Key moments

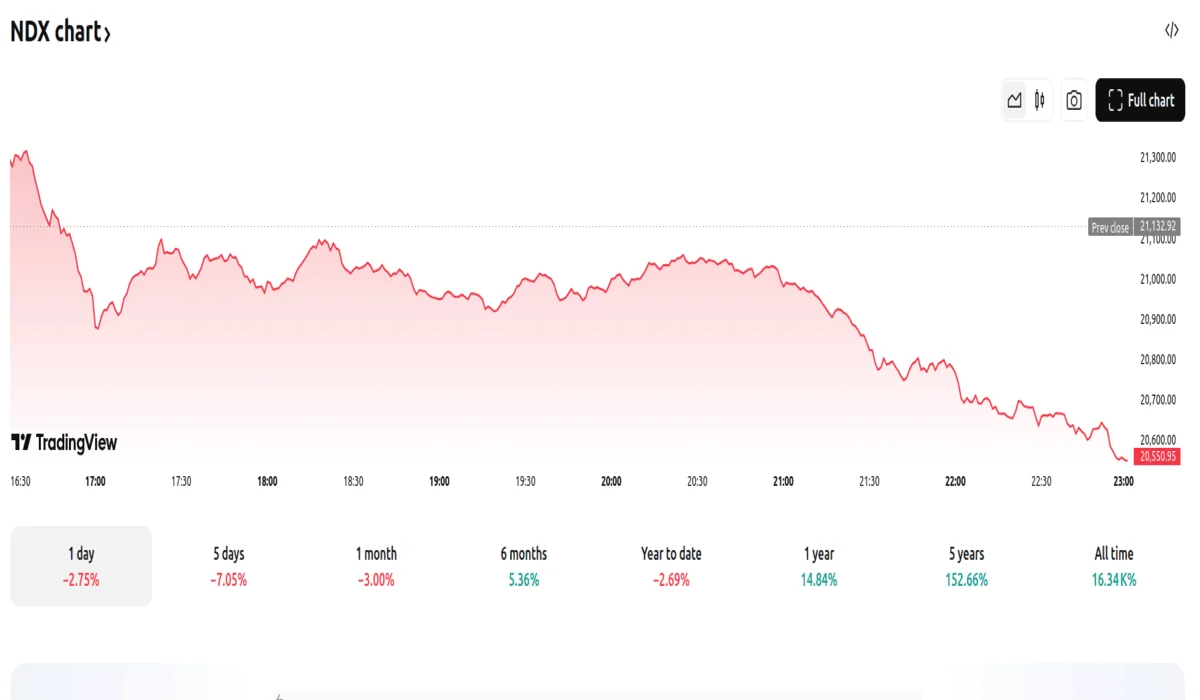

- The Nasdaq 100 experienced a 2.75% decline, closing at 20,550, its lowest point since November.

- The S&P 500 saw a 1.6% drop, finishing the day at 5,860, erasing its year-to-date gains.

- Nvidia’s stock plummeted by 8.5%, closing at $120, and was identified as a primary catalyst for the downturn.

Massive Market Slide Caused by Nvidia Dropping 8.5% to $120 at Close

The stock market underwent a significant selloff, with the Nasdaq 100 reaching its lowest valuation since November, and the S&P 500 erasing its gains for 2025. The decline was largely attributed to Nvidia’s substantial 8.5% drop to a closing price of $120, which triggered a ripple effect across the market. Analysts indicated that Nvidia’s post-earnings pullback was anticipated due to the structure of the options market, where the dissipation of call delta exposure and a sharp drop in implied volatility contributed to the selloff. Furthermore, Nvidia broke key technical support levels, potentially leading to further declines.

The S&P 500 breached the critical 5,900 support level, falling to approximately 5,860. The index’s previous range between 5,900 and 6,100 appears to have shifted downward, with the new range extending to 5,800. The Nasdaq 100 also approached support at 20,550, exhibiting a potential double-top pattern, suggesting further downside if support is breached. Industry experts suggested that the market needed to see credit spreads widen to confirm a sustained decline. Early indications of this were noted, with the CDX high-yield credit spread index closing above a trendline.

The dollar experienced a breakout from a falling wedge, signaling potential strength. The 10-year Treasury yield rose slightly, suggesting the broader market cycle remained intact. The 2s/10s yield curve also steepened, with expectations of continued steepening. Analysts expressed opinions that the market was experiencing a “growth scare”, but more economic data is required to confirm this.

Investor sentiment also shifted, with bearishness increasing significantly, as shown by the AAII sentiment survey. The increase of tariffs, and the uncertainty around them, also caused market unease. The US economy maintains a healthy growth pace, but inflation remains persistent. Analysts said that inflation must decrease and investors want lower interest rates, but without a significant deterioration in the economy. Earnings calls are also seeing an all time high in mentions of tariffs. The PCE index is expected to show a slowing of inflation, but price pressures are still a concern.