Key moments

- AppLovin reported $1.37 billion in sales earnings for Q4 2024, showing substantial year-over-year growth.

- Despite strong overall returns, AppLovin stock prices slid by 11% in the past quarter.

- Over the last three years, AppLovin shares have experienced a 588.23% return.

The Palo Alto-Based Company’s Net Revenue Surged to $599 Million in Q4

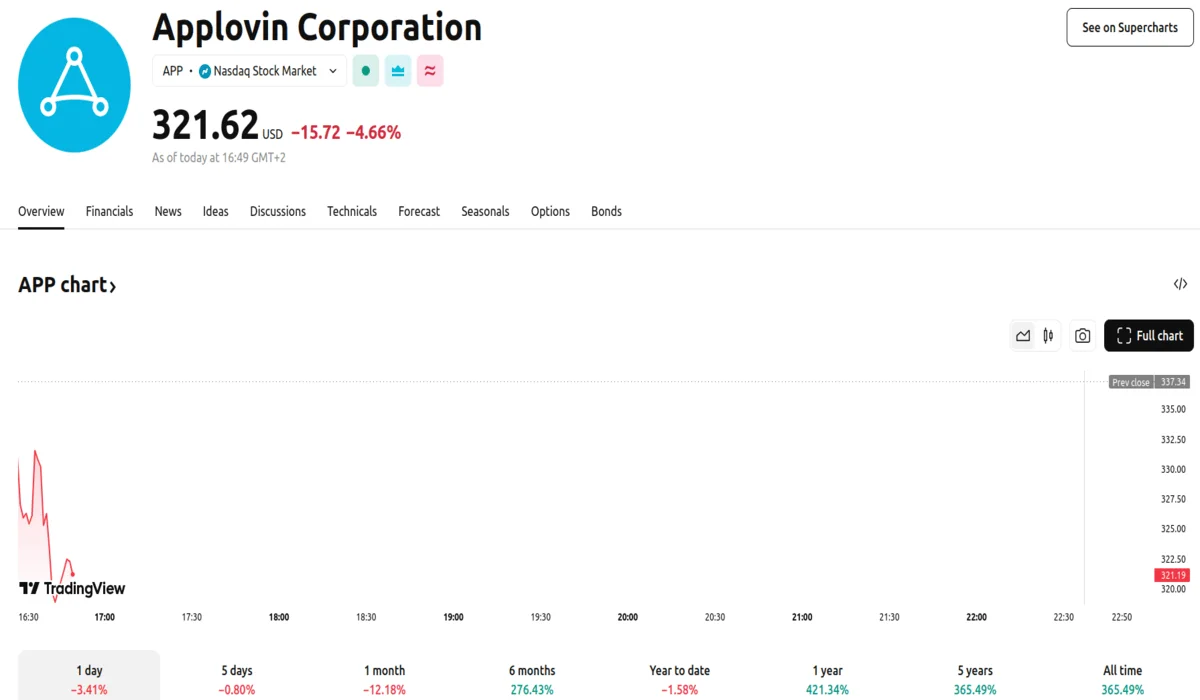

AppLovin announced robust earnings for the fourth quarter of 2024, with sales reaching $1.37 billion and net income surging to $599 million. This performance reflects notable year-over-year growth for the technology company. Despite these strong financial results, AppLovin’s stock price experienced an 11% decline over the past quarter. This decrease occurred as the broader market, particularly the Nasdaq, faced economic uncertainties and weaker-than-expected manufacturing data. The company’s stock currently trades at $321.62 down 4.66% from the previous day.

Adding to the company’s market challenges, AppLovin’s stock plummeted by 17% in a single trading session following accusations of advertising fraud. As TradingPedia wrote last week, research reports from Culper Research and The Bear Cave newsletter allege that AppLovin has been manipulating ad placements and revenue figures, potentially misleading advertisers and investors. These reports also claim that the company exploits app permissions to enable “silent, backdoor app installations” onto users’ phones.

The allegations have triggered significant investor concern, leading to a sell-off of shares amid fears of regulatory scrutiny and potential legal action. This sharp downturn marked the seventh consecutive day of falling share prices for AppLovin at the time. The stock, which had previously reached a high of $525.15 on February 13th, demonstrated a rapid reversal of investor sentiment.

Despite recent volatility, AppLovin has demonstrated significant long-term growth. Over the past three years, the company’s shares have experienced a 588.23% return. This growth is supported by strong earnings performance and positive revenue guidance, alongside strategic share buyback initiatives. Notably, the company recently purchased 2.62 million shares for US$128.85 million, a move that has likely contributed to boosting its shareholder value. AppLovin has also outperformed both the US software industry and the broader market over the past year.

The company’s strategic partnership expansion with MiMedia Holdings and forward-looking revenue guidance for Q1 2025 could also bolster investor confidence. However, these positive developments have been overshadowed by the recent allegations and broader market concerns. AppLovin, which provides a software platform for app developers and has expanded into advertising-based e-commerce and streaming television services, faces the challenge of navigating these market and legal uncertainties.