Key moments

- The Dow Jones Industrial Average experienced a second consecutive day of significant decline, contributing to a two-day total loss exceeding 1,300 points.

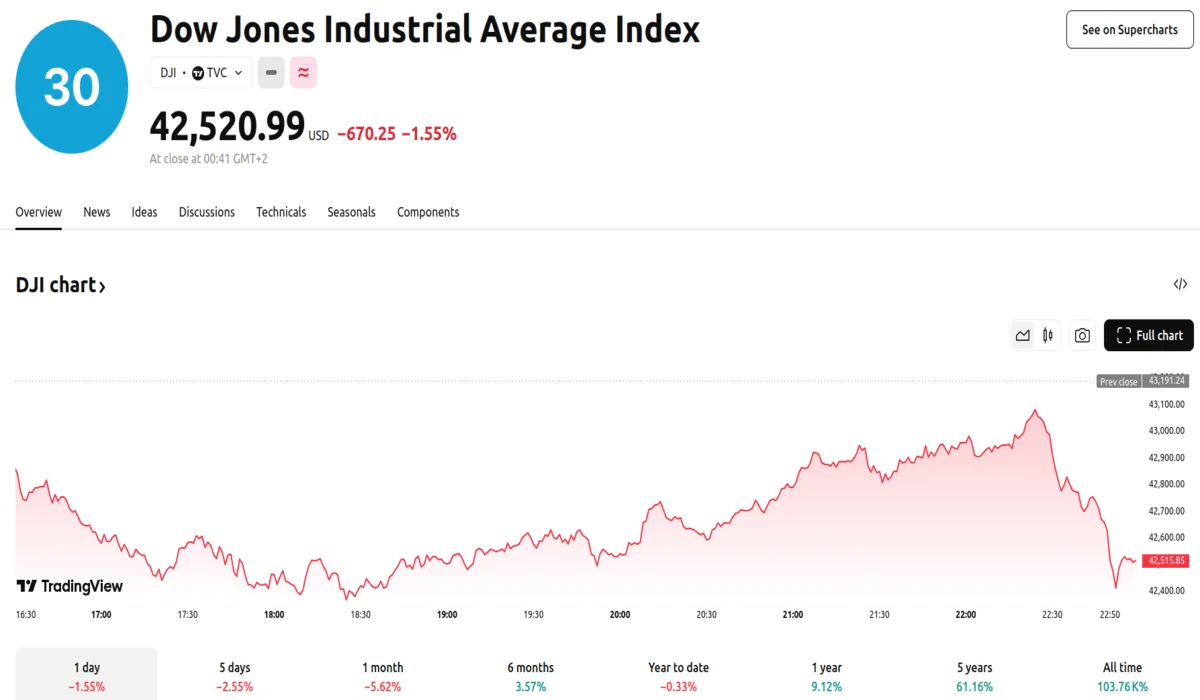

- Tuesday’s market activity saw the Dow close at 42,520.99, marking a further drop of 670.25 points after Monday’s substantial decrease.

- The Nasdaq Composite and S&P 500 registered losses of 0.35% and 1.22%, respectively. Import-heavy companies, including GM and Ford, also saw significant stock drops.

Dow Jones, S&P 500, and Nasdaq Composite All Tumble As Tariffs Come into Effect

The U.S. stock market experienced a sustained period of decline, with investor sentiment heavily influenced by the recent implementation of trade tariffs in the U.S. and the perceived potential for adverse economic consequences. The Dow Jones Industrial Average, a key benchmark of U.S. market performance, registered a further 1.55% decrease, culminating in a closing value of 42,520.99. This latest drop comes closely on the heels of the previous day’s substantial losses and has resulted in a cumulative two-day decline for the Dow that exceeds 1,300 points, signaling a period of heightened volatility and investor apprehension.

The broader market indices mirrored the Dow’s downward trajectory, with the S&P 500 recording a loss of 1.22%, closing at 5,778.15, and the Nasdaq Composite experiencing a decline of 0.35%, ending the trading day at 18,285.16. The introduction of U.S. tariffs on imported goods originating from Canada, Mexico, and China has injected a significant degree of uncertainty into the market landscape. This uncertainty stems from concerns regarding potential disruptions to established supply chains, the prospect of increased operational costs for businesses, and the potential for inflationary pressures to impact consumer spending.

During the trading day, the market experienced moments of more severe decline. The Dow saw intraday losses exceeding 840 points, while the S&P 500 and Nasdaq Composite both registered drops of over 2% at their lowest points. The Nasdaq’s decline brought it close to correction territory, a market condition defined by a 10% fall from a recent peak. Broad market weakness was evident, with over 80% of S&P 500 constituents closing lower. In the midst of this downturn, some investors seized the opportunity to acquire shares of companies that had experienced significant recent losses, such as Nvidia.

Businesses heavily reliant on international supply chains faced substantial market challenges, as demonstrated by the significant depreciation in the value of automotive manufacturers. Specifically, GM experienced a decline exceeding 4%, while Ford’s shares fell by nearly 3%. The food service industry also felt the impact, with Chipotle, which sources approximately 50% of its avocados from Mexico, seeing a 2% drop. Retailers were similarly affected. Target’s shares decreased by 3%, and its CEO indicated that consumers should anticipate higher prices for certain fresh produce in the immediate future due to the newly implemented tariffs.

The recent market downturn has shifted the S&P 500’s year-to-date performance into negative territory, while the Dow’s annual gains have been effectively erased. The sharp increase in losses observed during Monday’s session can be attributed to the dissipation of investor hopes for a last-minute agreement to avoid the full imposition of 25% tariffs on goods from Mexico and Canada, following confirmation by the administration that the levies would proceed.

According to Sam Stovall, a chief investment strategist at CFRA Research, the current market situation could be characterized as a ‘conditional correction,’ contingent upon the duration and magnitude of the tariffs. The combination of these trade measures and recent less-than-optimal economic data has amplified investor concerns regarding the overall strength of the U.S. economy. Sectors such as banking and retail experienced particularly pronounced declines on Tuesday, fueled by fears that the tariffs could further impede economic growth.

The S&P 500’s current valuation has dipped below its level at the time of the November election, when the current administration secured a second term. Market participants are now keenly awaiting the administration’s address to Congress, seeking clarity on the future of the tariffs, which have been a central element of its policy agenda.