Key moments

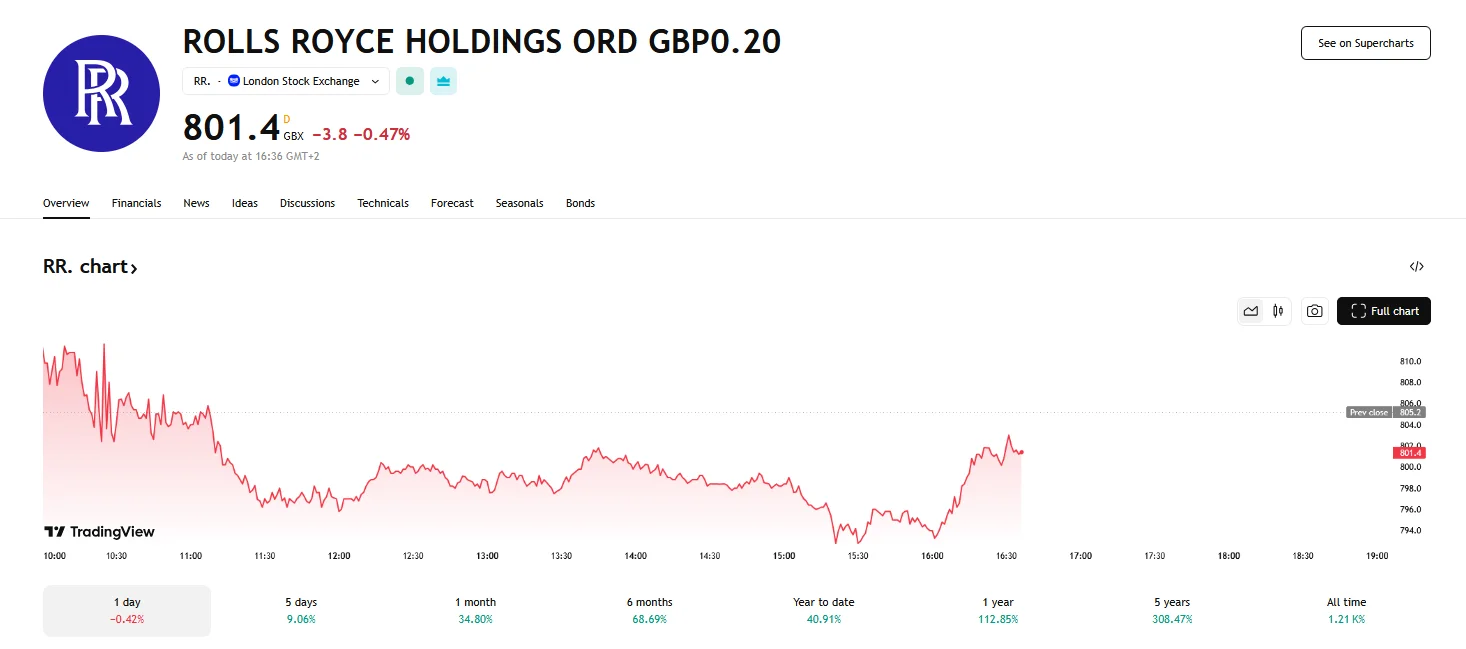

- The company’s stock exhibited significant strength, consistently holding above 790p and regaining levels above 800p after a brief dip.

- Rolls-Royce’s stock surge, up over 30% since February, stems from rising defense stock values, increased global defense spending, and CEO Erginbilgic’s strategic leadership.

- The CEO’s total compensation package has decreased by nearly £10 million.

Geopolitical Tensions and Defense Spending Fuel Rolls-Royce Share Price Surge

Rolls-Royce’s stock has demonstrated remarkable resilience, consistently maintaining a position above the 790p threshold and going higher than 800p. The share price experienced a surge to 811p on Thursday, which followed Wednesday’s impressive figures. This peak was followed by a dip below 800p before the price climbed back up.

The company’s stock has seen a steady increase overall, exceeding 30% since the beginning of February, a surge attributed to various factors, including the general uptick in defense-related stocks. This surge coincides with heightened geopolitical tensions and increased defense spending commitments by European nations, particularly in support of Ukraine. Rolls-Royce, a key player in defense manufacturing, has benefited significantly from this renewed focus on military investment.

However, the company’s success story is not solely driven by external factors. The leadership of CEO Tufan Erginbilgic has been instrumental in steering Rolls-Royce towards a significant turnaround. Appointed in January 2023, Erginbilgic has implemented strategic changes that have resulted in stronger-than-forecast financial results. His efforts to streamline operations, address supply chain issues, and enhance overall efficiency have been widely recognized and praised by investors and analysts alike.

Despite his pivotal role in the company’s resurgence, however, Erginbilgic’s compensation has seen a substantial reduction. His total pay package fell by nearly £10 million, dropping from £13.6 million in the previous year to £4.1 million in the latest financial year. This decrease is primarily attributed to the absence of a one-time compensation package received in his first year, which was intended to offset earnings lost from his previous position. Additionally, his annual incentive plan earnings were also reduced.

The company’s decision to reinstate dividend payments and initiate a £1 billion share buyback program underscores its strong financial health and commitment to shareholder value. These actions, coupled with the positive market sentiment surrounding defense stocks, have contributed to the sustained high share price.