Key moments

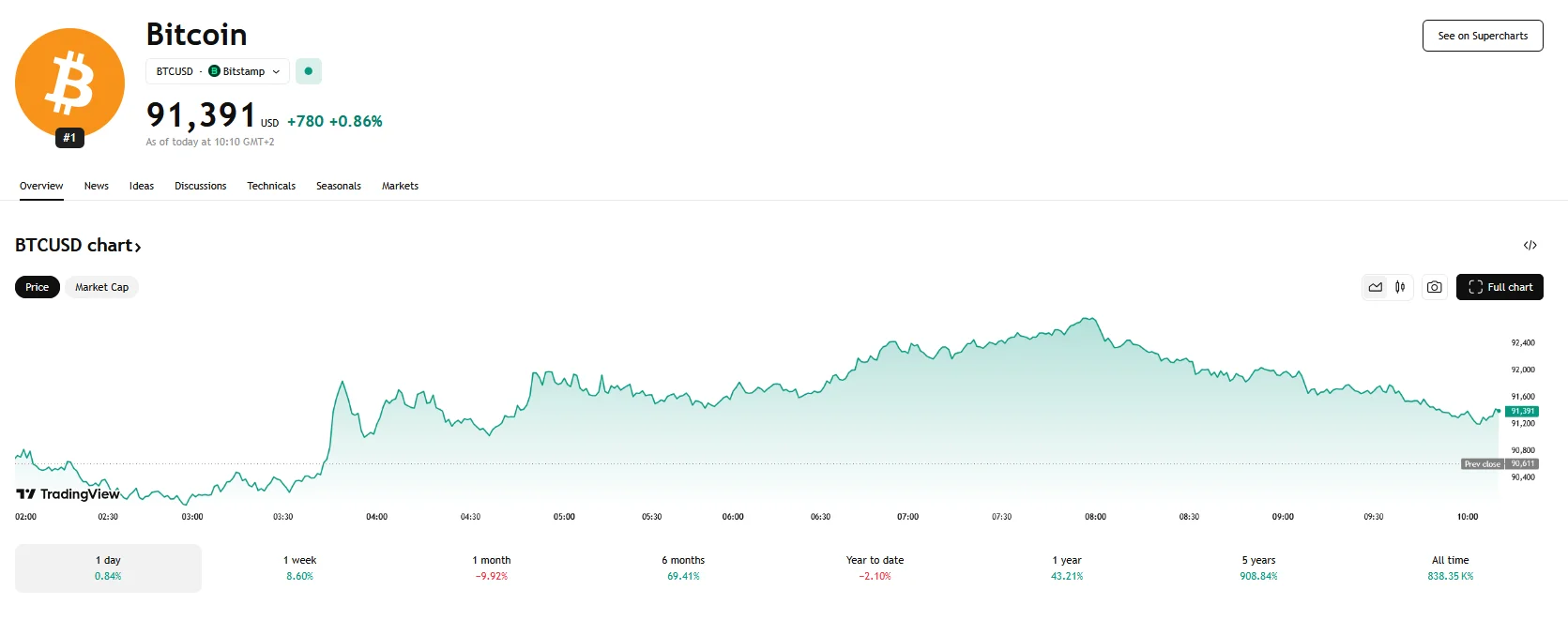

- Bitcoin’s price now stands above $91,000, up from Wednesday’s $90,000+.

- House Bill 302 received overwhelming support from New Hampshire’s House Commerce and Consumer Affairs Committee.

- If House Bill 302 comes into effect, up to 5% of public funds will be invested in digital assets with a $500 billion average market cap.

New Hampshire Committee’s Vote Signals Growing Crypto Acceptance Across The U.S.

In New Hampshire, the House Commerce and Consumer Affairs Committee delivered a resounding endorsement for House Bill 302. Meanwhile, Bitcoin has been experiencing an increase in value compared to Wednesday’s figures. At the time of writing, the price stands above $91,300 after briefly breaching the $92,000 mark on Thursday.

The bill, which was passed with a decisive 16-1 vote, will grant the state treasurer the authority to allocate up to 5% of public funds into digital assets. A critical aspect of the bill is its criteria for eligible digital assets: a market valuation averaging over $500 billion. Presently, Bitcoin stands as the only cryptocurrency meeting this stringent requirement. This effectively positions Bitcoin as the primary beneficiary of the proposed legislation, should it be enacted into law. This positive development is likely one of the factors that contributed to Bitcoin’s Thursday surge.

This development in New Hampshire aligns with a broader national movement, as states like Utah, Texas, Arizona, and Oklahoma are also exploring the integration of Bitcoin into their financial reserves. The momentum at the state level is complemented by discussions at the national level, where proposals for a strategic cryptocurrency reserve are gaining traction. While national plans envision a multi-asset approach, experts suggest that Bitcoin would likely play a central role due to its market dominance and established presence.

The New Hampshire bill, introduced by Republican Representative Keith Ammon, with bipartisan support from Democrats Chris McAleer and Carry Spier, demonstrates a growing consensus across party lines on the merits of digital asset integration. Amendments to the bill have focused on refining its scope, notably excluding stablecoins and staking. The legislation also mandates that any digital assets acquired by the state must be held by a qualified custodian or in the form of an exchange-traded product, ensuring secure management of these holdings.

The advance of these state-level initiatives occurs against a backdrop of varying opinions. While some states have embraced the potential of Bitcoin, others have voiced concerns regarding its volatility and suitability as a public asset.