Key moments

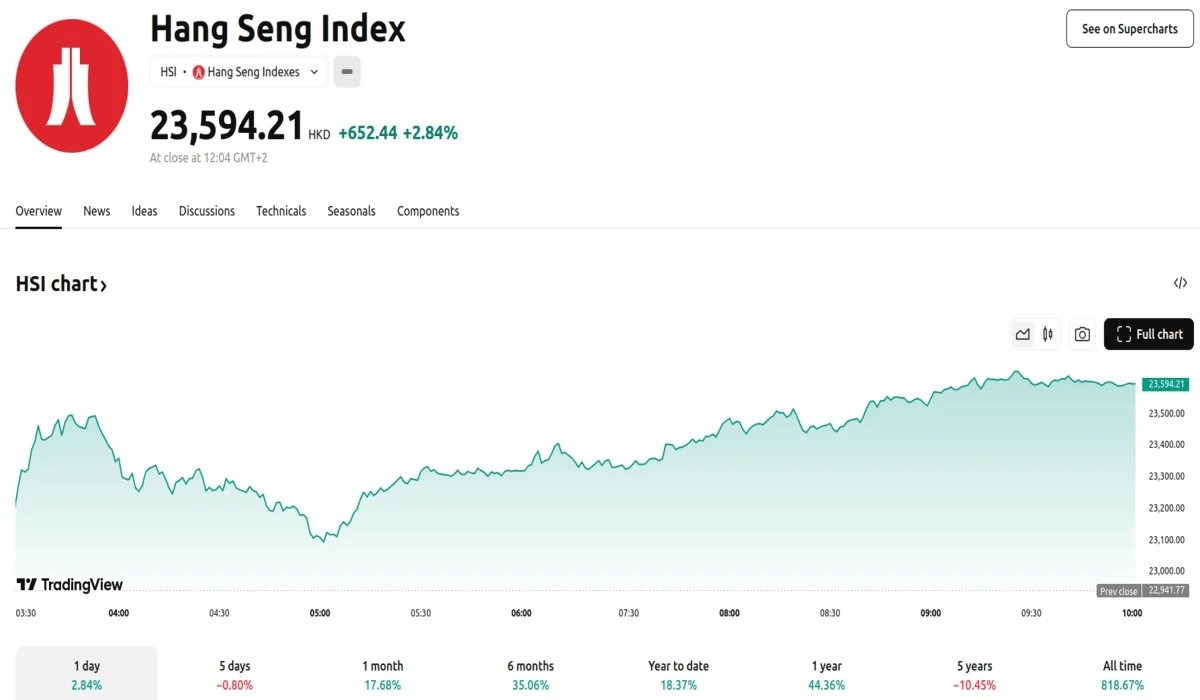

- The Hang Seng Index in Hong Kong experienced a significant increase, advancing by 1.65% to close at 23,320 points.

- The Shanghai Stock Exchange Composite Index showed moderate growth, increasing by 0.3%.

- CK Hutchison’s shares saw a dramatic surge, jumping over 21% to HK$46.85.

Stock Prices Surge Across Asian Markets

Hong Kong’s Hang Seng Index experienced a significant intraday surge, climbing by over 570 points before settling at 23,320 points by midday. This closing figure represents an increase of 378 points, or 1.65%, compared to the results at the previous market close. The trading volume on the main board reached HK$135 billion. Additionally, the Hang Seng Tech Index saw an approximate 1.9% rise, reaching a value of 5,638 points.

The Shanghai Stock Exchange Composite Index also recorded gains, albeit more modest, with a 0.32% increase to 3,334.9 points. Midday trading saw the Shenzhen Stock Exchange Composite Index experience a slight decline, decreasing by 0.29% to 2,039.9 points. In contrast, several other Asian markets saw gains.

Taiwan’s Taiex index rose by 1.2%, while Japan’s Nikkei 225 increased by 0.1%. South Korea’s Kospi Composite Index also climbed by 0.7%. Southeast Asian markets show positive movement, with the FTSE Bursa Malaysia Kuala Lumpur Composite Index gaining 0.6% and Singapore’s Straits Times Index rising by 0.3%. The positive sentiment across key Asian markets was influenced by the perception that China’s steady growth target signaled continued economic stability, despite ongoing global trade tensions.

A notable highlight of the trading day was the remarkable performance of CK Hutchison’s shares. The company’s stock skyrocketed, adding over 21% to its value, reaching HK$46.85. This surge was attributed to the company’s announcement of a deal to divest its ports division to a group of investors, with BlackRock at the forefront of this consortium.

China’s decision to maintain its 5% GDP growth target this year has been met with cautious optimism from market analysts. While recognizing the challenges posed by trade disputes and internal economic pressures, such as the property market situation, experts also acknowledged the potential for policy adjustments to support the stated goals.

The announcement of China’s budget deficit increase, reaching approximately 4% of its GDP, the highest in 30 years, signals the country’s intent to stimulate its economy amidst deflationary pressures and trade conflicts. The 2% inflation target, reduced from the previous 3%, further illustrates the government’s intent to navigate complex economic conditions.

Analysts have expressed that the steady growth target conveys a sense of confidence from Chinese authorities regarding their domestic economic outlook. The advancements in artificial intelligence are seen as a potential source of growth. However, the market also anticipates potential adjustments to fiscal policies should trade disputes negatively impact growth momentum.