Key moments

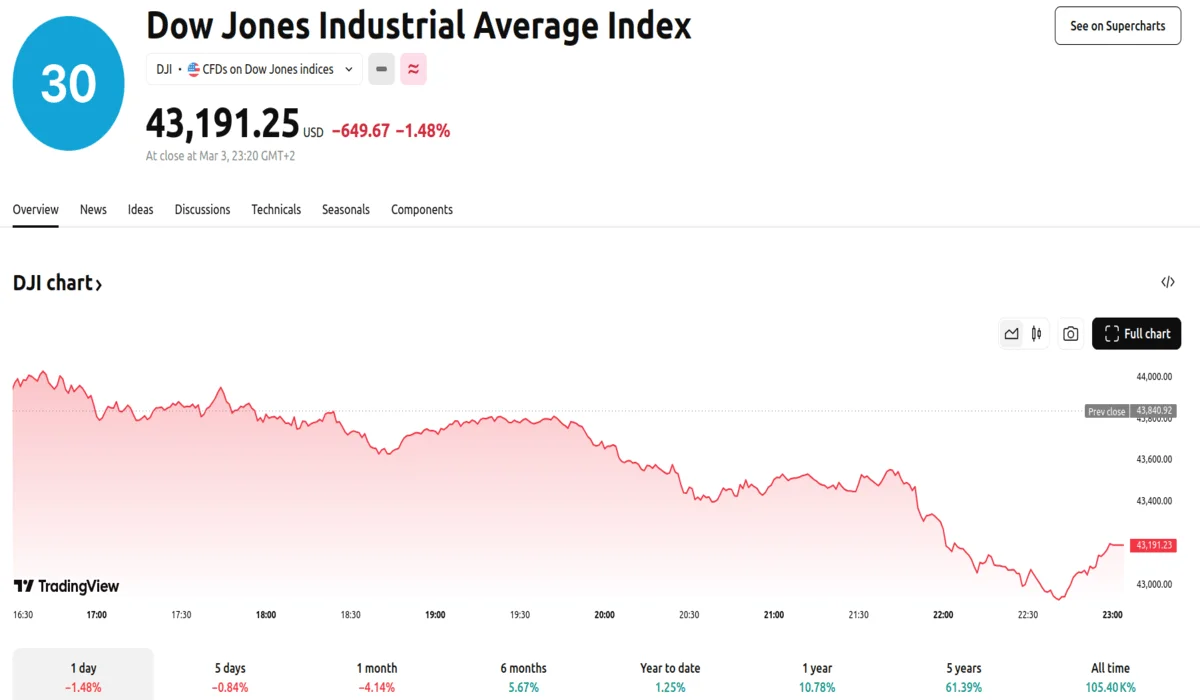

- The Dow Jones Industrial Average experienced a significant decline, falling approximately 650 points, or 1.48%, to close at 43,191.

- The Nasdaq Composite has seen a decrease of roughly 6.5% since President Trump’s inauguration on January 20th.

- The S&P 500 recorded its most substantial single-day loss of 2025, with a drop of 1.76%.

S&P 500 Takes Biggest Hit, Suffers Largest Single-Day Decline in 2025

The U.S. stock market experienced a sharp downturn on Monday as investors reacted to President Trump’s proposed tariffs on Canada and Mexico, as well as increased tariffs on Chinese imports. The Dow Jones Industrial Average plummeted, closing at 43,191, a decrease of approximately 650 points or 1.48%. The S&P 500 suffered its largest single-day decline of the year, falling by 1.76%, while the Nasdaq Composite dropped by 2.64%. The Nasdaq has declined about 6.5% since President Trump was inaugurated on January 20.

President Trump’s announcement of the 25% tariffs on goods from Canada and Mexico, set to take effect today, caused significant market anxiety. Additionally, he signed an executive order to raise tariffs on Chinese imports to 20%, an increase from 10%. These actions triggered a surge in the VIX, Wall Street’s “fear gauge,” to its highest level of the year.

The proposed tariffs have raised concerns about the potential impacts on global trade and economic growth. Analysts suggest that while the tariffs could stimulate domestic production, they also risk increasing production costs and prompting retaliatory measures from trading partners. Canadian Prime Minister Justin Trudeau already announced that Ottawa would immediately impose tariffs on $30 billion worth of U.S. goods should the Trump administration’s measures be implemented. He also declared in a statement that Canada would not allow the unjustified decision to go unchallenged.

The implementation of reciprocal tariffs, scheduled for April 2nd, further compounds the market uncertainty. Gustavo Flores-Macias, a professor of government and public policy at Cornell University, stated that the stock market had lost the gains attributed to the ‘Trump bump’ following the presidential election due to the uncertainty surrounding the tariffs. He also indicated that the anticipated upward pressure on prices was causing investors to hesitate.

The sentiment driving the market shifted towards “extreme fear” as investors digested the implications of the new tariffs. The 10-year Treasury yield fell to 4.16%, reflecting concerns about economic uncertainty. Nvidia, a major tech stock, experienced a significant drop of 8.7%. Bitcoin also saw a decline, trading around $85,600, down 8.6% in the past day.

European defense stocks, however, surged to record highs as European leaders are considering rearming as a result of reduced U.S. support for Ukraine. WTI crude oil prices fell approximately 2%, reaching their lowest point since December, following OPEC+’s announcement of increased oil production in April.

The sheer scale of these new import taxes is noteworthy. The initial tariffs put into place on February 4th, set in motion tariffs on $1.4 trillion of imported goods. This is more than triple the $380 billion worth of foreign goods that were hit with tariffs during Trump’s first term.