has unveiled an innovative new system, the SEMVision H20, which is intended to optimize the process of identifying and in semiconductor chips.

AMAT Shares Saw Decline of 7.04% But New Credit Facility and SEMVision H20 Development Promises an Optimistic Turn of Events

The market has witnessed Applied Materials, Inc. (AMAT) shares reaching a new low point over the past 52 weeks, with the stock price descending to $156.64. Despite this recent downward trend in share value, an in-depth analysis conducted by InvestingPro indicates that the company’s underlying financial stability remains robust, earning an overall “GOOD” rating. This positive assessment is substantiated by the company’s consistently strong profitability metrics and its well-established, solid position within the market. This prominent manufacturer of semiconductor equipment has encountered considerable challenges throughout the preceding year, as evidenced by a total return of -16.23%.

While financial analysts continue to maintain an optimistic outlook, projecting target prices that extend up to $250, investors are exercising heightened vigilance, closely scrutinizing the company’s operational performance as it navigates the complex landscape of ongoing global supply chain disruptions and the fluctuating patterns of demand within the dynamic semiconductor industry. The company’s capacity for resilience is clearly demonstrated by its track record of delivering consistent dividend payments, a practice that has seen increases for seven consecutive years. This newly established low stock price serves as a critical focal point for market observers and investors who are carefully evaluating the stock’s potential future trajectory, as well as the broader implications for the overall technology sector.

On February 24, 2025, Applied Materials, Inc. finalized a new five-year $2.0 billion revolving credit facility with Bank of America, effectively replacing a prior $1.5 billion agreement that was scheduled to expire in 2026. This strategic financial maneuver is designed to augment Applied’s available credit capacity, which has the potential to significantly reinforce its operational flexibility and strengthen its competitive market position.

In other recent developments, Applied Materials has unveiled the SEMVision™ H20 system, a cutting-edge technological tool specifically engineered to enhance the process of defect analysis in semiconductor chips. This innovative system integrates advanced electron beam technology with sophisticated artificial intelligence capabilities, resulting in improved defect detection speed and accuracy. This technological advancement is particularly crucial for the analysis of complex 3D architectures, such as those found in 2nm logic chips. Concurrently, Lam Research has introduced two new tools, the ALTUS Halo and Akara, both aimed at significantly boosting the production of AI chips. These tools are designed to enhance the overall performance of chips and facilitate the scaling of semiconductor devices, thereby positioning Lam Research as a highly competitive player within the semiconductor equipment market.