Key moments

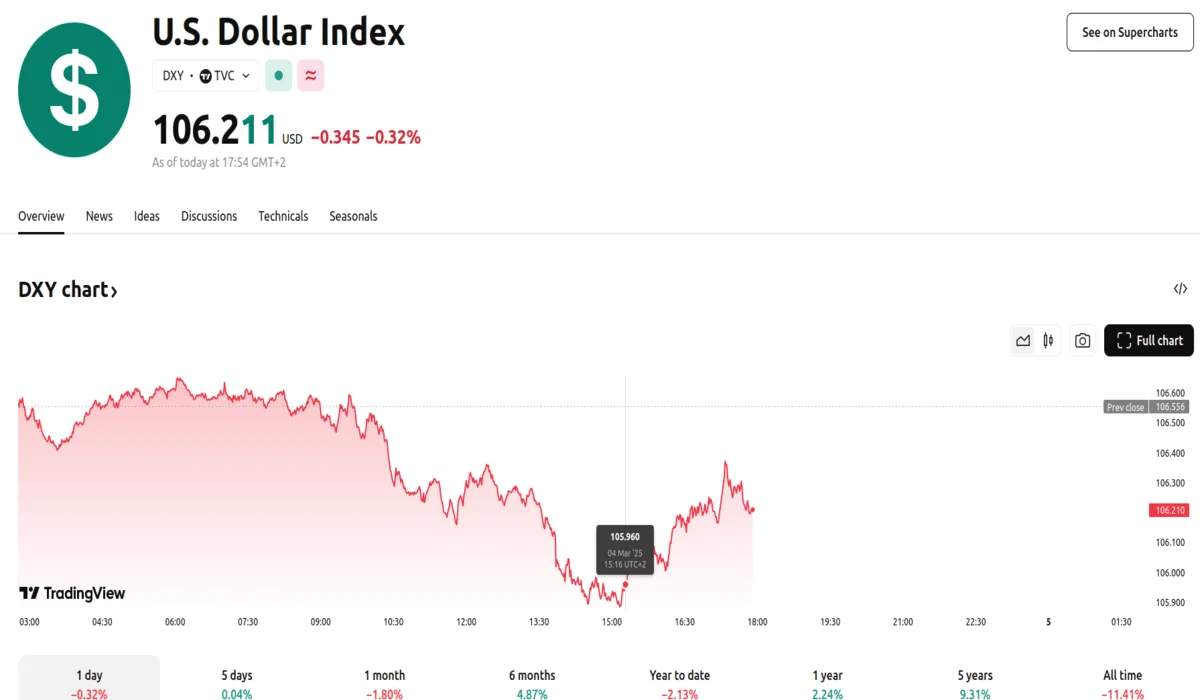

- The U.S. dollar index fell 0.54% to 105.96, reaching its lowest point for the past three months.

- The Japanese yen and Swiss franc both experienced gains of nearly 1%, as investors sought safe-haven currencies.

- The euro climbed to $1.0547, its highest level since December, marking a 0.5% increase.

US Dollar Index React Negatively to Recent Trade Tensions

The U.S. dollar experienced a significant decline on Tuesday, dropping to a three-month low as market participants grappled with concerns over slowing economic growth and the potential impact of newly implemented tariffs. The U.S. dollar index fell by 0.54%, settling at 105.96, its lowest level since December. The index measures the dollar’s value against a basket of six major currencies, namely JPY, EUR, GBP, SEK, CAD, and CHF.

The decline of the dollar coincided with the implementation of the new tariffs by President Donald Trump, including 25% tariffs on goods from Canada and Mexico, and the doubling of duties on Chinese goods to 20%. In response, China announced plans to impose additional tariffs on U.S. imports. Canada confirmed retaliatory tariffs and Mexico is expected to also follow suit.

Amidst these trade tensions, investors sought refuge in traditional safe-haven currencies. The Japanese yen and Swiss franc both experienced gains of nearly 1%, reflecting increased demand during times of economic uncertainty. The euro also saw a notable increase, climbing to $1.0547, its highest level since December, representing a 0.5% rise.

The Canadian dollar strengthened by approximately 0.45%, trading at 1.4471 per U.S. dollar, recovering from a one-month low. The Mexican peso, conversely, experienced a decline of roughly 0.3%, trading at 20.76 per dollar, after reaching its lowest point since February 3rd.

Analysts observed that the initial market reactions to the tariffs were relatively modest, suggesting that many investors remain hopeful that the tariffs will be short-lived. This optimism is based on the expectation that trade deals can be reached, similar to how previous tariff threats were resolved.

The euro’s increase was attributed to the current absence of tariffs on the European Union and the narrowing yield gap between U.S. and Eurozone bonds. The anticipation of the European Central Bank’s policy meeting on Thursday also influenced market activity. U.S. 10-year Treasury yields fell to their lowest level since October, trading at 4.115%, as traders processed weak economic data and tariff-related news.

The pound sterling rose to an 11-week high of $1.2744 as the dollar slipped, and was last up 0.3%. The Chinese yuan also experienced a rise of approximately 0.3%, trading at 7.265 per dollar, supported by the central bank’s strengthening bias.