Key moments

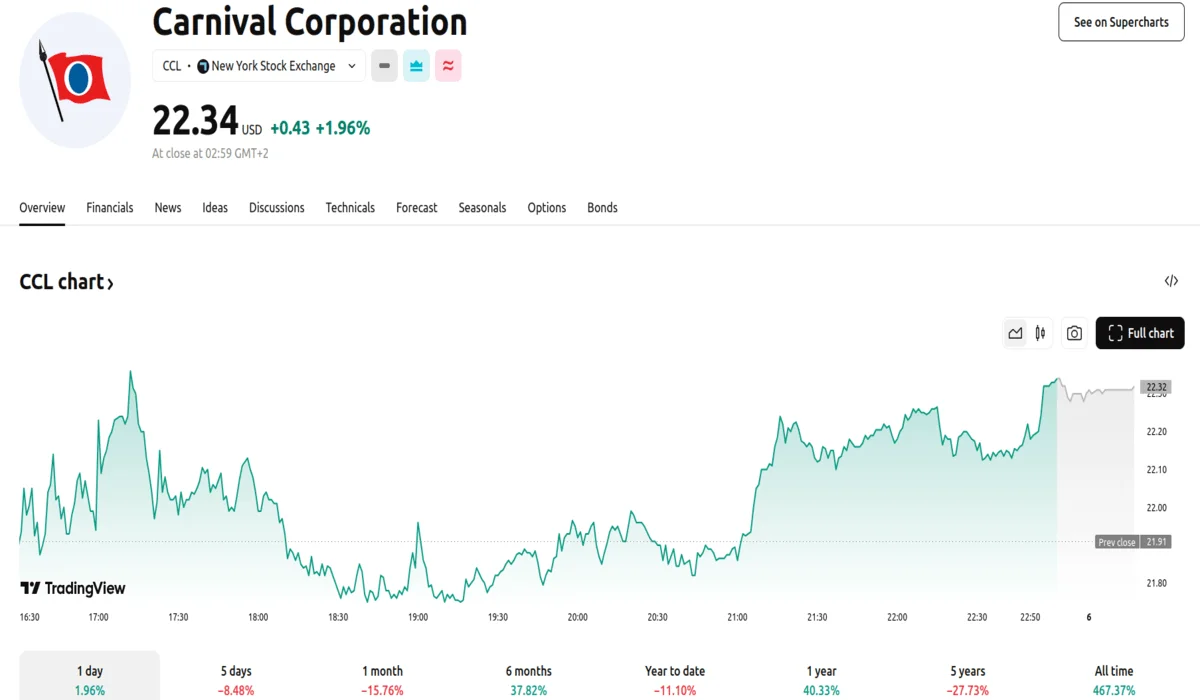

- Carnival (CCL) shares finished the latest trading session at $22.34, a 1.96% increase from the prior day’s close.

- Carnival’s upturn outperformed the gains of the S&P 500 (1.12%), Dow Jones (1.14%), and Nasdaq (1.46%).

- Analyst consensus estimates anticipate yearly earnings of $1.78 per share and total revenues of $26.01 billion for the cruise line operator.

Carnival Shares Outpace Gains of Major Stock Indices

Carnival Corporation’s shares concluded the most recent trading session with a closing value of $22.34, marking a 1.96% increase compared to the previous day’s close. This upward movement in the company’s stock value surpassed the gains observed in major market indices, demonstrating a stronger performance than the S&P 500 (up 1.12%), Dow Jones (up 1.14%), and Nasdaq (up 1.46%).

Looking ahead, financial analysts’ consensus estimates project earnings per share (EPS) of $1.78 for the year, alongside estimated revenue of $26.01 billion. This figure represents a significant growth projection for the company. While the daily increase in stock value is a positive indicator, it is also important to look at the stock’s performance over the past month. During this period, Carnival’s shares experienced a 19.12% decrease, lagging behind both the Consumer Discretionary sector’s 2.8% loss and the S&P 500’s 4.13% decline.

Investors are now awaiting Carnival’s upcoming earnings release. The anticipated earnings per share for the next quarter are $0.02, reflecting a substantial 114.29% increase compared to the same quarter last year. Revenue expectations are set at $5.75 billion for a 6.34% rise from the previous year’s corresponding quarter. These figures, along with the projected $1.78 EPS for the year and $26.01 billion revenue estimate, suggest a positive outlook for the company’s financial performance.

Carnival currently holds a Zacks Rank of 2, signifying a “Buy” recommendation. Over the past 30 days, the consensus EPS projection has increased by 0.57%. In terms of valuation, Carnival’s forward price-to-earnings ratio is 12.31, which is lower than the industry average of 19.11. Additionally, the company’s price-to-earnings-to-growth ratio is 0.65 and compares favorably to the Leisure and Recreation Services industry’s average of 1.01.

Carnival operates within the Leisure and Recreation Services industry, which is a component of the Consumer Discretionary sector. This industry currently holds a Zacks Industry Rank of 73, placing it within the top 30% of over 250 industries. The Zacks Industry Rank is calculated by averaging the Zacks Rank of the individual stocks within each industry group, and historically, the top 50% of ranked industries have outperformed the bottom 50%. Carnival’s projected yearly earnings of $1.78 per share and revenue of $26.01 billion would mark changes of +25.35% and +3.97%, respectively, from last year.