Key moments

- NBIM allocates $250 million to hedge funds as part of its long-short equity strategies.

- New mandates target returns over 1.8% above benchmark.

- Norway’s fund, managing oil revenues, achieved 7.5% annualized returns over a decade.

NBIM Aims to Outperform Benchmark by More Than 1.8% after Fees

Norway’s $1.8 trillion sovereign wealth fund, managed by Norges Bank Investment Management (NBIM), is diversifying its investment strategy by allocating a significant amount to external hedge fund managers specializing in long-short equity strategies. This move represents a strategic shift for NBIM, which has historically focused on long-only strategies and internal long-short operations.

NBIM plans to provide mandates of approximately $250 million to selected external managers, with a focus on those employing long-short equity strategies in the European and US markets. The purpose is to achieve returns exceeding the fund’s benchmark by more than 1.8% annually after fees, surpassing the performance of its existing external managers who operate long-only strategies.

The decision to invest in long-short strategies is driven by concerns about potentially overvalued equity markets and the need to explore alternative avenues for generating returns. NBIM’s move comes at a time when some investors are questioning the effectiveness of traditional long-only portfolios.

NBIM will utilize separately managed accounts for these strategies, allowing managers to take short positions by borrowing stocks from the fund’s index portfolio. This approach will ensure that the fund maintains an overall net long position. The fund will prioritize managers who short stocks deemed to have “high valuation, fraud and unsustainable business models.”

The selection process will focus on smaller, privately managed organizations, as NBIM believes they often deliver higher excess returns due to better alignment of interests, performance-based compensation structures, and a greater ability to attract and retain talent. The fund will consider a range of long-short equity strategies, including those that balance short bets against long bets and those that are tilted towards rising or falling prices.

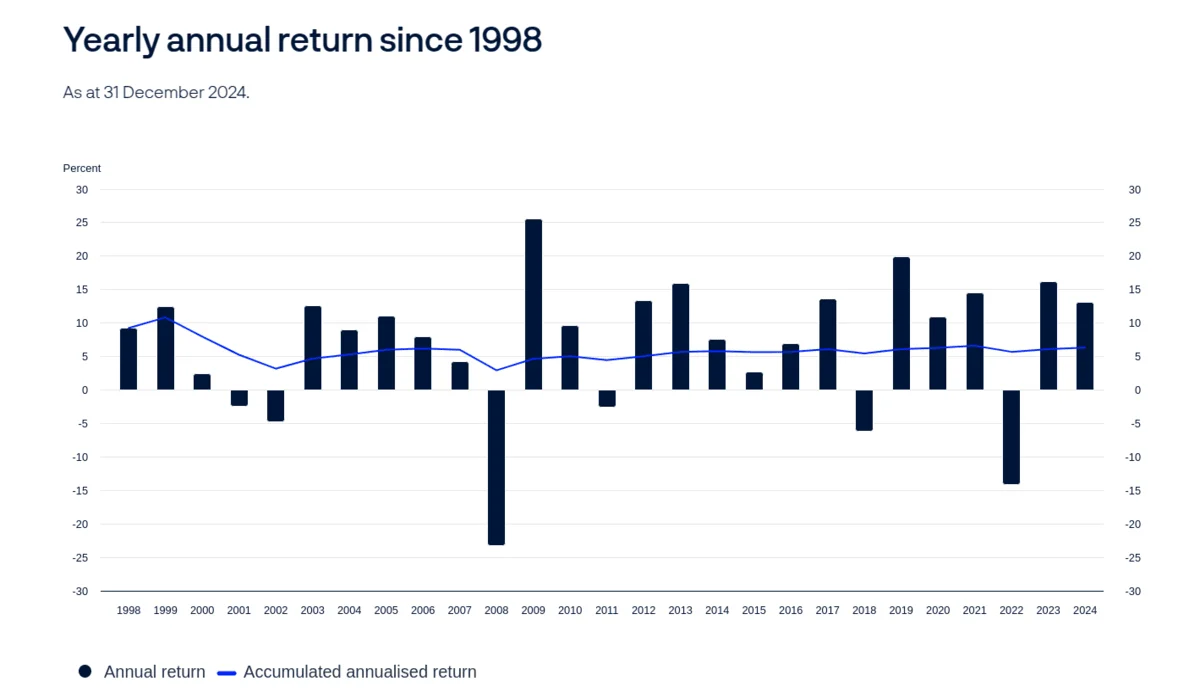

NBIM’s decision to allocate funds to hedge fund managers is part of its broader strategy to enhance returns and diversify its portfolio. The fund, which has delivered annualized returns of 7.5% over the past decade, is seeking to capitalize on opportunities in the evolving investment landscape. A significant portion of the fund, over 70%, is invested in equities, while 27% is in fixed income and 2% in unlisted real estate. The move also comes as the fund has continually requested to be allowed to invest in private markets, something that has been consistently denied by the country’s finance ministry.