Key moments

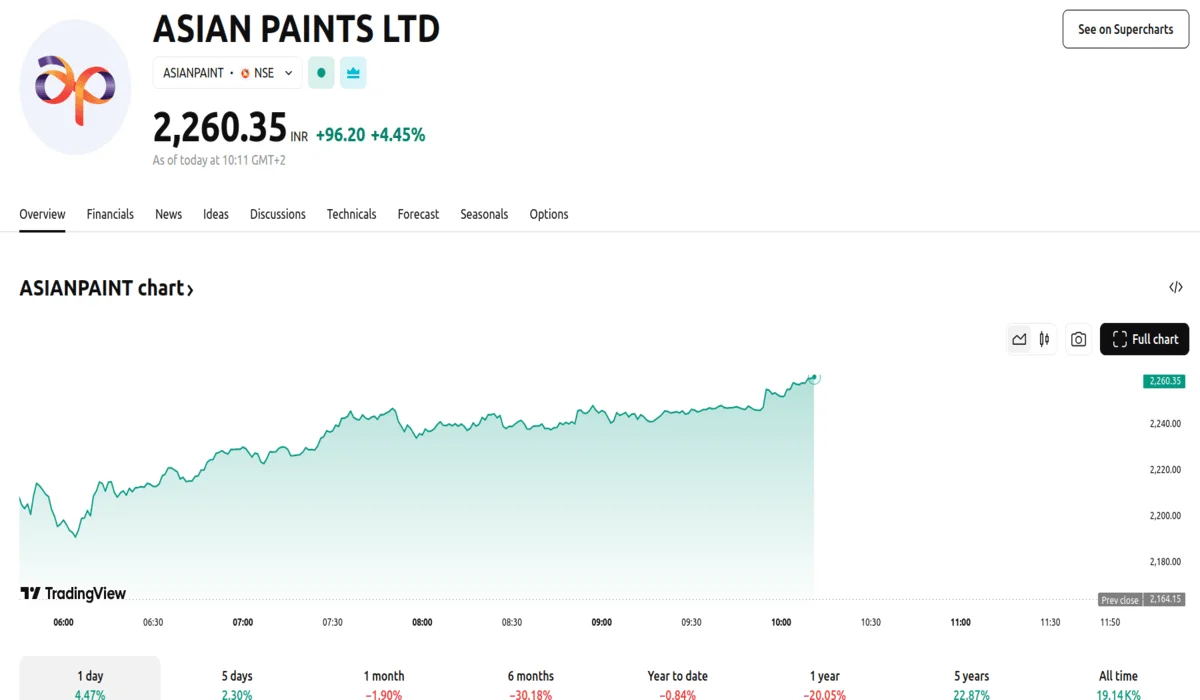

- Shares of Asian Paints climbed by 4.45%, reaching a value of 2,260.35, driven by the decline in crude oil prices.

- HPCL’s stock value also increased by 4.03%, settling at 339.30 as a result of reduced oil costs on downstream refiners.

- Brent crude oil prices descended below the $70 per barrel threshold, extending a downward trend observed over the preceding four trading sessions.

Crude Oil’s Decline Positively Impacts Companies like Apollo Tyres and Asian Paints

Oil prices dropping below $70 per barrel has triggered notable market reactions, particularly among Indian companies whose operations are significantly influenced by oil-related expenses. Apollo Tyres experienced a 3.53% surge with a price of ₹403.20, while Bharat Petroleum Corporation (BPCL) shares also saw an increase, gaining 3.74% to reach ₹265.40. These gains reflect the market’s response to the potential for reduced input costs across various sectors.

The decline in crude oil prices, which has seen Brent crude slide by over 6% in the last four trading sessions, is anticipated to provide a substantial boost to industries reliant on crude oil as a primary raw material. For downstream refining companies, the diminished cost of raw materials translates to enhanced profitability and improved margins, allowing for greater flexibility in pricing strategies. This positive impact was also reflected in the upward movement of shares for companies such as Chennai Petro (up 10.38%) and IOCL (up 3.03%), alongside the previously mentioned BPCL.

The decorative paint industry, characterized by its heavy reliance on raw materials, also stands to benefit significantly from the falling crude oil prices. With petroleum-based components constituting a substantial portion of input costs, fluctuations in crude oil prices directly affect the gross margins of paint manufacturers. The reduced cost of crude oil is expected to lower the expenses associated with producing essential paint components, such as titanium dioxide, thereby enhancing profitability for companies like Berger Paints, Kansai Nerolac, and Asian Paints, which saw a 4.45% increase to ₹2,260.35.

Similarly, the tyre manufacturing sector, which depends on synthetic rubber and petrochemical products derived from crude oil, is poised to experience reduced production costs. The decrease in raw material expenses is anticipated to improve profit margins, contributing to the overall financial performance of tyre companies, exemplified by the 3.53% gain seen in Apollo Tyres.

However, the decrease in crude oil prices presents challenges for oil drilling companies such as ONGC and Oil India. These companies may suffer reduced profit margins as the price of refined products may not decrease at the same rate as that of crude oil, and inventories purchased at higher prices may lose value. Morgan Stanley has adjusted its Brent crude oil price projections, forecasting that the benchmark will trade within the $70 range during the latter half of 2025.