Key moments

- SoFi Technologies’ share price dropped 8.5% on Tuesday, with trading volume also decreasing.

- While Cathie Wood’s ARK ETFs reduced their SoFi holdings, other institutional investors, such as Oppenheimer & Co. Inc., significantly increased their stakes.

- Several hedge funds and investment firms increased or initiated positions in SoFi Technologies, highlighting ongoing institutional interest in the company.

Notable 8.5% Drop In SoFi Technologies’ Share Price On Tuesday Contrasted With Significant Increases In Holdings By Several Institutional Investors

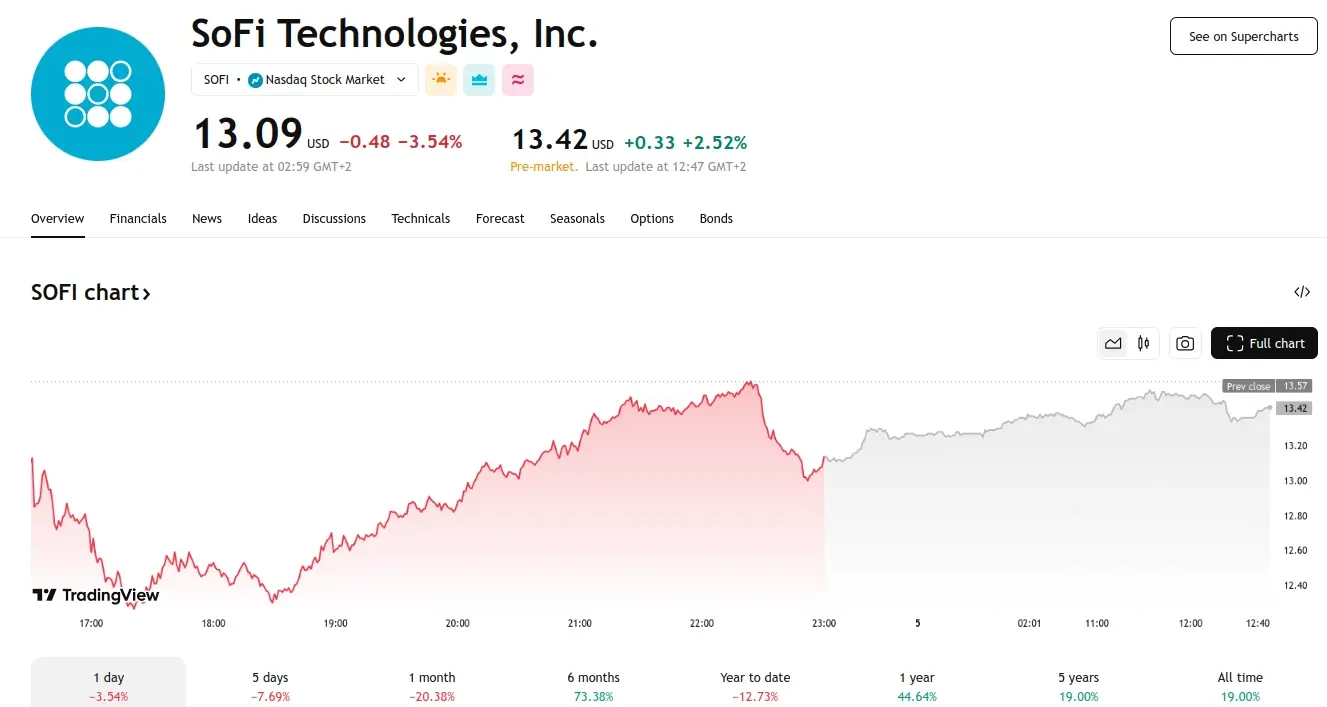

SoFi Technologies experienced a significant downturn on Tuesday, with its share price declining by 8.5% during the trading session. The stock reached a low of $12.24 and closed at $12.41, marking a notable decrease from its previous closing price of $13.57. Trading volume was also down, with approximately 30,533,628 shares changing hands, a 32% reduction compared to the average daily volume of 45,004,020 shares.

While Cathie Wood’s ARK ETFs adjusted their holdings by offloading some SoFi Technologies shares on Tuesday, March 4th, 2025, other institutional investors demonstrated increased confidence in the company. Oppenheimer & Co. Inc., for instance, significantly expanded its stake in SoFi Technologies during the fourth quarter, according to recent filings with the Securities and Exchange Commission.

Oppenheimer & Co. Inc. increased its holdings by 47.9%, acquiring an additional 118,288 shares, bringing their total ownership to 365,439 shares. At the end of the quarter, their holdings were valued at $5,628,000.

Several other hedge funds also made adjustments to their SoFi Technologies positions. Connor Clark & Lunn Investment Management Ltd. significantly increased its stake by 214.9% during the third quarter, now holding 3,940,340 shares valued at $30,971,000. This increase followed the purchase of 2,688,847 additional shares. Quadrature Capital Ltd. initiated a new position in SoFi Technologies during the third quarter, investing $16,014,000.

Zacks Investment Management also established a new position, acquiring shares worth approximately $3,766,000 in the third quarter. Similarly, Point72 DIFC Ltd. made a new investment in SoFi Technologies, purchasing shares valued at about $3,219,000 during the same period. Rockefeller Capital Management L.P. increased its holdings by 20.6% during the third quarter, now owning 2,209,266 shares valued at $17,365,000, after acquiring an additional 376,899 shares. Currently, approximately 38.43% of SoFi Technologies’ stock is held by institutional investors, indicating a significant level of institutional involvement.