Key moments

- Binance Considers Delisting USDT in Select European Regions

- MiCA Regulations Impose Stricter Stablecoin Compliance

- Potential Market Disruptions Anticipated if Delisting Occurs

Uncertainty Surrounds USDT EU Outlook as Binance Assesses MiCA Compliance

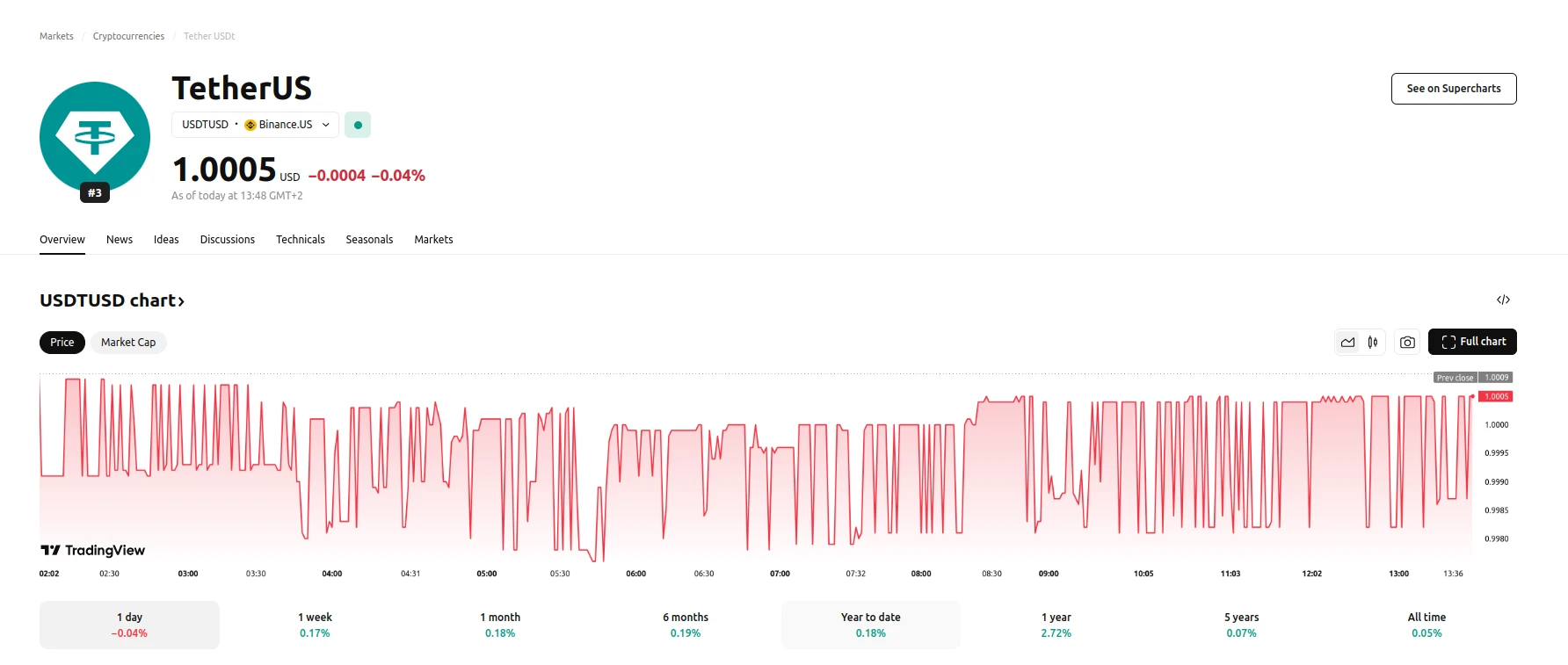

The European status of Tether (USDT), the leading stablecoin by market capitalization, is currently under scrutiny as Binance, a major cryptocurrency exchange, evaluates the potential delisting of USDT within specific European jurisdictions. This strategic review is occurring against the backdrop of the European Union’s impending Markets in Crypto-Assets (MiCA) regulations, which are designed to enhance oversight of stablecoins and their issuers.

The MiCA framework, set for full implementation in 2025, aims to establish a comprehensive regulatory environment for crypto-asset service providers, including stablecoin issuers. Key provisions mandate stringent transparency requirements, such as maintaining fully backed reserves and adhering to robust operational oversight. Tether, which has faced ongoing questions regarding its reserve transparency, may encounter challenges in meeting these new regulatory standards. The European Securities and Markets Authority (ESMA) and national competent authorities will gain increased enforcement powers, potentially leading to market restrictions or outright bans for non-compliant stablecoins.

Binance, a significant player in the global cryptocurrency trading landscape, is currently conducting a thorough review of its product offerings within the European Union to ensure alignment with MiCA regulations. Reports indicate that the exchange is evaluating the possibility of delisting USDT in certain European regions to mitigate potential regulatory conflicts. While no formal announcements have been released, industry sources suggest that Binance is weighing the risks associated with continuing to offer USDT against the regulatory and compliance burdens it might impose. Binance has already demonstrated its willingness to adapt to regulatory pressures by delisting privacy coins in some European areas and implementing more rigorous Know Your Customer (KYC) procedures.

The potential removal of USDT trading pairs from Binance in Europe could significantly impact the region’s cryptocurrency trading ecosystem. As USDT serves as a primary liquidity provider and trading pair for numerous cryptocurrencies, its absence could prompt traders to seek alternative stablecoins, such as Circle’s USD Coin (USDC) or other MiCA-compliant stablecoins. This development could also have broader implications for the global crypto market, as other exchanges might follow suit, further limiting Tether’s reach. Such actions could influence Tether’s overall market capitalization and encourage the company to enhance its transparency and compliance efforts.