Key moments

- The iShares Bitcoin Trust by BlackRock saw a single-day withdrawal of $418.1 million, the largest since its launch.

- Total daily outflows from U.S. spot Bitcoin ETFs reached $754.6 million on February 26.

- Bitcoin ETFs collectively experienced a $1 billion outflow on said day, ETF Store president claims.

$1 Billion Outflow and $82,000 Bitcoin Price Dip Signal Market Adjustment

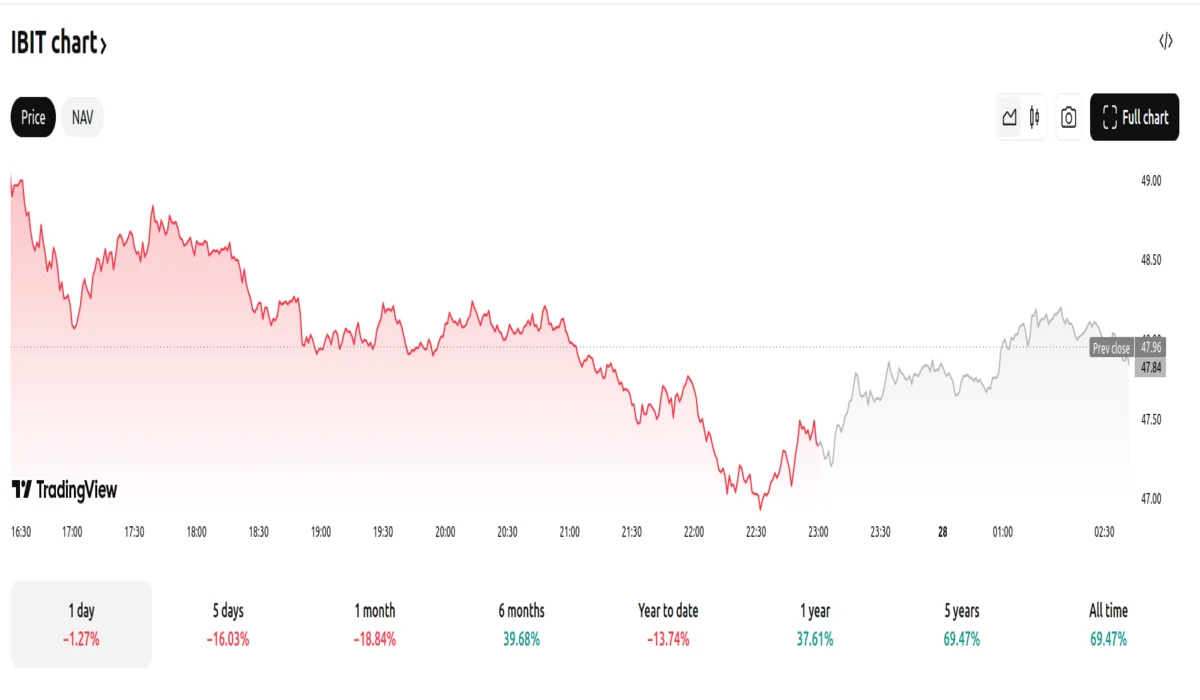

Recent market activity points to significant shifts in the cryptocurrency sector, with Bitcoin experiencing a notable decline. Data indicates there was a substantial outflow from U.S. spot Bitcoin ETFs, totaling $754.6 million on February 26. Specifically, BlackRock’s iShares Bitcoin Trust (IBIT) registered a record one-day withdrawal of $418.1 million, marking its largest single-day outflow since its inception in 2024. This sharp reduction in assets reflects a broader trend of investor caution within the digital currency space.

Furthermore, market analysts highlight a cumulative outflow of approximately $1 billion from Bitcoin ETFs on February 26, as reported by ETF Store President Nate Geraci, a figure described as a record-breaking event. The price of Bitcoin itself dropped to a low of approximately $82,000, representing a 25% correction from its peak. This movement coincides with a total outflow of over $3.6 billion from these ETFs since early February. Additionally, withdrawals occurred across multiple ETF providers, including Fidelity, Bitwise, ARK 21Shares, Invesco, Franklin, WisdomTree, and Grayscale. Grayscale, in particular, moved roughly $290 million worth of Bitcoin to Coinbase Prime.

Analysis of Bitcoin’s trading patterns suggests potential for further price adjustments. Market observers have noted a gap in Bitcoin futures prices, indicating the possibility of a decline towards the $78,000-$80,700 range. The current market liquidity of around $80,000 is considered weak, with a stronger sell wall near $90,000, suggesting continued downward pressure. Some analysts believe that the current sell-off is a temporary correction, while others anticipate further declines due to macroeconomic uncertainties and potential trade tariffs.