Key moments

- Market Indices Decline: Major European market indices, including the FTSE 100, DAX, CAC, and FTSE MIB, are projected to open significantly lower.

- Investor Concerns: The prospect of tariffs has triggered concerns among investors about reigniting inflation and escalating global trade tensions.

- Retaliatory Measures: China has announced retaliatory tariffs on U.S. goods and export restrictions in response to the U.S. actions.

A Deeper Dive into Market Reactions and Global Trade Dynamics

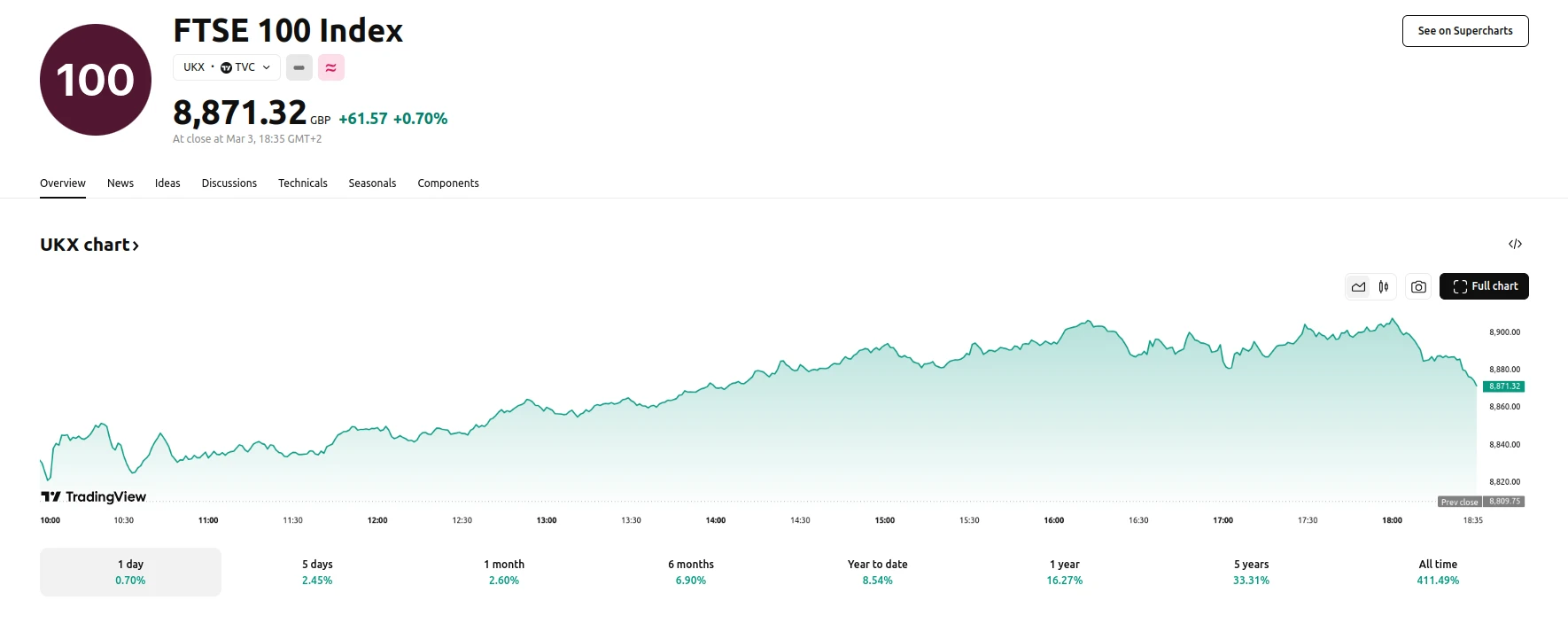

European markets are expected to open lower on Tuesday, with key indices indicating a downturn. The U.K.’s FTSE 100 is projected to open 42 points lower at 8,833, while Germany’s DAX is anticipated to fall by 155 points to 22,982. France’s CAC is expected to decline by 48 points to 8,165, and Italy’s FTSE MIB is forecast to drop 346 points to 38,789, according to data from IG.

The impending tariffs have unsettled investors, who fear that they could reignite inflation in the U.S. and escalate a global trade war. The concern stems from the potential for increased costs for businesses and consumers, as tariffs raise the price of imported goods. This could lead to a decrease in demand and slower economic growth, with supply chain effects also potentially hurting export performance.

In response to the U.S. tariffs, China has announced that it will impose additional tariffs of up to 15% on some U.S. goods and restrict exports to 15 U.S. companies. These retaliatory measures underscore the escalating trade tensions between the two economic powerhouses.

On Monday, U.S. indexes reacted negatively after President Trump confirmed the imposition of tariffs on Canada and Mexico, as well as additional tariffs on Chinese goods. While European markets had traded higher on Monday, driven by gains in defense shares and positive euro zone inflation data, the impact of the U.S. tariff announcement is now expected to reverse those gains.