Key moments

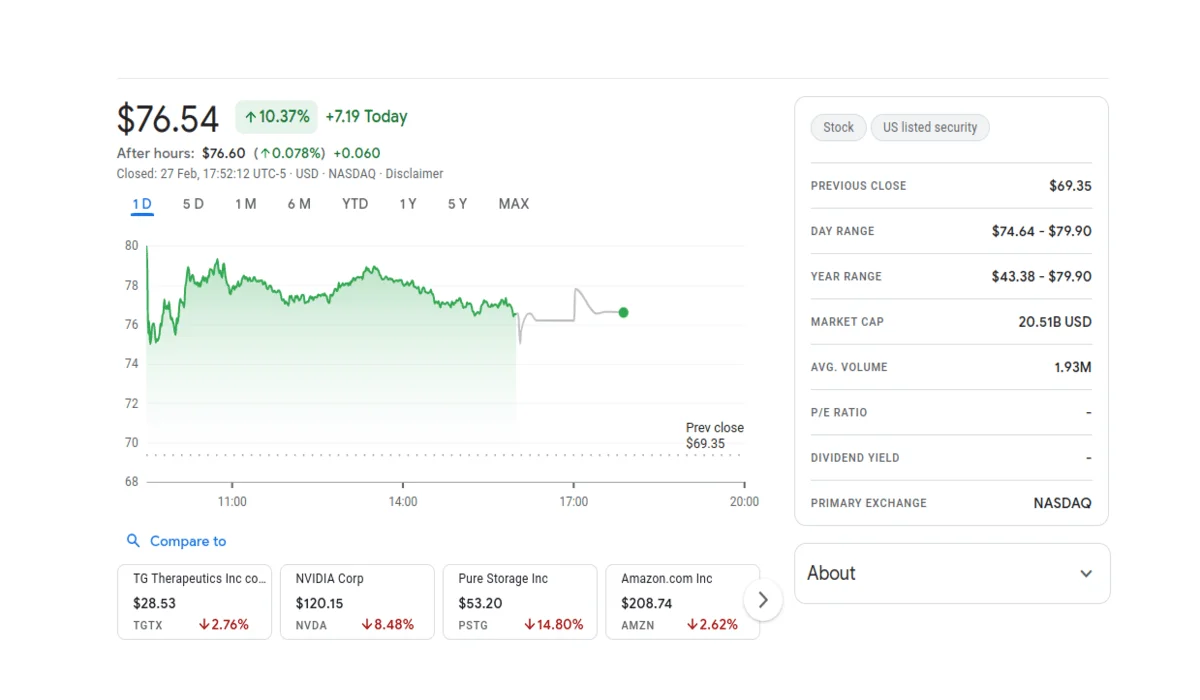

- Nutanix’s stock value jumped by 10.37% to $76.54 after the company released its Q2 fiscal 2025 financial results.

- The company reported a 19% year-over-year increase in annual recurring revenue (ARR) and a 16% year-over-year improvement in quarterly revenue.

- Nutanix provided a positive outlook for 2025’s third quarter and full fiscal year, projecting revenues between $620-630 million for Q3 and $2.495-2.515 billion for the full year.

Nutanix Stock Jumps 10.37% on Back of Strong Financial Results

Nutanix saw a notable increase in its stock price, with shares rising by 10.37% to $76.54, following the release of its second-quarter fiscal 2025 financial results. The market responded favorably due to the company’s impressive performance, marked by significant year-over-year growth in annual recurring revenue (ARR) and strong free cash flow generation.

The financial report revealed a 19% increase in ARR compared to the same period in the previous year, highlighting the company’s sustained growth trajectory. Additionally, the quarterly revenue reached $654.7 million, marking a 16% year-over-year improvement, exceeding both analyst expectations and the company’s own guided range. This performance was attributed to successful customer acquisition strategies, enhanced engagement amid industry consolidation, and strengthened partnerships with OEMs and channel partners.

Rajiv Ramaswami, President and CEO of Nutanix, indicated that the company’s exceptional results stemmed from the strength of the Nutanix Cloud Platform, the increasing demand from businesses seeking reliable and innovative solutions, and the effectiveness of their partnership-driven go-to-market strategies. He conveyed that the company surpassed all guided metrics during the quarter.

Nutanix’s CFO, Rukmini Sivaraman, emphasized the company’s focus on achieving sustainable and profitable growth, as reflected in the 19% year-over-year ARR growth and strong year-to-date free cash flow. She also highlighted the company’s efforts to bolster its financial position through the issuance of convertible notes and the establishment of a new revolving credit facility, providing increased financial flexibility.

Looking ahead, Nutanix provided its outlook for the third quarter of fiscal 2025, projecting revenues to fall within the range of $620 million to $630 million. For the full fiscal year 2025, the company anticipates revenues ranging from $2.495 billion to $2.515 billion, and free cash flow between $650 and $700 million. They also forecast a non-GAAP operating margin of 17.5% to 18.5% for the full fiscal year.