Key moments

- Marqeta’s stock price increased by 21.08% on the last trading day, rising from $3.51 to $4.25.

- The company reported sales revenue of $135.8 million, a 14.3% YoY increase, exceeding analyst expectations by 3%.

- Revenue guidance for the next quarter was set at $135.7 million at the midpoint, surpassing estimates by 1.7%.

Marqeta Sees 14.3% Revenue Increase, Reporting $135.8 Million for Q4 2024

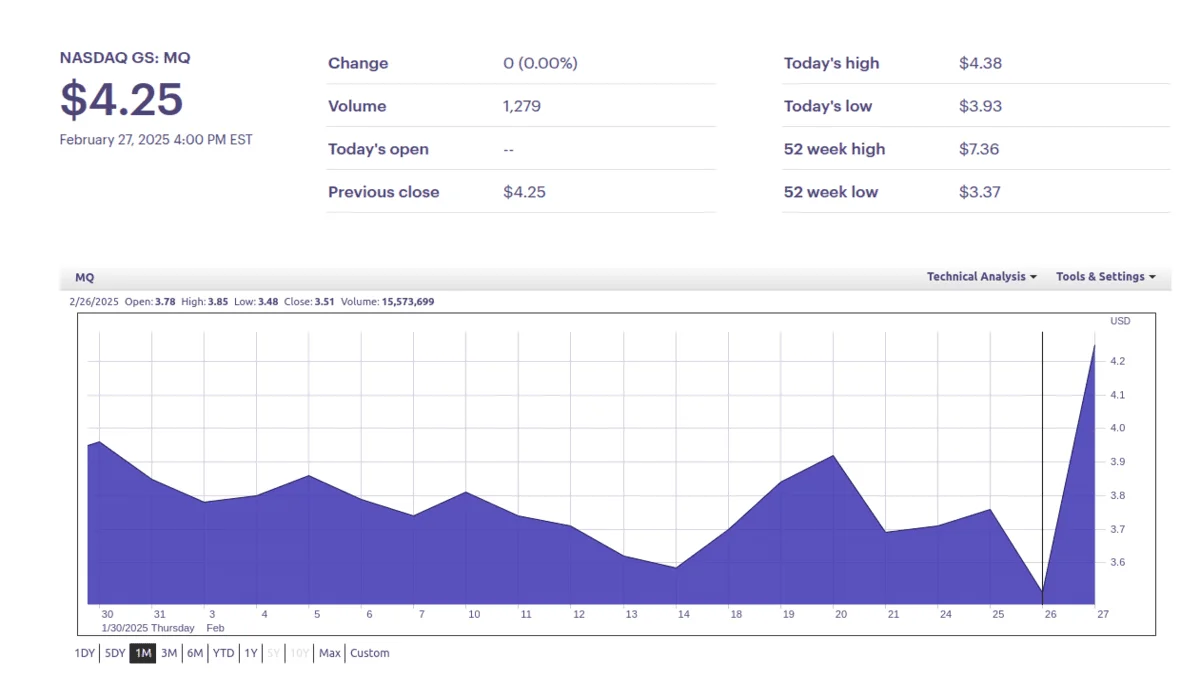

Prime card issuer Marqeta witnessed a pronounced upswing in its stock valuation during the recent trading session, characterized by a period of increased market activity. The company’s stock value experienced an impressive ascent of 21.08%, progressing from $3.51 to $4.25. Intraday trading was marked by significant fluctuations, oscillating between a low of $3.93 and a high of $4.37, thereby indicating an 11.22% fluctuation range.

The trading volume registered a considerable expansion, with 23 million shares being exchanged, resulting in a substantial $96.11 million turnover, and representing an augmented volume of 7 million shares relative to the preceding trading day. The stock shows it has increased in price in 6 of the last 10 trading days. The stock price has increased 14.56% over the last couple of weeks.

Marqeta’s financial performance for the fourth quarter of 2024 revealed a robust 14.3% YoY revenue growth with $135.8 million reported, exceeding analyst expectations of $131.9 million by a 3% margin. The company’s GAAP loss per share remained consistent with analyst consensus, registering at -$0.05.

Adjusted EBITDA demonstrated strong performance, reaching $12.66 million, which significantly outpaced analyst forecasts of $8.06 million, consequently yielding a 9.3% margin. The company’s revenue guidance for the first quarter of 2025 was strategically set at $135.7 million, effectively surpassing analyst projections of $133.4 million, thereby signaling confidence in sustained growth momentum.

Marqeta’s total payment volume (TPV) reached $79.91 billion during the fourth quarter, showcasing 31.1% four-quarter average YoY growth. However, the company’s customer acquisition cost (CAC) payback period registered a negative value for the quarter, signifying that incremental sales and marketing investments outpaced revenue.

The company’s operating margin demonstrated improvement, progressing to -27.6%, up from -47.4% during the corresponding quarter of the previous year. The free cash flow margin experienced an uptick, reaching 15.1%. The stock technicals have shown that the stock has broken a wide and falling short-term trend, and might see a trend shift soon. The company’s market capitalization sits at $1.89 billion. Sell side analysts expect revenue to grow 15% over the next 12 months.