Key moments

- KOMSCO halts gold bar sales for over three weeks due to supply issues, amidst strong market demand.

- South Korea’s bar and coin investment rose 29% in Q4, coinciding with an 11% won depreciation.

- Individual investors pull ₩224.88 billion from equities, while gold prices climb 10%, showing a shift to gold.

Supply Constraints and Political Uncertainty Drive 29% Increase in Gold Demand

The Korea Minting and Security Printing Corporation (KOMSCO), responsible for the production and distribution of security products, has found itself unable to meet the robust demand for gold bars. This shortage has led to a three-week suspension of gold bar sales, impacting commercial banks, stores, and online retailers that rely on KOMSCO for bullion supply. Reports indicate that vending machines in Seoul, which offer small gold bars, have been emptied as consumers scramble to acquire the precious metal.

The surge in gold demand is attributed to a combination of factors, including domestic political instability and international economic uncertainties. South Korea’s political landscape has been turbulent, with ongoing impeachment proceedings and public opposition to government actions. This domestic turmoil coincides with the potential for escalating trade tensions stemming from the return of Donald Trump to the White House.

The Korean won’s rapid depreciation, particularly during Q4 of 2024, has further fueled the demand for gold. Investors are seeking a hedge against currency devaluation, and gold’s proven track record as a safe-haven asset makes it an attractive option. Data from the World Gold Council reveals that bar and coin investment in South Korea surged by 29% in Q4, aligning with an 11% drop in the won’s value.

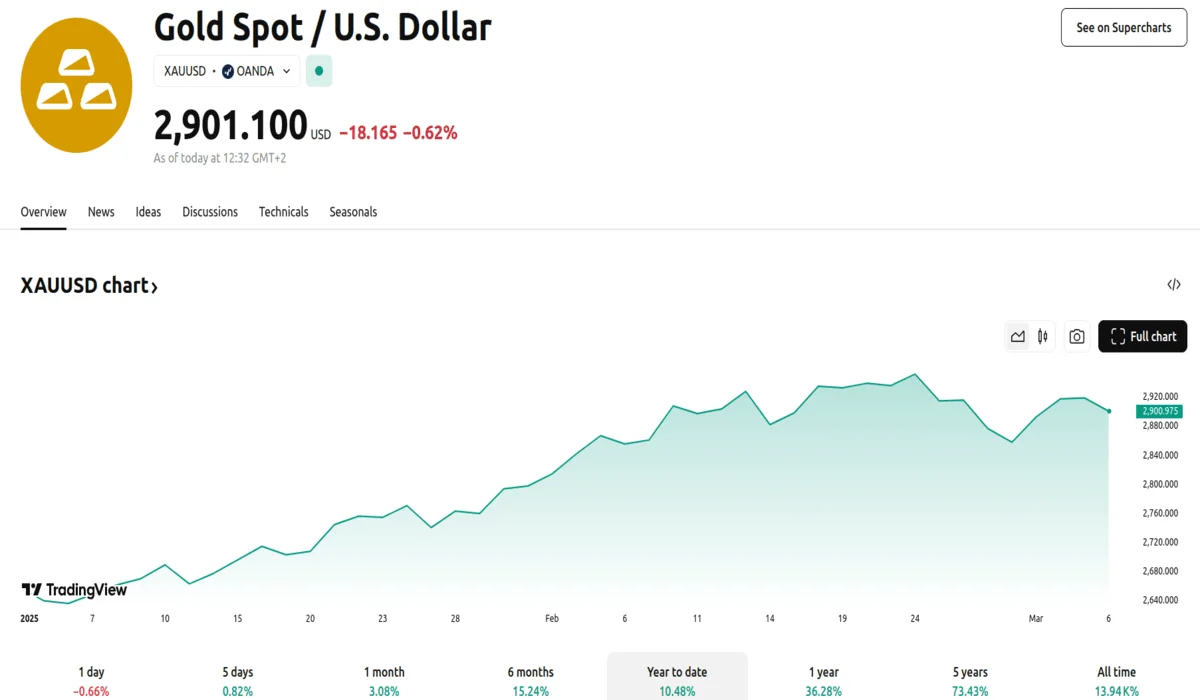

In contrast to the gold market’s performance, South Korea’s equity market has seen an outflow of capital from individual investors. Data from the stock exchange indicates that individual investors divested ₩224.88 billion from domestic equities between December 3 and March 5. This contrasts with a 10% increase in spot gold prices over the same period, suggesting that gold’s superior returns have driven investor interest.

The gold bar shortage is not solely a South Korean phenomenon. Regional shortages are being observed, with strong U.S. demand redirecting bullion away from other markets. The prospect of new U.S. tariffs has led to increased stockpiling of gold in the United States, reducing supply availability in markets like London and South Korea.

Furthermore, the demand for kilogram bars, which are preferred for delivery to U.S. Comex depositories, has led to a shift in production priorities among refineries. This shift has further contributed to the supply constraints in regional markets.