Key moments

- Warner Bros. Discovery stock gains 10% despite underwhelming results form financial report.

- Warner Bros. Discovery aims to expand its streaming subscriber base to 150 million by the end of 2026.

- The company faces a challenging environment due to the decline of linear television viewership and increasing fragmentation of audiences across streaming platforms.

Warner Bros. Discovery Sees Path to Profitability with 150 Million Streaming Subscribers by 2026

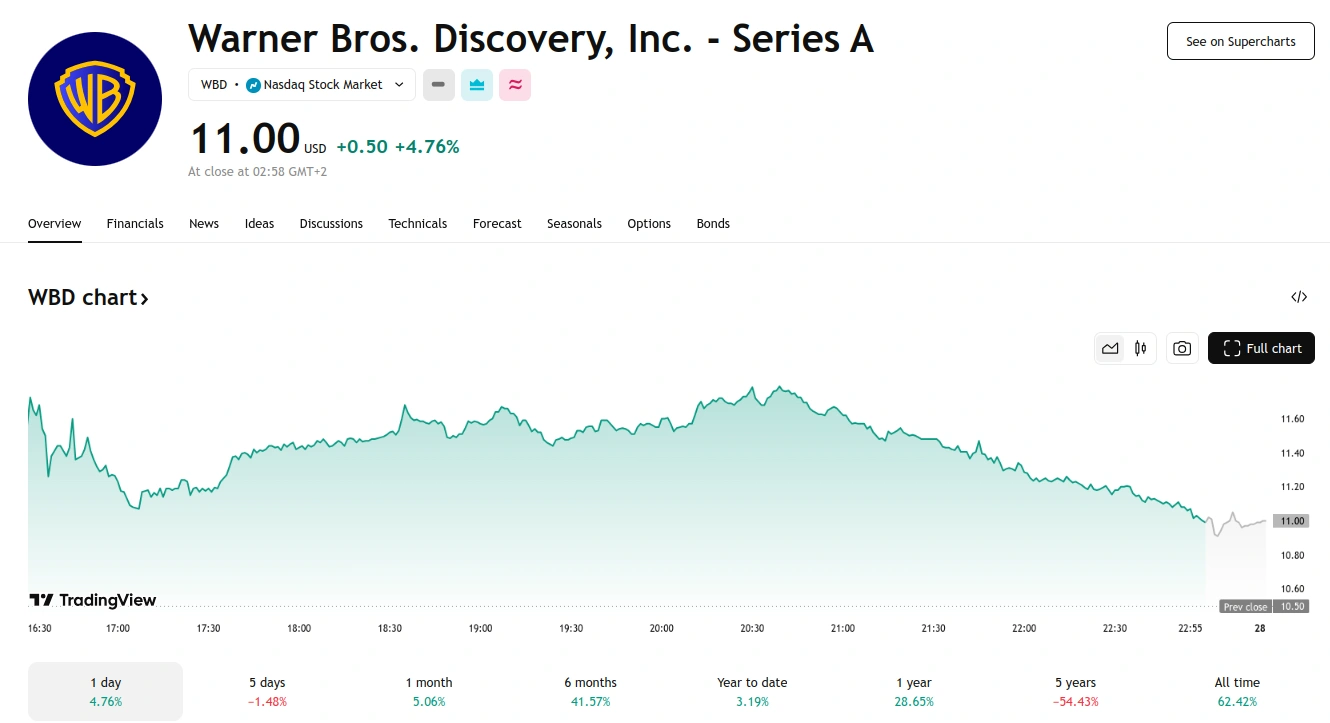

Warner Bros. Discovery experienced a roughly 10% surge in its stock value following the release of its fourth-quarter earnings report, where the entertainment conglomerate presented optimistic projections regarding the future of its streaming operations. This positive market reaction occurred despite an otherwise lackluster financial report for the quarter.

The company has articulated a clear objective to expand its streaming subscriber base to 150 million by the conclusion of 2026. This represents a substantial increase from the 116.9 million subscribers reported at the end of 2024, which already reflected a gain of 6.4 million subscribers compared to the third quarter. Furthermore, Warner Bros. Discovery anticipates significant growth in direct-to-consumer Ebitda revenue, forecasting a rise to approximately $1.3 billion in 2025. This would be a considerable increase from the nearly $700 million generated in 2024.

To achieve these ambitious goals, the company is currently producing new seasons of several of its most popular and critically acclaimed series, including “House of the Dragon,” “Euphoria,” and “True Detective” (2024). In addition, Warner Bros. Discovery is also developing a slate of new series based on well-known intellectual properties, such as “Harry Potter,” “A Knight of the Seven Kingdoms,” “Lanterns,” and “DTF St. Louis”.

However, Warner Bros. Discovery, like its competitors in the media and entertainment industry, is operating in a challenging environment marked by the ongoing decline of linear television viewership and the increasing fragmentation of audiences across various streaming video platforms. This shift in viewing habits has created difficulties in monetizing content, as linear TV audiences are generally easier to reach and convert into revenue. As a result of these challenges, Warner Bros. Discovery reported an overall revenue decline of 2%, reaching $10 billion for the quarter.

The company also experienced declines in revenue from distribution (down 2%) and advertising sales (down 11%), which it attributed to “continuing softness” in traditional advertising markets. The company’s losses for the quarter widened to $494 million, compared to a loss of $400 million in the same period of the previous year, representing a 24% increase in losses.

In some areas of its business, Warner Bros. Discovery’s studio operations demonstrated strong performance during the quarter, with revenue from the studio segment increasing by 15% to nearly $3.66 billion. In contrast, revenue from the company’s television networks fell by 5% to $4.77 billion, with Warner Bros. Discovery reporting a significant decline of 28% in audiences for its U.S. networks.

One of the most positive aspects of the fourth-quarter results was the strong performance of Warner Bros. Discovery’s direct-to-consumer operations. The company added 6.4 million subscribers to its streaming services around the world during the quarter, bringing its total global subscriber base to 116.9 million. Revenues from direct-to-consumer operations also increased, rising by 5% to $2.65 billion.