Key moments

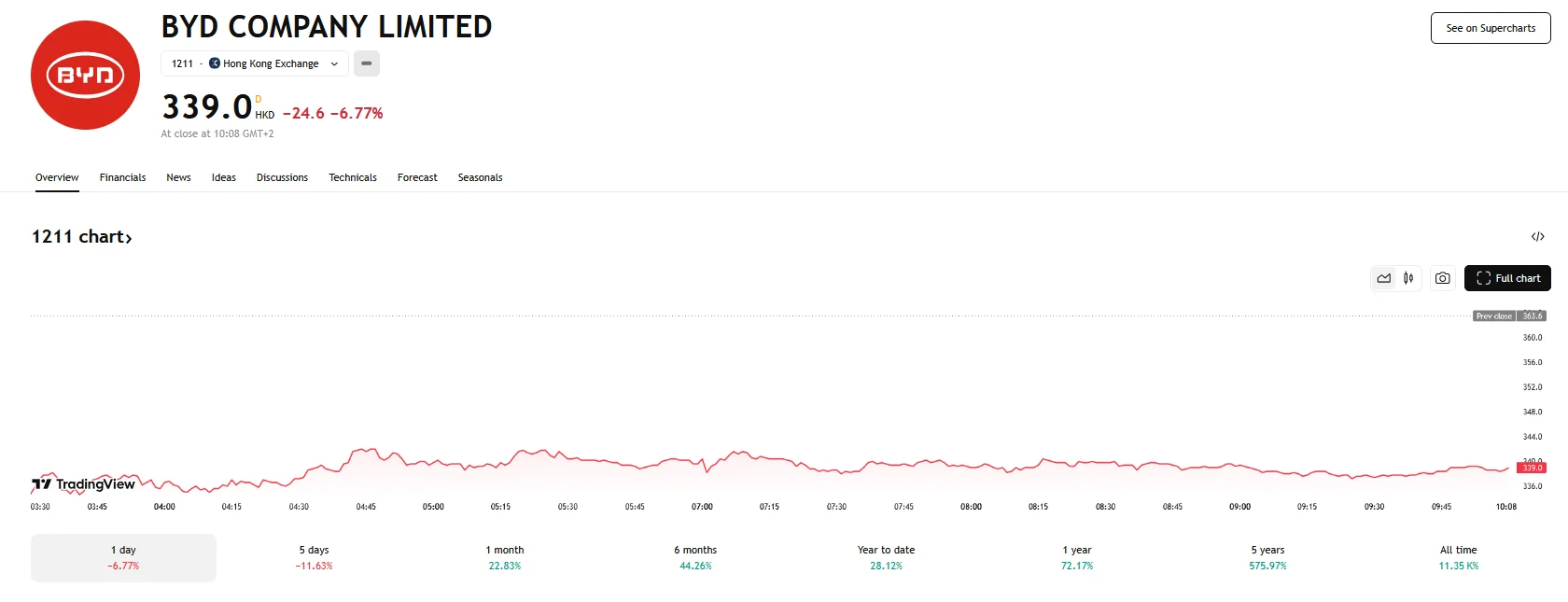

- BYD’s stock price took a sharp tumble on Tuesday, falling 6.8% to reach HK$339 per share on the Hong Kong Stock Exchange.

- The decline followed a successful share placement that earned the company US$5.59 billion.

- BYD sold a total of 129.8 million primary shares, surpassing the initial goal of 118 million

BYD Company Secures US$5.59 Billion in Share Placement, Stock Price Down 6.8%

On Tuesday, the stock price of China’s leading electric vehicle manufacturer BYD plummeted by 6.8%, settling at HK$339 per share on the Hong Kong Stock Exchange. The abrupt decline resulted in a substantial reduction in BYD’s market capitalization, erasing HK$27 billion, or approximately US$3.5 billion, from its overall value. This market reaction followed the announcement of a large-scale share placement, through which BYD secured US$5.59 billion in funding.

The company opted to offer shares at a discounted price of HK$335.20 each, marking a 7.8% drop from the prior day’s closing value, which significantly shaped the market’s reaction. While the original intent was to sell 118 million primary shares, heightened demand pushed the final tally to 129.8 million, reflecting robust investor enthusiasm. Despite this strong interest, the discounted pricing inevitably created downward momentum for the stock.

Amidst the recent market volatility, experts highlight the strategic foresight driving BYD’s fundraising initiative. The significant influx of capital is seen as a crucial step to strengthen the company’s technological edge and fuel its global expansion goals. With the electric vehicle industry becoming increasingly competitive, BYD’s move to secure extra funding underscores the pressing need for innovation and broader market reach.

A broad spectrum of investors, ranging from state-backed financial entities to collaborators from the Middle East, were drawn to the share placement. A particularly noteworthy participant was the Al-Futtaim Family Office, based in the UAE, whose significant investment suggests the potential for a future strategic partnership between the two organizations. Beyond this financial maneuver, BYD’s dedication to cutting-edge technology is readily apparent. This is illustrated by their recent integration of the “God’s Eye” self-driving technology across multiple vehicle lines, as well as their collaborative effort with DJI, a drone manufacturing giant, to create integrated drone systems for their vehicles.

BYD’s ambitious expansion plans include the establishment of production facilities across Asia and Europe, namely Thailand, Indonesia, Brazil, and Hungary. These facilities are intended to bolster the company’s production capacity and solidify its presence in key international markets. While the immediate market reaction was negative, analysts suggest that BYD’s strategic moves are designed to ensure its long-term competitiveness and solidify its position as a global leader in the electric vehicle industry.