Key moments

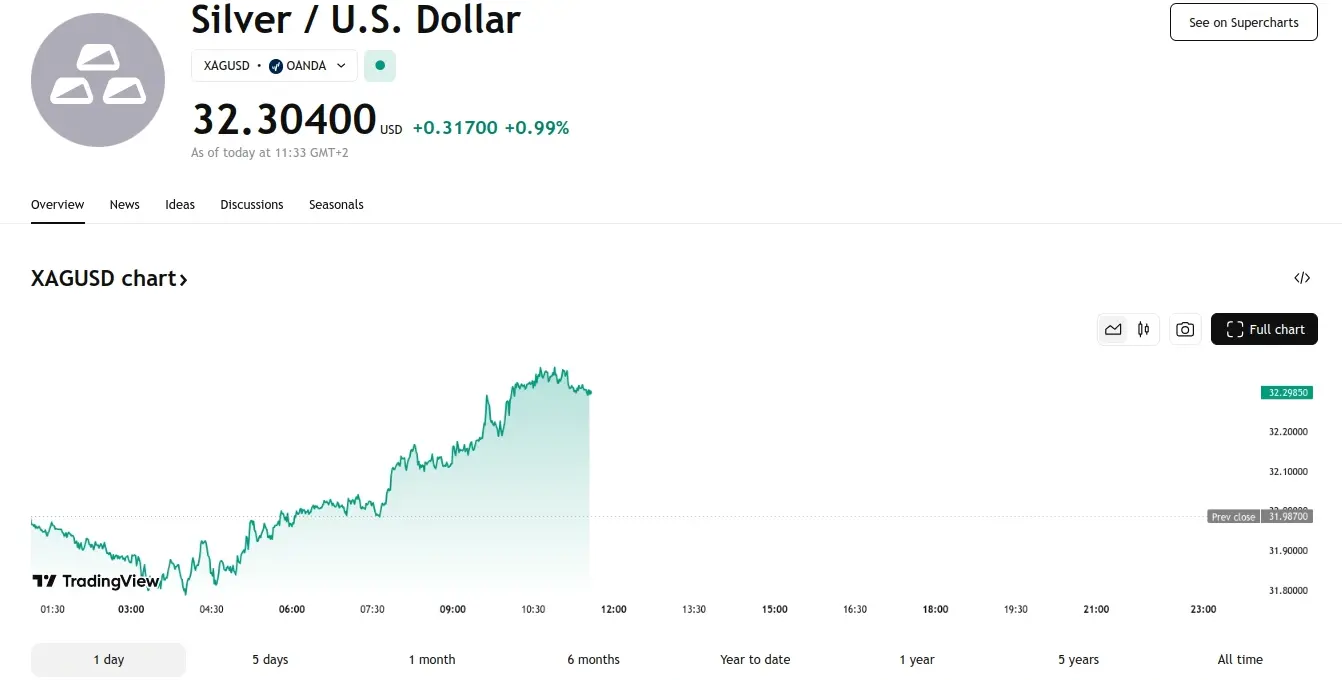

- Silver price extends the rally to near $32.15 in Wednesday’s early European session, up 0.90% on the day.

- The positive view of Silver prevails above the key 100-day EMA with the bullish RSI indicator.

- The immediate resistance level emerges at the $33.00-$33.05 region; the key support level to watch is in the $31.15-$31.00 zone.

Silver Prices Continue Their Ascent Wednesday, Approaching $32.15, as Investors Sought Safe-Haven Assets Amidst Escalating Global Trade Tensions

Silver prices (XAG/USD) continued their upward trajectory, reaching approximately $32.15 during the early European trading session on Wednesday. The precious metal experienced gains as uncertainty and concerns over escalating trade tensions bolstered safe-haven demand among investors.

From a technical perspective, the bullish trend for silver remains intact, with the commodity maintaining a strong position above the critical 100-day Exponential Moving Average (EMA) on the daily chart. This upward momentum is further supported by the 14-day Relative Strength Index (RSI), which is positioned above the 55.00 midline, indicating sustained bullish momentum in the near term.

The initial upside target for silver is identified within the $33.00-$33.05 range, representing both a psychological barrier and the upper boundary of the Bollinger Band. A sustained rally beyond this level could potentially push prices towards $33.40, the high recorded on February 14th. Further upward movement could target $34.55, the high observed on October 29, 2024.

Conversely, the confluence of the round number, the lower limit of the Bollinger Band, and the 100-day EMA within the $31.15-$31.00 zone provides crucial support for XAG/USD. A breach below this level could lead to a decline towards the next support at $29.52, the low registered on January 25th.

The silver market is on track for its fifth consecutive year of deficit, driven by anticipated growth in industrial demand. Economic and geopolitical uncertainties are further fueling demand for silver, although concerns regarding the Chinese economy are acting as a limiting factor on price increases.

A significant portion of above-ground silver stocks remains immobile and unavailable to the market, regardless of price fluctuations, with only minor annual adjustments. Total known global silver ETF holdings currently stand at 709.299 million ounces, reflecting a decline of nearly 9 million ounces this year.