Key moments

- U.S. stock futures rebounded early Wednesday after a second consecutive day of losses.

- Commerce Secretary Lutnick hinted at a possible compromise on tariffs with Canada and Mexico.

- Ongoing trade tensions and forthcoming economic reports continue to create market uncertainty.

Detailed Insights into Market Recovery, Evolving Tariff Negotiations, and Upcoming Economic Data that Are Shaping Investor Sentiment

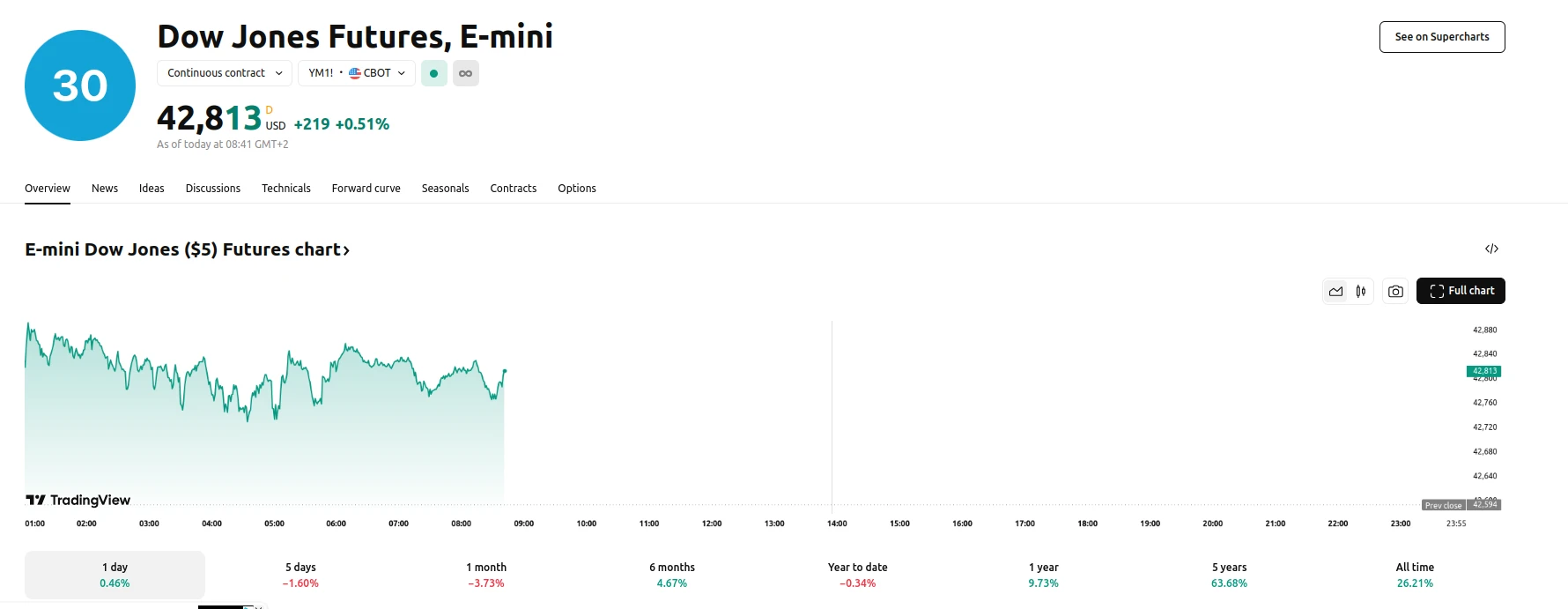

Early Wednesday, U.S. stock futures rose following two days of significant declines in the major indices. Futures tied to the Dow Jones Industrial Average increased by approximately 219 points (0.51%), while S&P 500 and Nasdaq 100 futures advanced by 0.62% and 0.72%, respectively. This rebound comes after Tuesday’s session, when the Dow experienced a sharp drop of over 670 points, and both the S&P 500 and Nasdaq Composite registered notable losses, with the tech-heavy Nasdaq nearly reaching correction territory.

The market downturn was largely attributed to the implementation of President Trump’s new 25% tariffs on Canada and Mexico, which sparked retaliatory measures from these nations as well as from China, where an additional 10% duty was imposed. However, in a recent interview on Fox Business, Commerce Secretary Howard Lutnick indicated that there might be room for compromise. Lutnick suggested that discussions with Canada and Mexico could lead to a mutually agreeable solution, potentially easing the escalating trade tensions. This news has injected a measure of optimism among investors, though some experts caution that the situation remains fragile due to the high level of uncertainty and the possibility of rapid shifts in market sentiment.

Additionally, investors are awaiting key economic data releases, including the ADP private payrolls report for February and the latest purchasing managers’ index. Several companies, such as Thor Industries, Abercrombie & Fitch, Campbell’s, and Brown-Forman, are also set to report quarterly earnings. These developments are expected to provide further clarity on the state of the U.S. economy amid ongoing trade disputes and may influence market trends in the near future.