Key moments

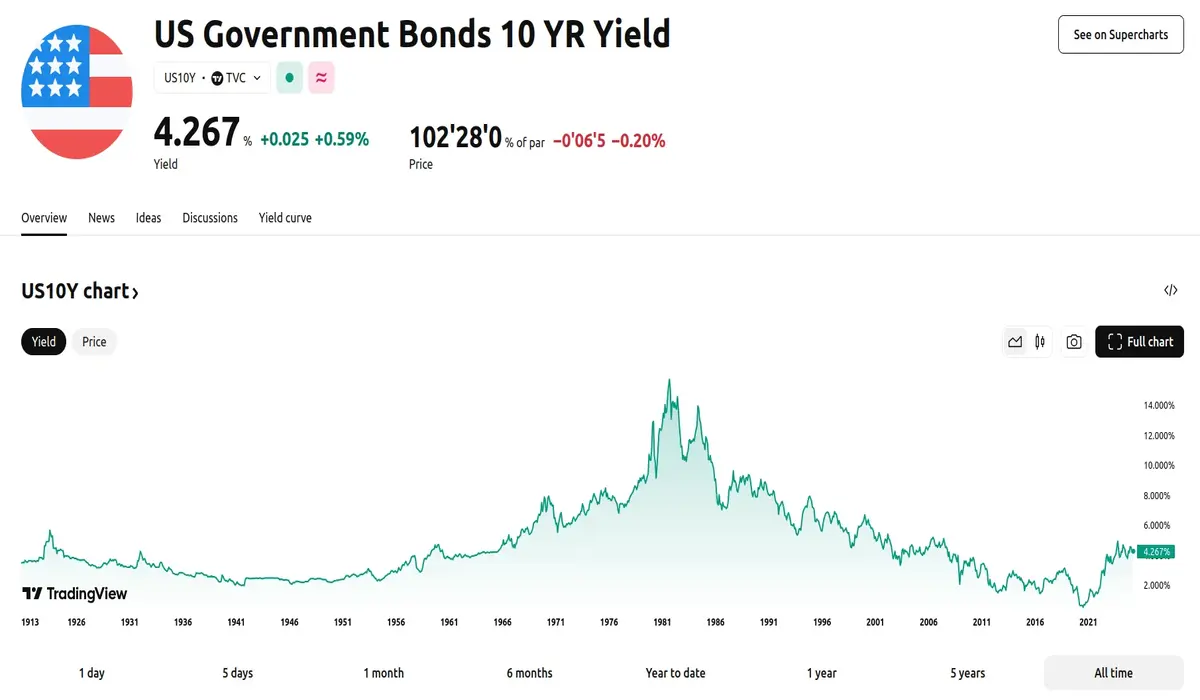

- The 10-year Treasury yield rose by 2 basis points to 4.236%, reflecting investor concerns over economic policies and trade tensions.

- The 2-year Treasury yield dipped slightly by 2 basis points to 3.937%, reversing an earlier increase.

- Private payrolls data revealed a significant shortfall, with only 77,000 jobs added in February, well below the Dow Jones forecast of 148,000.

10-Year Treasury Yield up 2 Bps, 2-Year Yield Drops by the Same Margin

U.S. Treasury yields experienced mixed movements on Wednesday at 8:18 am Eastern Time as investors grappled with the dual impact of new trade tariffs and disappointing private payrolls data. The 10-year Treasury yield edged higher by 2 basis points to 4.236%, while the 2-year yield declined by the same margin to 3.937%, surrendering earlier gains.

The market’s unease stems from President Donald Trump’s recent imposition of tariffs, including a 25% duty on imports from Canada and Mexico and an additional 10% levy on Chinese goods. These measures, which took effect earlier this week, have prompted retaliatory actions from the affected nations, further escalating trade tensions. Commerce Secretary Howard Lutnick hinted at potential compromises with Canada and Mexico, but the administration has signaled a willingness to endure short-term economic disruptions to advance its policy agenda.

Meanwhile, the latest ADP employment report revealed a stark underperformance in private sector job growth, with only 77,000 positions added in February—less than half the Dow Jones forecast of 148,000. This weak data has heightened concerns about the labor market’s resilience ahead of the broader U.S. jobs report due this Friday.

Analysts warn that ongoing policy uncertainty and trade disputes could continue to dampen business investment and hiring decisions, potentially slowing economic activity in the coming months. As investors weigh these factors, market volatility is expected to persist, with Treasury yields reflecting the broader economic uncertainty.