Key moments

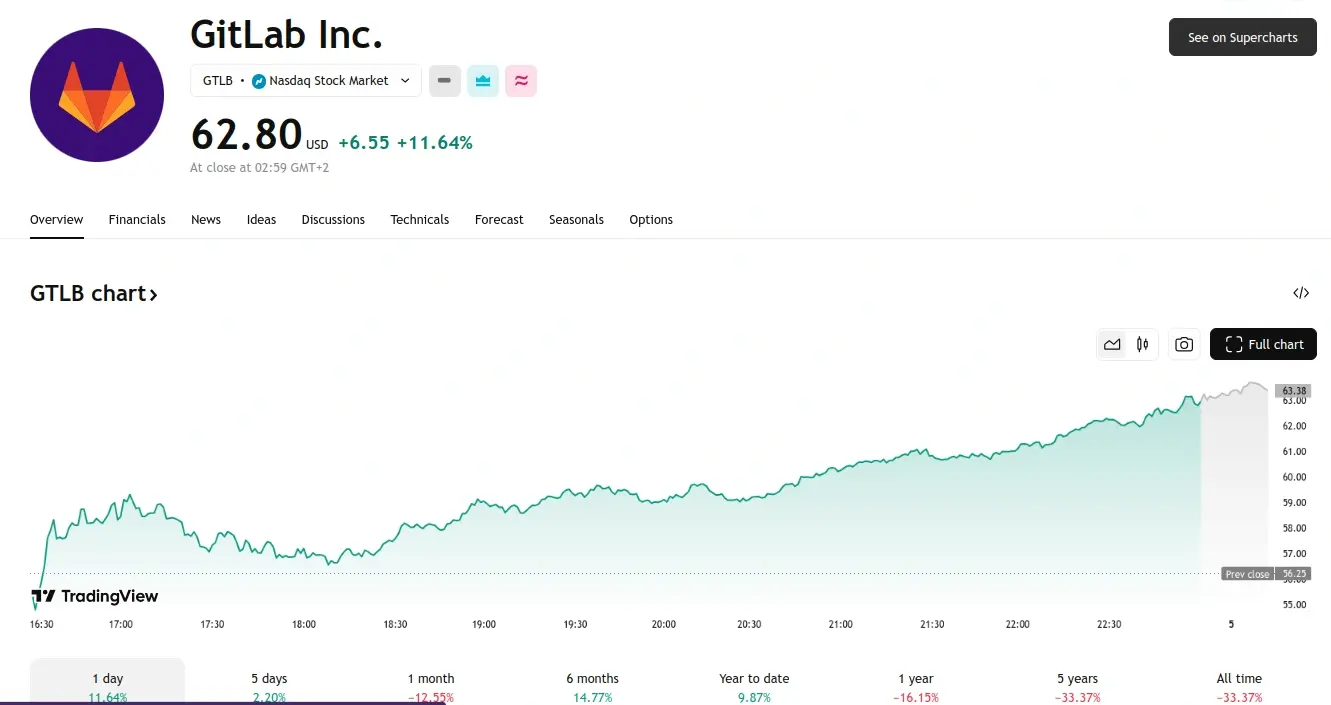

- GitLab stock saw a significant surge in value on Tuesday, closing at $62.80.

- GitLab reported strong Q4 2025 earnings, surpassing revenue and EPS expectations, but its full-year 2026 profit forecast fell short of analyst estimates.

- Despite the lowered full-year profit guidance, GitLab’s shares rose significantly, demonstrating investor confidence in the company’s growth potential and Q4 performance.

GitLab Among the Top Gainers on Tuesday Trading Session with Shares Closing at $62.80

GitLab Inc. announced its fiscal Q4 2025 earnings on Monday, surpassing Wall Street expectations, though its full-year profit forecast fell short of analyst estimates. Despite this mixed outlook, the company’s shares experienced a notable surge, climbing over 1% in premarket trading on Tuesday, and ultimately concluding the trading session with an 11.6% increase, reaching $62.80 per share.

The provider of the DevOps platform reported adjusted quarterly earnings per share (EPS) of $0.33, significantly exceeding analysts’ projections of $0.23. The company’s revenue also demonstrated strong growth, reaching $211.4 million for the quarter ending January 31st, surpassing consensus estimates of $206.15 million.

GitLab’s guidance for the first quarter of fiscal 2026 anticipates adjusted earnings per share ranging from $0.14 to $0.15, aligning closely with the consensus estimate of $0.15. The company also projected revenue between $212 million and $213 million, slightly above the analysts’ average estimate of $212.4 million.

However, the company’s full-year fiscal 2026 earnings guidance, projecting $0.68 to $0.72 per share, fell below analysts’ expectations of $0.81. Revenue projections for the full year, ranging from $936 million to $942 million, were also slightly below the consensus projection of $941.8 million.

“After two of the cleanest quarters in our coverage, F4Q was a little mixed as the outperformance to revenue ticked down but the revenue guidance for next year was better than feared,” Wolfe Research analysts commented in a post-earnings analysis.

They continued, “However, with the potential for high-20s growth this year and shares trading at a discount to growth peers, we reiterate our OP rating but lower our PT to $69 (from $78 prior), highlighting the company’s growth potential despite the lowered price target.

In a separate analysis, Barclays analysts observed that while GitLab’s Q4 revenue beat was slightly below the more optimistic investor expectations, the company’s fiscal 2026 guidance was marginally better than the more pessimistic projections circulating prior to the earnings release. This nuanced perspective underscores the varying interpretations of GitLab’s financial performance and future outlook among market analysts.