Key moments

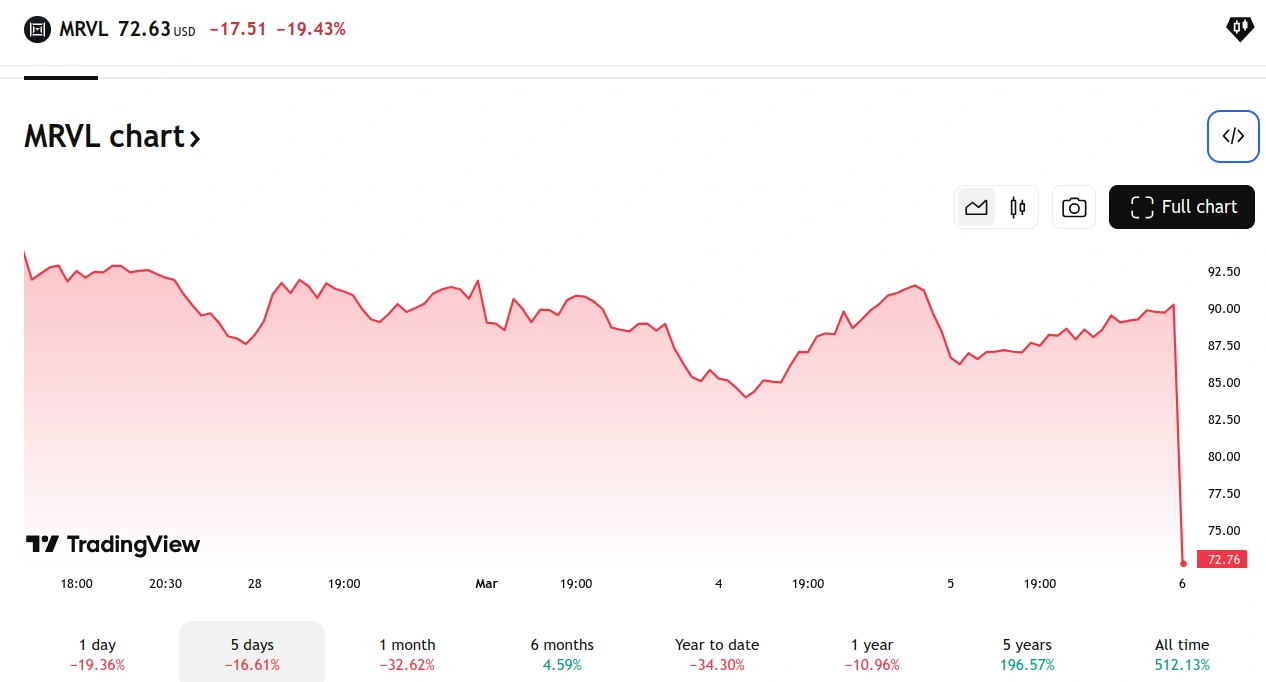

- Marvell Technology’s stock fell 16% due to concerns about AI infrastructure spending.

- Marvell’s revenue forecast failed to reassure investors, despite a slight beat, raising worries about AI investment.

- Marvell’s decline affected other chipmakers, with Broadcom and Nvidia also experiencing stock drops.

Disappointing Revenue Forecast Sent Marvell Technology Shares Tumbling 16%

Marvell Technology’s shares plummeted 16% on Thursday, impacting other chipmakers, as its revenue forecast failed to reassure investors about continued AI infrastructure spending, signaling a potential slowdown in the sector’s multi-year rally. Wall Street had anticipated Marvell’s earnings, a major supplier of custom AI chips, to provide insights into sustained demand that has driven market gains since the rise of generative AI in late 2022.

However, the company’s current-quarter revenue forecast, while slightly above estimates by $10 million, did not alleviate concerns about the substantial investments required for AI infrastructure, particularly following recent low-cost AI breakthroughs from Chinese startup DeepSeek. Investors are now focused on Broadcom’s earnings, due later Thursday, as the leading supplier in the custom AI chip market, with Marvell ranking second. Consequently, Broadcom’s shares fell 4%, and Nvidia’s declined 2%.

The semiconductor industry has also been affected by President Trump’s tariffs on countries including China. The Philadelphia Semiconductor Index has decreased by 5% in 2025, following a nearly 20% increase in 2024. “Sentiment is rough for AI semiconductor stocks right now,” according to Melius Research analysts, who attributed Marvell’s negative reaction to “what was only a slight revenue beat and raise.”

Marvell, which briefly surpassed Intel in market value last year, was poised to lose $12 billion in market capitalization if premarket share losses were sustained. The stock, which rose over 83% in 2024, has fallen approximately 18% in 2025.

Marvell exceeded its fiscal 2025 AI revenue target of $1.5 billion and anticipates surpassing its fiscal 2026 projections of $2.5 billion in AI sales, CEO Matt Murphy stated during a post-earnings call. J.P. Morgan analysts attributed the subdued outlook to “a slowdown in on-premise datacenter products,” indicating reduced demand for ethernet cables and fiber channels used in server data transfer.

As Big Tech companies prioritize AI chip investments, demand for networking equipment, Marvell’s core business, has diminished. Custom chips also yield lower profit margins than standard processors. Marvell expects adjusted April-quarter gross margin of approximately 60%, down more than two percentage points from the previous year.

Following the earnings results, at least nine brokerages lowered their price targets for Marvell, with the median target at $130, as per LSEG, representing a 44% potential upside from the stock’s most recent closing price.