Key moments

- REV Group reported revenue of $525.1 million in Q4, surpassing analyst projections by 6.5%, despite a 10.4% YoY decrease.

- Adjusted earnings per share (EPS) reached $0.40, exceeding the analyst estimates of $0.27 by 50.9%.

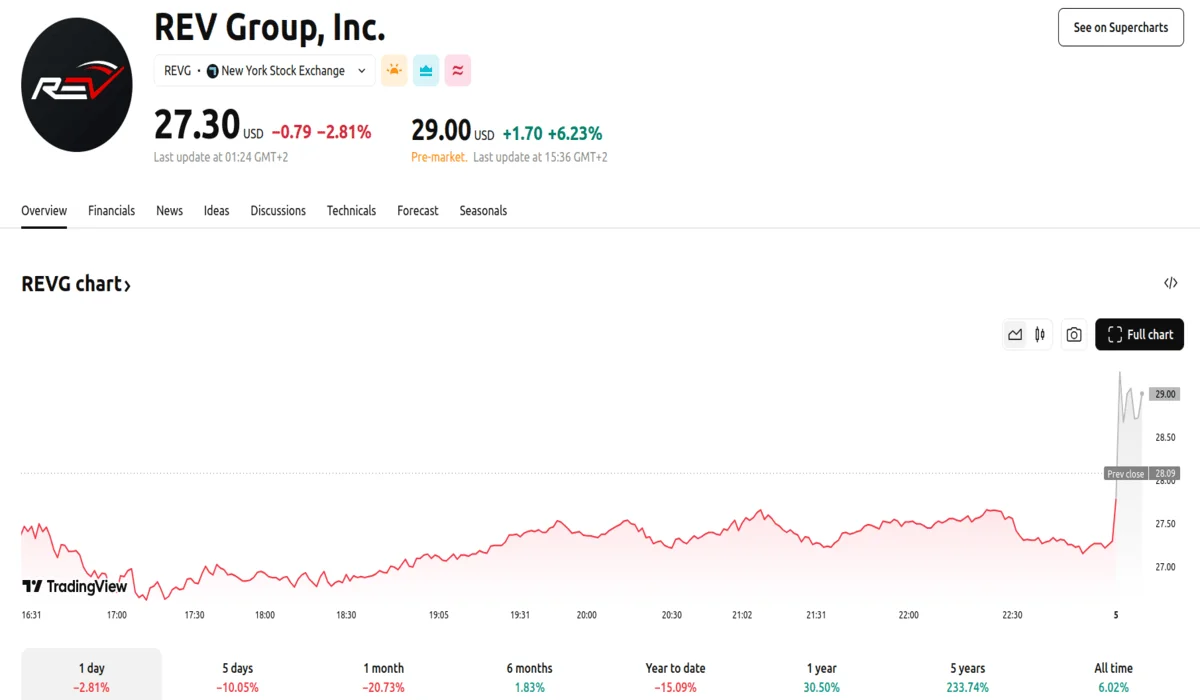

- Following the revenue release, REV Group’s stock experienced an 11.6% increase, reaching $30.45 immediately after.

Revenue Beat Caused REV Stock to Climb 11.6% Only to Slide 2.81% at Closing

REV Group, a prominent specialty vehicle manufacturer, announced its Q4 2024 financial results, revealing performance that significantly exceeded market expectations. The company’s revenue reached $525.1 million, which, despite representing a 10.4% YoY decline from $586.1 million, surpassed the analyst projections of $492.8 million by 6.5%.

The company’s adjusted earnings per share (EPS) reached $0.40, a figure that significantly exceeded the analyst consensus estimates of $0.27, representing a 50.9% beat. The company also reported adjusted EBITDA of $36.8 million, which was a 32.4% beat of the analyst estimates of $27.8 million, demonstrating the company’s efficient operational management.

REV’s operating margin improved to 5.3%, a notable increase from the -1.1% recorded in the same quarter of the previous year. This 6.4 pp increase reflects enhanced operational efficiency and cost management. Furthermore, the company was able to reduce its free cash flow losses from $80.2 million to $18 million, indicating improved financial control. REV Group’s backlog at the quarter’s end stood at $4.49 billion, signaling strong future demand.

The release of these positive financial results initially triggered a significant positive market response. REV Group’s stock experienced an 11.6% increase, reaching $30.45 shortly after the revenue report was published. Unfortunately, this upward trend was short-lived as the company’s stock dropped 2.81% to $27.30 at market close.

REV Group, known for producing specialty vehicles, including the first fully electric North American fire truck, operates within the heavy transportation equipment sector. The sector is undergoing significant transformations, driven by advancements in automated vehicles, connected machinery, and electric mobility solutions. The company’s market capitalization stands at $1.42 billion.

Despite facing challenges related to economic cycles and fluctuating demand, REV Group has demonstrated its ability to adapt and deliver strong profitability. The company’s EPS grew at an astounding 30.8% compounded annual growth rate over the last five years, indicating effective cost structure adaptation. The Group’s two-year annual EPS growth of 48.7% was higher than its five-year trend, which is a positive sign. Analysts expect REV Group’s full-year EPS of $1.78 to grow 41.3% over the next 12 months.