Key moments

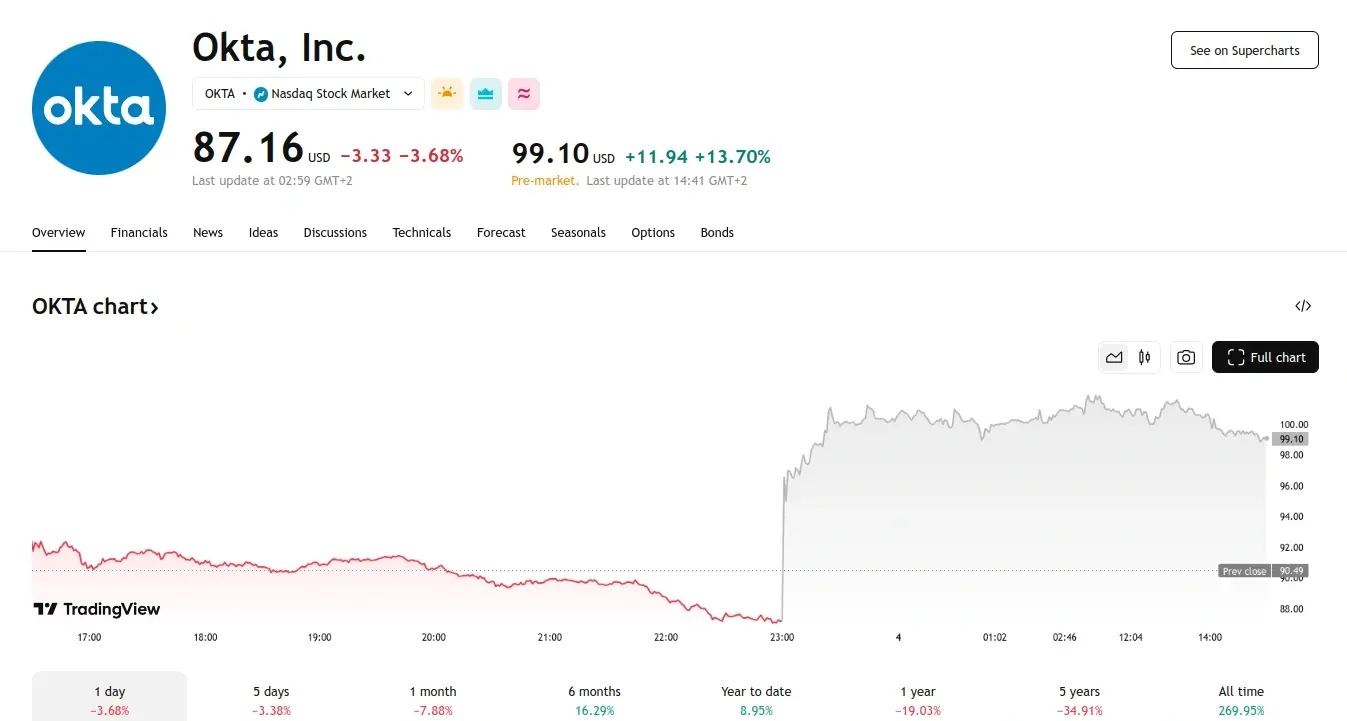

- Okta’s shares experienced a substantial 15.25% pre-market increase, reaching $100.45, driven by the company’s Q4 fiscal 2025 results.

- Okta reported adjusted EPS and revenue that exceeded consensus estimates, and provided optimistic guidance for Q1 and the full fiscal year 2026.

- Following the impressive earnings report, multiple analysts upgraded Okta’s stock to “buy”.

Pre-Market Trading Hours See Surge in Okta Stock After Company Reports Positive Q4 Results

Okta’s shares experienced a significant pre-market surge, climbing 15.25% to $100.45 as of 5:43 AM ET on Tuesday, following the release of its robust Q4 fiscal 2025 results and optimistic guidance, which both exceeded market expectations on Monday.

For the quarter ending January 31, 2025, Okta reported adjusted earnings per share of $0.78, surpassing the consensus estimate of $0.74. The company also announced revenue of $682 million, exceeding analysts’ predictions of $669.1 million.

Looking forward, Okta provided strong guidance, forecasting Q1 fiscal 2026 revenue between $678 million and $680 million, above the $670.7 million estimate. The company also projected adjusted EPS of $0.76 to $0.77, exceeding the $0.70 forecast. For the full fiscal year 2026, Okta anticipates revenue between $2.85 billion and $2.86 billion, reflecting 10% year-over-year growth and surpassing the $2.8 billion estimate.

In addition to its strong financial results, Okta announced that it has achieved over $1 billion in total sales through the Amazon Web Services (AMZN) Marketplace over the past four years, highlighting its expanding presence in the cloud security sector.

Following the release of Okta’s impressive fourth-quarter results, D.A. Davidson upgraded the stock to “buy” from “hold” on Monday. The firm also raised its price target to $125 per share from $90, indicating a potential upside of more than 43%. This upgrade was driven by Okta’s better-than-expected earnings, which propelled the stock 15% higher in pre-market trading. The company also increased its full-year outlook.

“Double-digit growth now seems durable,” wrote analyst Rudy Kessinger of D.A. Davidson. “[Management] repeatedly characterized the qtr. as a ‘blowout’ & spoke more positively about the business than we have heard in years.” He further added, “Sales productivity reached a multi-year high, DBNRR (dollar-based net retention rate) is stabilizing, enterprise & channel contribution are picking up, newer products are contributing more meaningfully, and more.”

Kessinger was not alone in upgrading Okta after its earnings report. Mizuho’s Gregg Moskowitz also upgraded his rating to “outperform” from “neutral” and increased his price target to $127 from $110. “Mgmt emphasized that the macro environment was largely unchanged this quarter. That said, OKTA clearly executed better this quarter, and mgmt cited a ‘blowout quarter’ with record bookings,” he stated.