Key moments

- Geopolitical tensions and trade uncertainties are driving increased demand for gold as a safe-haven asset.

- Tariffs and potential trade wars could lead to higher inflation, which may support gold prices.

- The Fed’s response to potential inflation, including interest rate decisions, will significantly impact gold’s performance.

Gold Price Climbs on Dollar Weakness and Trade War Fears

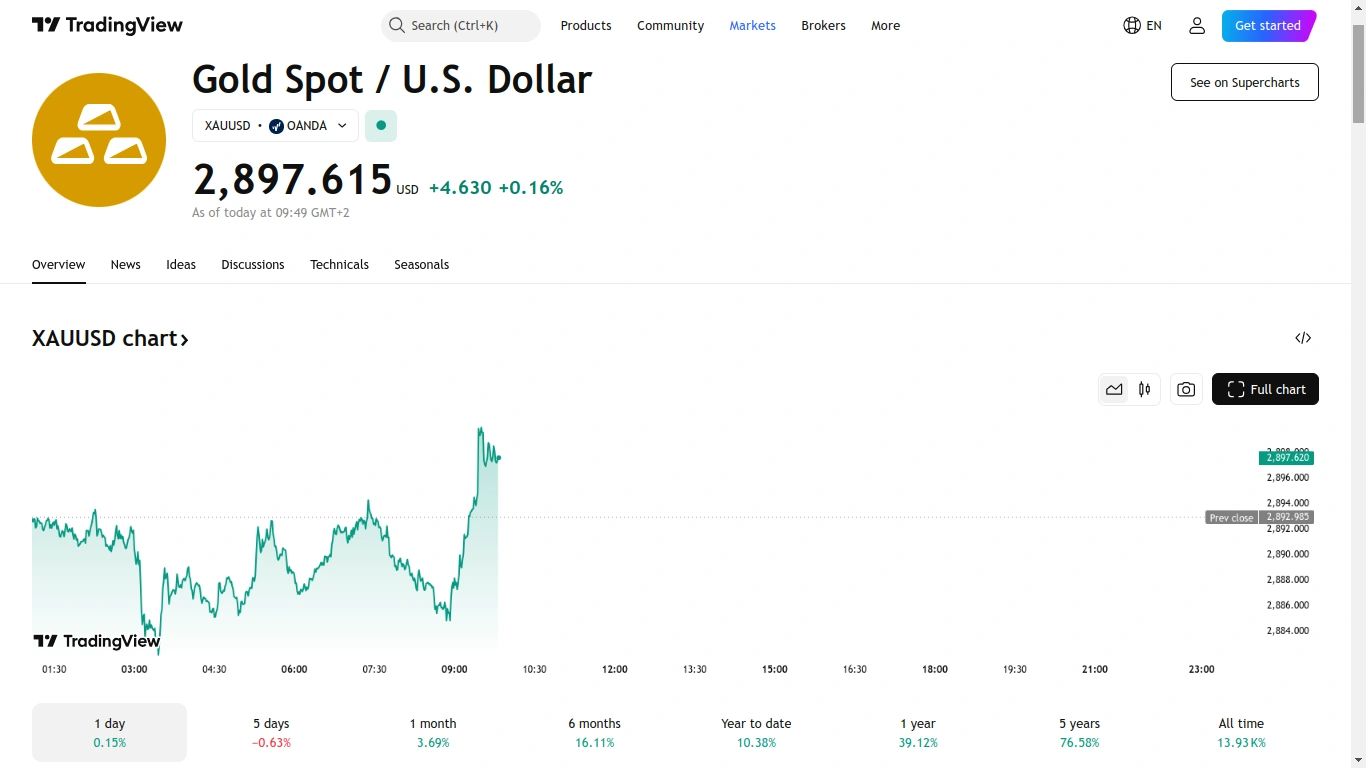

Gold prices experienced a notable surge on Monday, climbing over 1%, rebounding from a three-week low. This upward trend was primarily fueled by a weakening U.S. dollar and a surge in safe-haven demand as investors reacted to concerns surrounding President Trump’s newly implemented tariff policies. Spot gold reached $2,890.57 per ounce, while U.S. gold futures settled at $2,901.1, reflecting a significant 1.8% increase.

The momentum continued into Tuesday, with gold prices maintaining their stability around $2,892.64 per ounce, as market participants remained focused on the potential inflationary and economic growth impacts of Trump’s tariffs on Canada and Mexico. The implementation of 25% tariffs, effective Tuesday, has ignited fears of a North American trade war, causing ripples throughout global financial markets.

Further escalating trade tensions, Trump also announced plans for reciprocal tariffs on countries imposing duties on U.S. products, to take effect on April 2nd. Additionally, he reaffirmed intentions to double tariffs on Chinese imports to 20%.

These trade uncertainties have raised concerns about potential inflation, which could prompt the Federal Reserve to maintain higher interest rates. This scenario poses a challenge for gold, as higher interest rates typically diminish the appeal of non-yielding assets.

Adding to the economic uncertainty, St. Louis Federal Reserve President Alberto Musalem expressed concerns about potential risks to U.S. economic growth, citing recent weaker-than-expected consumption and housing data.