Key moments

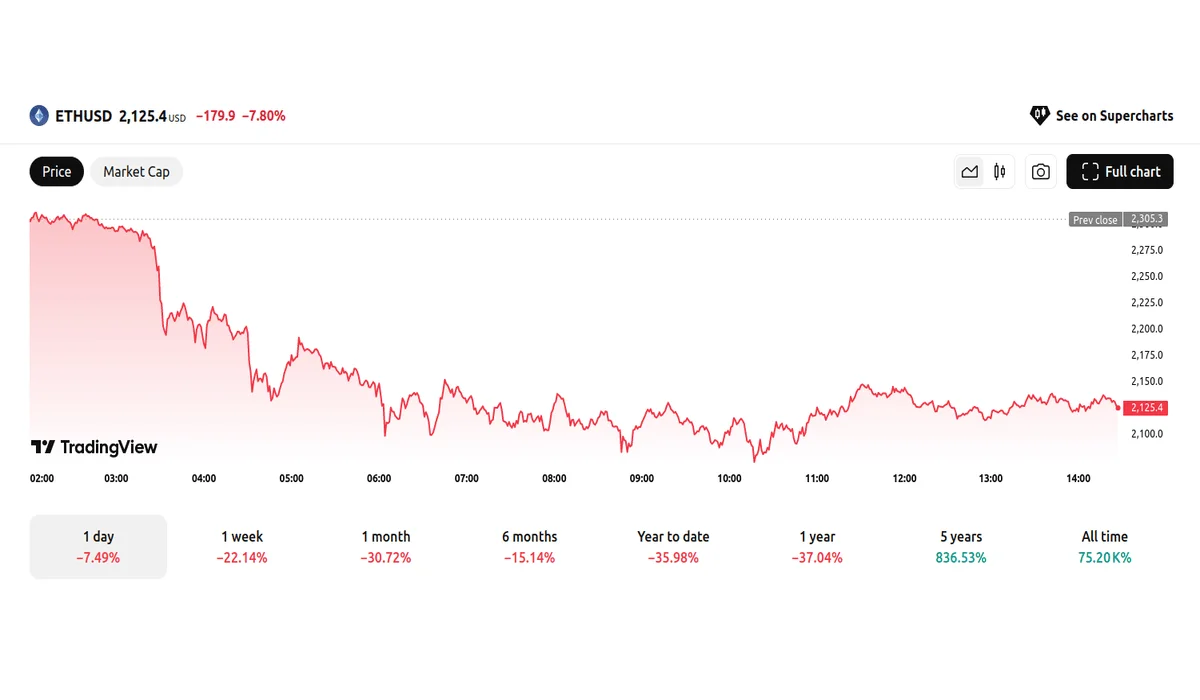

- Ethereum fell 7.80% to $2,125.4, echoing a broader market slump and emphasizing the erratic nature of the cryptocurrency sector.

- This drop is part of a larger decline, with Ethereum losing approximately 50% of its value since December.

- The market’s reaction to security breaches, trade tariffs, and macroeconomic uncertainties has led to a period of significant price correction, resulting in a heavy impact on Ethereum’s value and the overall cryptocurrency market.

Security Breaches and Macroeconomic Fears Drive Cryptocurrency Market Decline

On February 28th, the cryptocurrency market suffered a notable downturn, with Ethereum’s value dropping 7.80% to $2,125.4. Although this marked a significant decrease, it also represented a modest rebound from a previous low of $2,074, underscoring the extreme volatility that characterizes the digital asset market.

Ethereum has been steadily declining this past month, with the cryptocurrency having lost approximately 50% of its value since December. This substantial decrease indicates a major shift in market sentiment, moving away from the bullish trends observed following the recent U.S. elections. The decline can be attributed to a complex array of factors, including both internal and external influences.

One significant event contributing to Ethereum’s woes was a substantial security breach at the Bybit exchange, resulting in the theft of a large quantity of Ether tokens. This incident not only caused immediate price pressure but also sparked concerns about potential future sell-offs by the perpetrators, further undermining investor confidence. Additionally, technical analysis of Ethereum’s price movements revealed a descending channel, with key support levels being tested.

The overall cryptocurrency market mirrored Ethereum’s decline. Bitcoin, the leading cryptocurrency, fell below the $80,000 threshold, a significant drop that contributed to a market-wide sell-off. This downturn was exacerbated by large-scale liquidations, with substantial losses incurred by traders holding long positions. The market’s reaction to newly announced trade tariffs by the U.S. administration also played a pivotal role, creating uncertainty and volatility across various asset classes.

The collective impact of these factors, including security breaches, technical indicators, and macroeconomic uncertainties, has led to a period of significant price correction. The sentiment shift is clear, and the market is heavily affected by the current economic climate.