Key moments

- Global producers propose aluminum premiums of $245-$260 per metric ton for Japan, a potential 14% increase from the prior quarter.

- Japanese buyers deem offers too high, noting spot market prices are currently below $200 per metric ton.

- The first quarter premium was agreed at $228 per metric ton, the highest in nearly ten years, creating a challenge for current negotiations.

Aluminum Talks Stall Over Price Divergence of $60

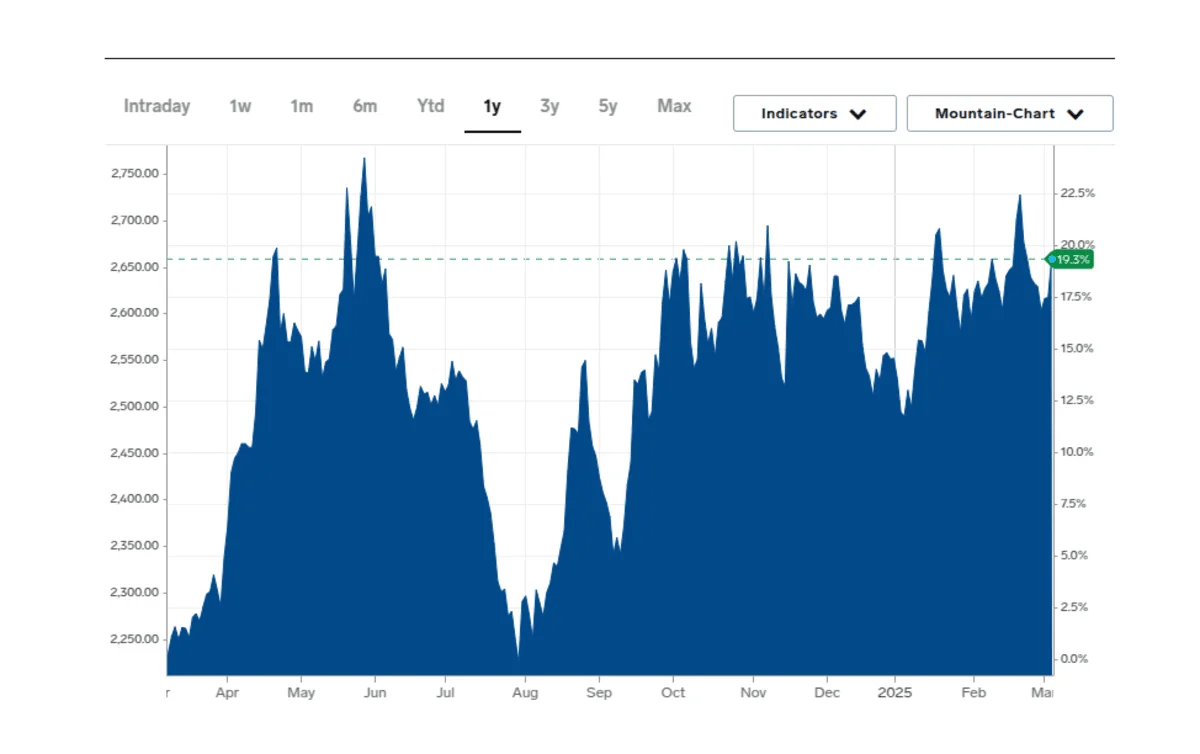

The ongoing quarterly negotiations between global aluminum suppliers and Japanese purchasers are marred by a significant divergence in pricing expectations. Producers are seeking a premium of $245 to $260 per metric ton for aluminum shipments during the April-June period. This contrasts sharply with the current spot market prices in Japan, which are hovering around $180 per ton, thus creating a substantial price gap of $60.

The rationale behind the proposed premium increase stems from concerns regarding potential supply constraints. The imposition of new 25% U.S. tariffs on Canadian aluminum has raised fears that supplies traditionally targeting Asia may be diverted towards North America. This potential shift in supply dynamics could lead to a tightening of aluminum availability in the Asian market.

Conversely, Japanese buyers find the offered premiums to be inflated, particularly in light of the declining demand and ongoing efforts to reduce existing inventories. The agreed-upon premium of $228 per ton for the January-March quarter, the highest in nearly ten years, has set a high precedent, but current market conditions do not support a further increase.

As a result, negotiations could be prolonged. The wide gap between the expectations of buyers and suppliers suggests that reaching a mutually agreeable price will be a challenging process. The previous round of quarterly negotiations, which lasted approximately a month longer than usual, serves as an indication of the potential for extended discussions.

The influence of Japanese buyers in these price negotiations has diminished over the past two decades. This decline is attributable to a reduction in domestic demand, which has led to a near halving of primary aluminum imports. Consequently, global producers are increasingly prioritizing the interests of higher-volume buyers in other regions. Despite this shift, the outcome of these negotiations remains a crucial indicator for aluminum pricing in the broader Asian market.