Key moments

- Root Inc. shares surged nearly 30% after the company reported fourth-quarter earnings of $1.30 per share, significantly surpassing analyst expectations of a loss.

- The company’s revenue reached $326.7 million, a 67.7% increase year-over-year, driven by a 21% growth in policies in force and substantial increases in gross premiums.

- Root’s success reflects its effective use of technology-driven, personalized insurance pricing as evidenced by a 293% year-over-year stock increase.

Root Inc. Exceeds Expectations with Strong Q4 Earnings and Revenue Growth

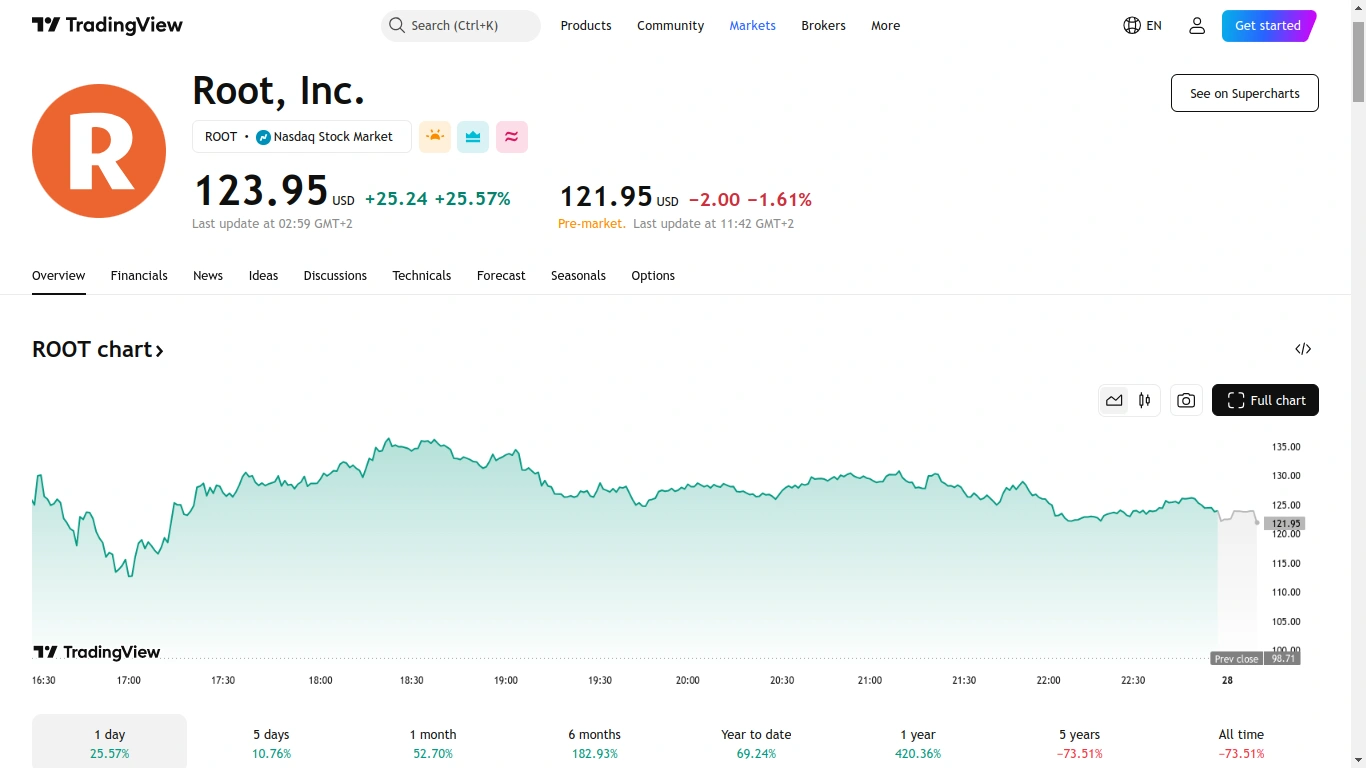

With a market capitalization of $1.5 billion, Root Inc. (ROOT), a key player in the insurance industry, experienced a remarkable surge in its stock value, climbing by almost 30% to $128.09 during the midday trading session, and reaching an intraday peak of $136.51. This significant increase in share price materialized after the company released its financial results for the fourth quarter and the complete fiscal year, both concluding on December 31, 2024. The reported figures conveyed a narrative of substantial growth and operational success, surpassing the expectations of Wall Street analysts and solidifying Root’s standing within a highly competitive market environment.

The technology-driven insurance firm disclosed fourth-quarter earnings of $1.30 per share, when excluding non-recurring items, which notably exceeded the consensus estimate of a $0.45 loss per share by a substantial $1.75 margin. The company’s revenue for the quarter reached $326.7 million, demonstrating a 67.7% increase compared to the previous year’s figures and surpassing the anticipated $291 million. This strong performance highlights Root’s ability to leverage its technology-centric approach to insurance, which focuses on providing personalized pricing based on individual driving behavior. The market’s positive reaction, which pushed the stock price above the $136 threshold, underscores the confidence that investors have in the company’s future growth trajectory.

Root’s operational metrics further illustrate its current momentum. The number of policies in force expanded by 21%, reaching 414,862, indicating a strong rate of customer adoption. Gross premiums written increased by 18%, totaling $331 million, while gross premiums earned saw an impressive surge of 54%, also reaching $331 million. These figures not only reflect a growing customer base but also demonstrate the company’s effectiveness in converting policies into sustained revenue streams. The 67.7% revenue increase to $326.7 million is directly correlated to this growth, showcasing Root’s ability to scale its operations and its appeal in a market that is increasingly receptive to data-driven insurance models.

The transformation from a projected loss to a $1.30 per-share profit reflects Root’s strategic execution in an industry often burdened by traditional operational practices. Exceeding revenue forecasts by more than $35 million further supports the narrative of a company that is outperforming expectations amidst economic uncertainties. With its stock price increasing by 293% year-over-year, Root’s market valuation accurately reflects its operational advancement. As the insurance sector undergoes significant changes, Root’s focus on technology and customer-centric innovation positions it favorably for continued growth and success.