Key moments

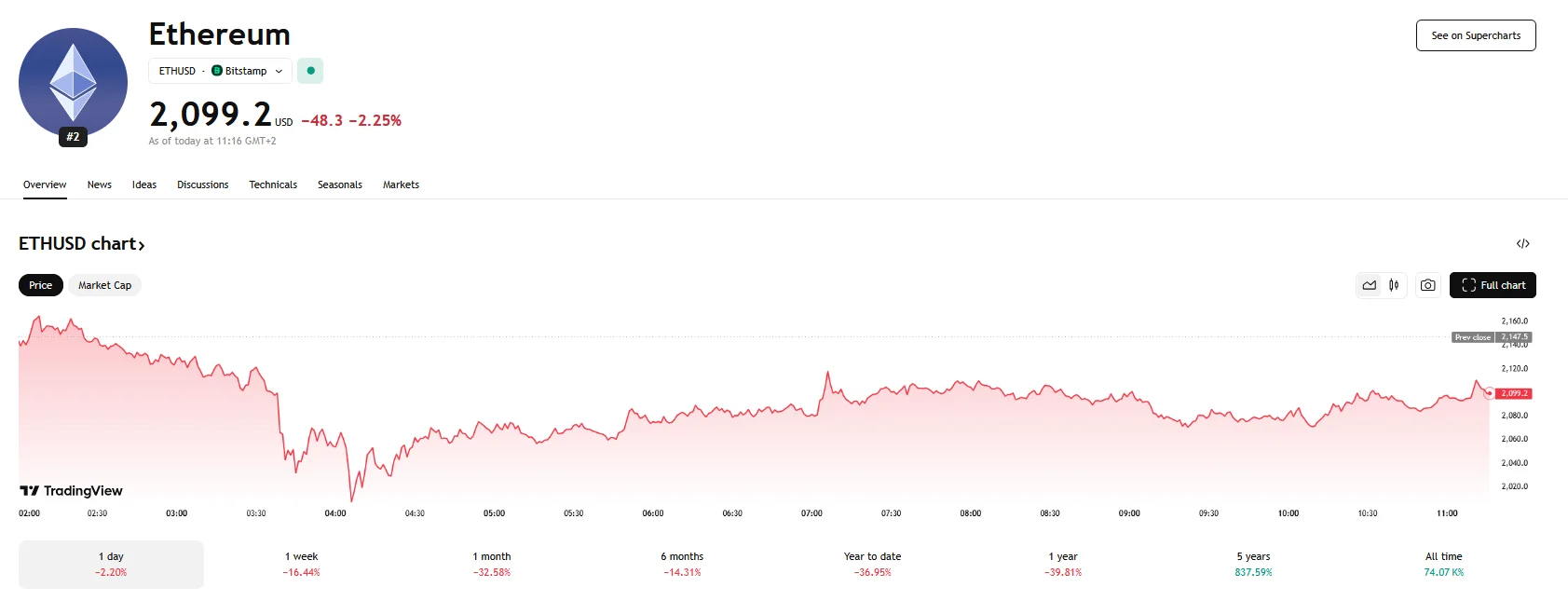

- Ethereum’s value has plummeted below $2,100, hitting a low of $2,003.

- A 14% Sunday surge, driven by potential U.S. reserve inclusion, was quickly reversed by a 15% Monday decline.

- Global trade tensions, particularly U.S. tariff policies, and “whale” liquidations contributed significantly to Ethereum’s price decline.

Crypto Market Whiplash: Ethereum Drops Under $2,100 Despite Reserve-Fueled Optimism

Ethereum’s market value faced a significant downturn, dipping below the $2,100 threshold. This decline culminated in a momentary drop to $2,003, underscoring the volatility inherent within the cryptocurrency sector. This downward trend occurred following a period of optimism, where the value of Ethereum surged by 14% on Sunday. This price increase was initially fueled by announcements concerning the potential inclusion of Ethereum in U.S. cryptocurrency reserves. However, the positive sentiment proved fleeting, as the market subsequently witnessed a 15% drop on Monday, with prices remaining suppressed.

The recent price action highlighted the inherent volatility of the cryptocurrency market. Ethereum’s inability to maintain its upward momentum signaled a shift in investor confidence, as the decline below the $2,100 barrier raised concerns about further potential losses. Technical indicators, such as the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI), reflected the prevailing bearish sentiment.

The broader economic landscape played a significant role in Ethereum’s price fluctuations. Global trade tensions, particularly those stemming from the Trump administration’s tariff policies, created an environment of uncertainty. The resulting risk-off sentiment among investors affected high-risk assets like cryptocurrencies.

Ethereum’s price was pushed lower by a combination of significant sales and the actions of major investors, often referred to as “whales.” Blockchain analysis showed a sharp increase in the amount of Ethereum moved to trading platforms. Moreover, the forced selling of heavily leveraged positions amplified the price drop, accelerating the cryptocurrency’s slide.

Some analysts argue that there is room for future recovery. One factor supporting this view is the observable trend of investors pulling their Ethereum holdings from centralized trading platforms. This move toward personal storage could lessen the immediate pressure from sellers. Planned improvements to the platform’s core infrastructure, addressing issues related to speed and supply management, are also expected to rekindle investor enthusiasm.