Key moments

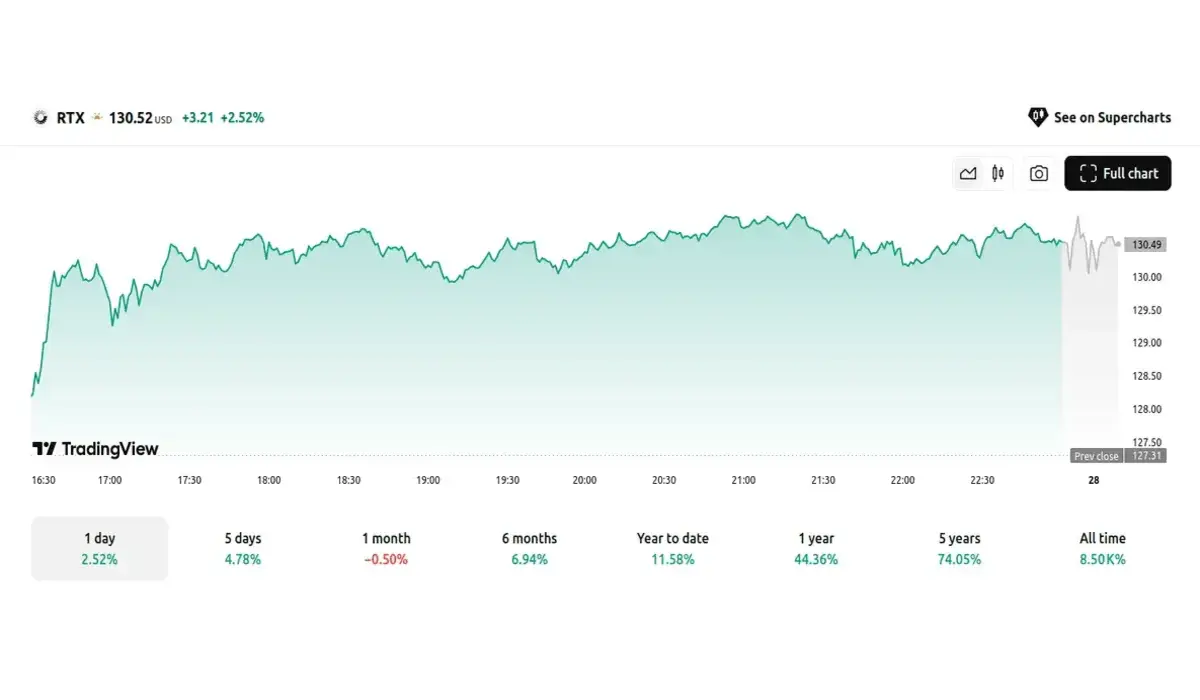

- RTX Corporation’s stock value jumped 2.52%, driving the share price up to $130.52 in a notable surge.

- The company’s progress in various divisions, including Pratt & Whitney’s FAA type certification and Collins Aerospace’s contract with Boeing, contributed to the positive market sentiment.

- Maharajh Ramsaran, RTX’s Executive Vice President and General Counsel, sold 19,431 shares, generating approximately $2.46 million.

RTX Corporation Sees 2.52% Stock Surge

RTX Corporation experienced a notable boost in its stock value, culminating in a 2.52% increase that pushed its share price to $130.52. This upward movement was driven by a combination of factors, reflecting the company’s dynamic position within the aerospace and defense sector. A significant trading volume of 5.54 million shares underscored strong investor interest and confidence in RTX’s performance.

Several key developments contributed to this positive market sentiment. Pratt & Whitney’s achievement in securing U.S. FAA type certification for its GTF Advantage™ engine, along with the $1.5 billion contract with the U.S. Air Force for F119 engine support, highlighted RTX’s continued technological advancements and contract wins. Collins Aerospace’s selection by Boeing to supply ACES II ejection seats for the F-15EX fleet, alongside providing other vital pilot survivability components, further solidified RTX’s role in critical defense programs.

However, RTX also faced challenges, such as the loss of a counter-hypersonic bid due to technological discrepancies with a partnering nation’s requirements. Additionally, concerns regarding potential Pentagon budget cuts introduced an element of uncertainty. Yet, despite these challenges, RTX maintained momentum with successful subsystem demonstrations for the U.S. Army’s Next-Generation Short-Range Interceptor program and an additional contract from NSPA for optical day sights. The combination of technological advancements, significant contract wins, and investor faith all have contributed to RTX’s increased stock price.

Amidst these operational developments, executive financial activities also came to light. Maharajh Ramsaran, RTX’s Executive Vice President and General Counsel, executed a substantial sale of company stock. On February 25th, Ramsaran sold 19,431 shares, generating approximately $2.46 million. This sale occurred near the stock’s 52-week high. In addition, stock appreciation rights were exercised, resulting in the acquisition of two separate blocks of stock. Following all transactions, Ramsaran retained significant shareholdings, both directly and indirectly, in RTX.