Key moments

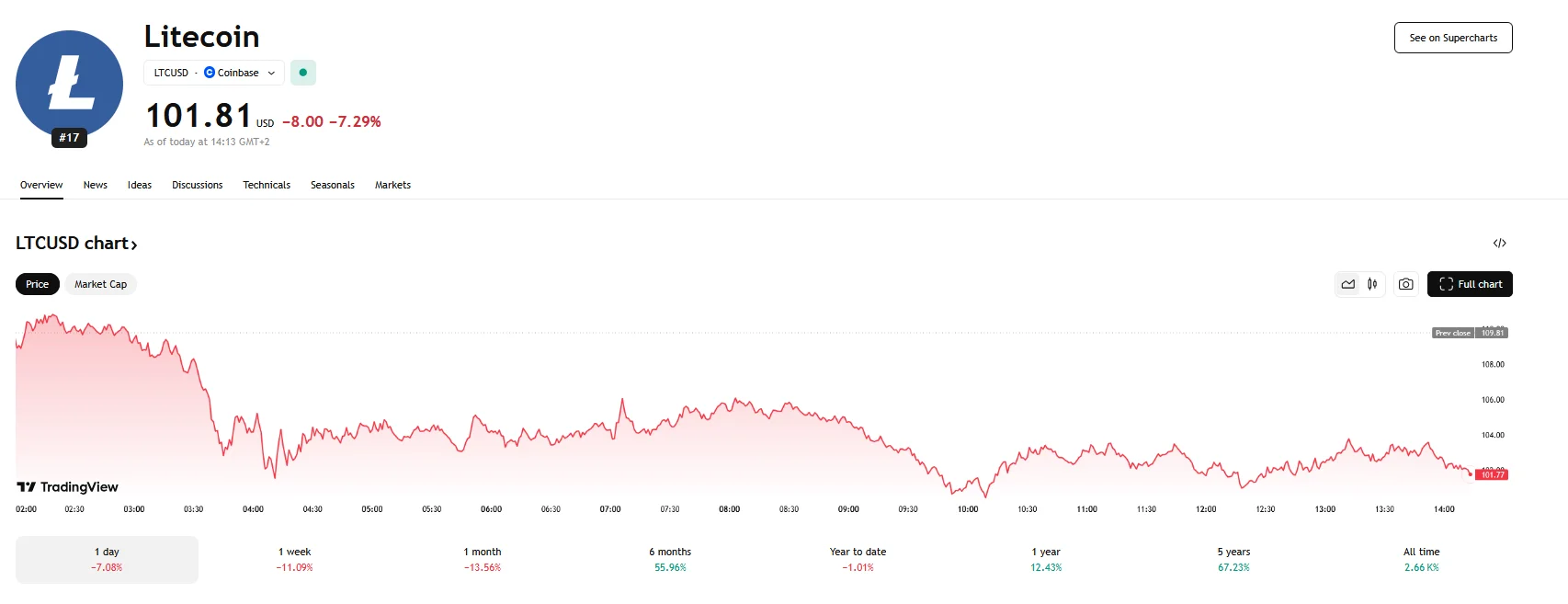

- Litecoin’s valuation has faced significant challenges, with its price nearing the $100 mark, reflecting a general sense of unease within the cryptocurrency market.

- Litecoin’s market capitalization now stands at roughly $7.7 billion.

- The recent volatility in Litecoin’s price can be attributed to a combination of factors, including overall market consolidation and a notable decrease in trading volume.

Bearish Sentiment Overpowers Litecoin’s Recovery Attempts

This week saw Litecoin’s market value taking a noticeable hit, edging precariously close to the $100 threshold, a sign of widespread market hesitancy. A sharp 10% decline was observed on Monday, and this downward momentum continued into Tuesday, with the cryptocurrency briefly dipping below $101. This price erosion has shrunk Litecoin’s total market value to roughly $7.7 billion at press time, indicating the value of Litecoin has been under considerable strain.

Several interconnected elements have fueled the recent fluctuations in Litecoin’s value, with a notable factor being a decline in transaction levels. The observed drop in Litecoin’s trading volume (roughly $1.48 billion at the time of writing) suggests a more conservative approach by investors, who are actively reevaluating their holdings given the current ambiguous market conditions. Data derived from blockchain analysis confirms a decrease in acquisition activity, further compounded by substantial Litecoin holders transferring their assets to trading platforms, thereby increasing selling pressures.

The broader cryptocurrency market is also experiencing a period of consolidation, with major assets like Bitcoin and Ethereum witnessing price corrections. This widespread market trend has amplified the downward pressure on Litecoin.

Even with the current market downturn, Litecoin’s core technological strengths, including its secure infrastructure and efficient transaction handling, continue to be a source of perceived stability. Many members of the Litecoin user base maintain a degree of optimism, fueled by observations of past price drops that were ultimately followed by rebounds.

While speculation surrounding the potential approval of a Litecoin ETF has generated some interest, it has not been sufficient to counteract the prevailing bearish sentiment. The ongoing uncertainty regarding regulatory approvals and market conditions has contributed to the cautious approach adopted by traders.